Project Overview

Project Overview

Project Overview

Fundify's Background Story

Fundify's Background Story

Fundify's Background Story

I never fully understood the importance of saving money at a young age. Learning about the value of money isn’t often taught in depth, it’s sometimes touched upon briefly.

My inspiration in learning how to save money came from friends and my family. When I was adjusting to high school and college, I didn’t understand how hard it would be to save money, or how important understanding the fundamentals would be when you got older.

My final project focuses on developing issues I've dealt with as a student who lived on campus. Research indicates that more than 40 percent of students are still not equipped with adequate financial literacy knowledge and skills. EBSCO

Here comes the most important question:

How can I help students understand and learn the fundamentals of budgeting and goal setting before a problem arises?

I never fully understood the importance of saving money at a young age. Learning about the value of money isn’t often taught in depth, it’s sometimes touched upon briefly.

My inspiration in learning how to save money came from friends and my family. When I was adjusting to high school and college, I didn’t understand how hard it would be to save money, or how important understanding the fundamentals would be when you got older.

My final project focuses on developing issues I've dealt with as a student who lived on campus. Research indicates that more than 40 percent of students are still not equipped with adequate financial literacy knowledge and skills. EBSCO

Here comes the most important question:

How can I help students understand and learn the fundamentals of budgeting and goal setting before a problem arises?

I never fully understood the importance of saving money at a young age. Learning about the value of money isn’t often taught in depth, it’s sometimes touched upon briefly.

My inspiration in learning how to save money came from friends and my family. When I was adjusting to high school and college, I didn’t understand how hard it would be to save money, or how important understanding the fundamentals would be when you got older.

My final project focuses on developing issues I've dealt with as a student who lived on campus. Research indicates that more than 40 percent of students are still not equipped with adequate financial literacy knowledge and skills. EBSCO

Here comes the most important question:

How can I help students understand and learn the fundamentals of budgeting and goal setting before a problem arises?

When I was young, my dad always told me and taught me the importance of money. Did I fully understand this at a young age? Not entirely. I knew money could get you certain items you wanted in life, a lot of needs and wants. Growing up I'd always try my best to save my money but often got sidetracked and purchased a sweater or two from the mall.

Learning the value of money is something that isn’t normally taught; it’s touched upon briefly. My inspiration for learning how to save money came from my friends and family. Navigating through high school and college, I didn’t understand how hard it would be to save money or how important understanding the fundamentals would be as I got older.

My final project focused on developing issues I've dealt with as a student who lived on campus. Research indicates that more than 40 percent of students are still not equipped with adequate financial literacy knowledge and skills. EBSCO

Here comes the most important question:

How can I help students understand and learn the fundamentals of budgeting and goal setting before a problem arises?

Timeline

10 Months

Team Members

Manuela Mensah

Role

UI/UX Designer

User Experience Researcher

Tools

Figma

Photoshop

Illustrator

InDesign

Timeline

Timeline

10 Months

10 Months

Team Members

Team Members

Manuela Mensah

Manuela Mensah

Role

Role

UI/UX Designer

User Experience Researcher

UI/UX Designer

User Experience Researcher

Tools

Tools

Figma

Photoshop

Illustrator

InDesign

Figma

Photoshop

Illustrator

InDesign

what did we want to achieve?

what did we want to achieve?

what did we want to achieve?

The Problem Statement & Main Objectives

The Problem Statement & Main Objectives

The Problem Statement & Main Objectives

What i discovered

What i discovered

What i discovered

The Problem

The Problem

The Problem

College students aren’t being taught or informed about financial literacy. Students look into learning about the importance of financing when a problem arises.

This results in students not knowing or understanding the basic financial skills to succeed in college and prepare themselves afterward.

College students aren’t being taught or informed about financial literacy. Students look into learning about the importance of financing when a problem arises.

This results in students not knowing or understanding the basic financial skills to succeed in college and prepare themselves afterward.

College students aren’t being taught or informed about financial literacy. Students look into learning about the importance of financing when a problem arises.

This results in students not knowing or understanding the basic financial skills to succeed in college and prepare themselves afterward.

key focus

key focus

key focus

Our Main Objectives

Our Main Objectives

Our Main Objectives

Designing a educational tool for current and incoming students

Enhance students financial knowledge and skills

Make the application fun but informative!

Designing a educational tool for current and incoming students

Enhance students financial knowledge and skills

Make the application fun but informative!

Designing a educational tool for current and incoming students

Enhance students financial knowledge and skills

Make the application fun but informative!

Objective

Top Challenges

Challenge #1

Maintaining student engagement and decreasing/minimizing abandonment.

Challenge #2

Creating a simple and easy interface for students to navigate through without any hassles.

Challenge #3

Implement gamification strategies to motivate students to help them complete financial goals and monitor their spending habits.

Ongoing Challenge #4

Designing Fundify to be approachable students with different levels of budgeting experience.

Objective

Top Challenges

Research

Top Challenges

Challenge #1

Maintaining student engagement and decreasing/minimizing abandonment.

Maintaining student engagement and decreasing/minimizing abandonment.

Challenge #2

Creating a simple and easy interface for students to navigate through without any hassles.

Creating a simple and easy interface for students to navigate through without any hassles.

Challenge #3

Implement gamification strategies to motivate students to help them complete financial goals and monitor their spending habits.

Implement gamification strategies to motivate students to help them complete financial goals and monitor their spending habits.

Ongoing Challenge #4

Designing Fundify to be approachable students with different levels of budgeting experience.

Designing Fundify to be approachable students with different levels of budgeting experience.

The Solution

The Solution

The Solution

What is Fundify?

What is Fundify?

What is Fundify?

A mobile application designed for college, and incoming students aiming to educate them on financial responsibility and saving strategies.

The app provides organizational tools such as goal-setting and budgeting features to help support students future success beyond their collegiate year.

A mobile application designed for college, and incoming students aiming to educate them on financial responsibility and saving strategies.

The app provides organizational tools such as goal-setting and budgeting features to help support students future success beyond their collegiate year.

A mobile application designed for college, and incoming students aiming to educate them on financial responsibility and saving strategies.

The app provides organizational tools such as goal-setting and budgeting features to help support students future success beyond their collegiate year.

Achieving Success for Fundify

Achieving Success for Fundify

Achieving Success for Fundify

Fundify’s Design Process

Fundify’s Design Process

Fundify’s Design Process

Research

Research

Discover a Problem

Data Overview

Survey Quotes

Key Quotes

Competition

Discover a Problem

Data Overview

Survey Quotes

Key Quotes

Competition

Discover a Problem

Data Overview

Survey Quotes

Key Quotes

Competition

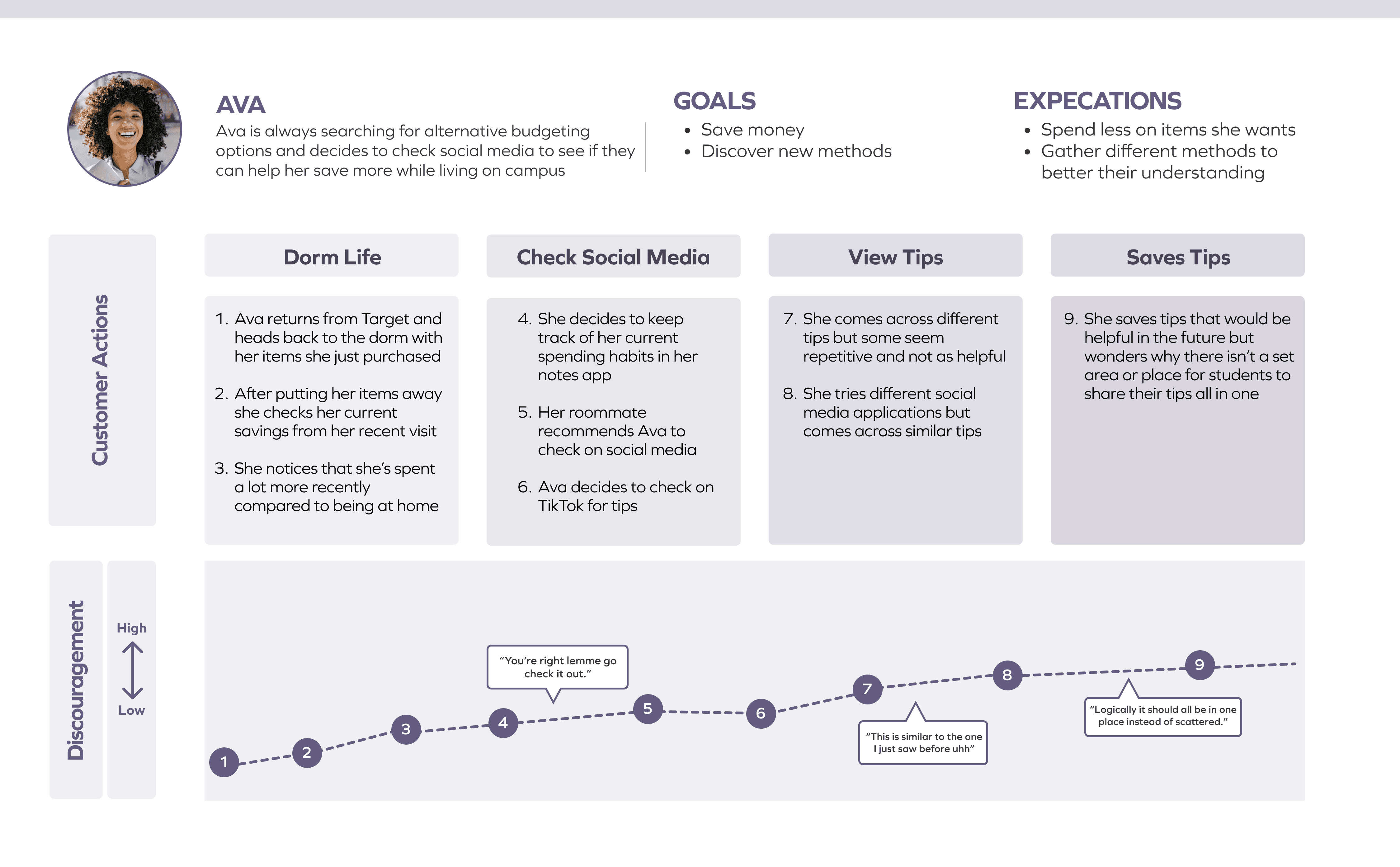

Personas

Personas

Persona (3)

Empathy Map

Journey Map

Storyboard

Persona (3)

Empathy Map

Journey Map

Storyboard

Persona (3)

Empathy Map

Journey Map

Storyboard

UI Workflow

UI Workflow

Interaction Model

Wireframe

Sketches

User Flow

Interaction Model

Wireframe

Sketches

User Flow

Interaction Model

Wireframe

Sketches

User Flow

UI Comps

UI Comps

User Testing

Hi-Fidelity Comps

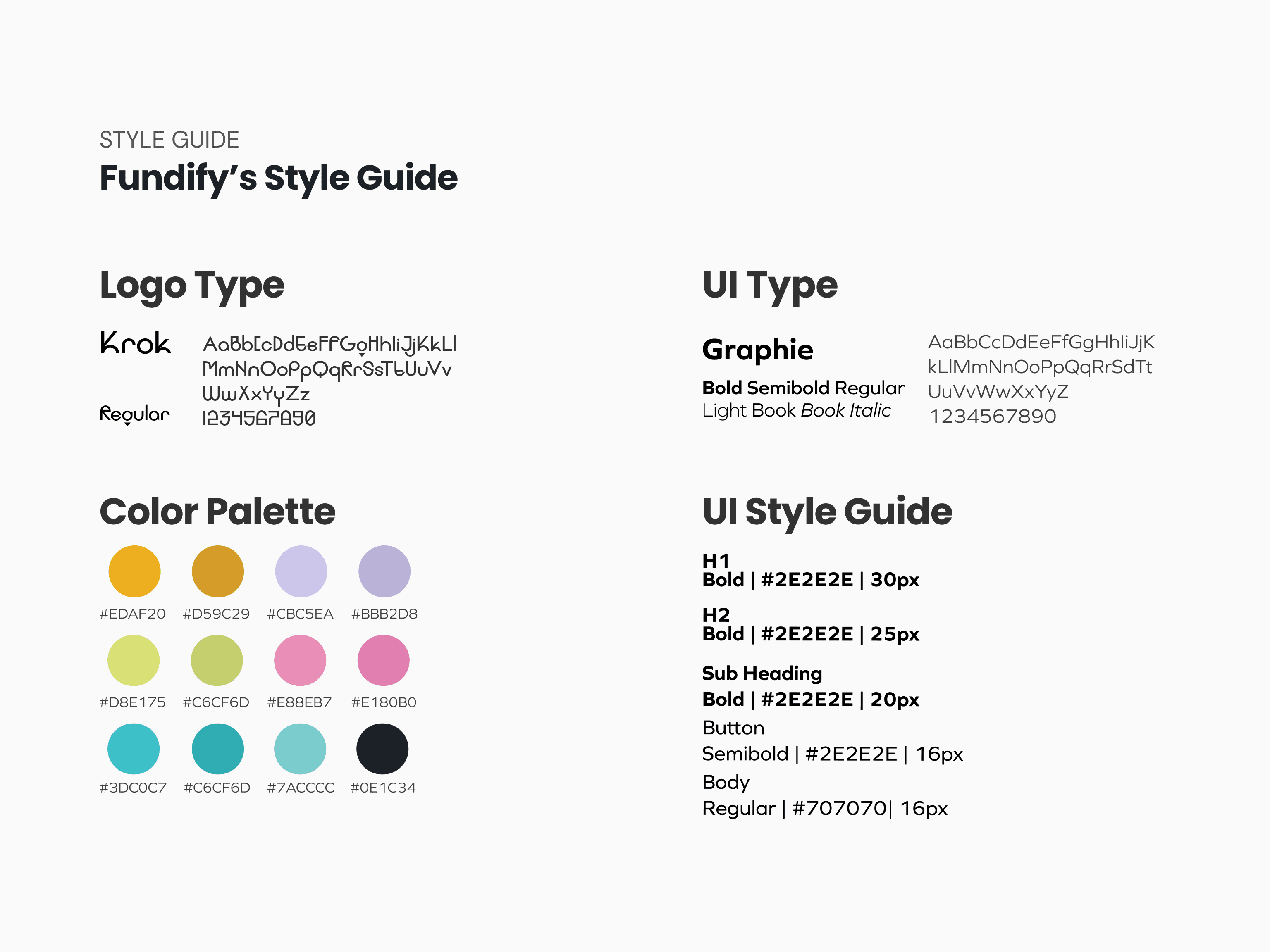

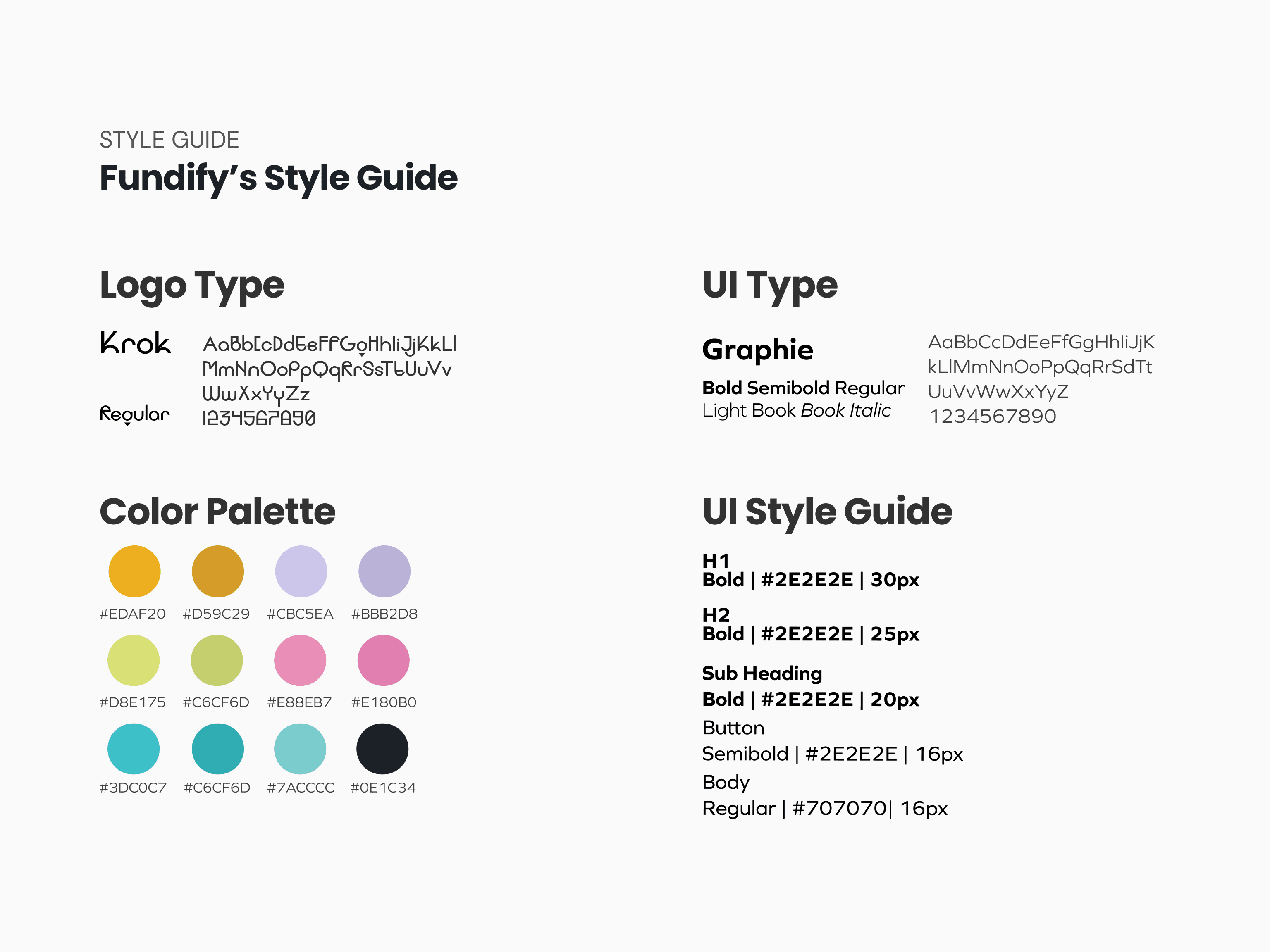

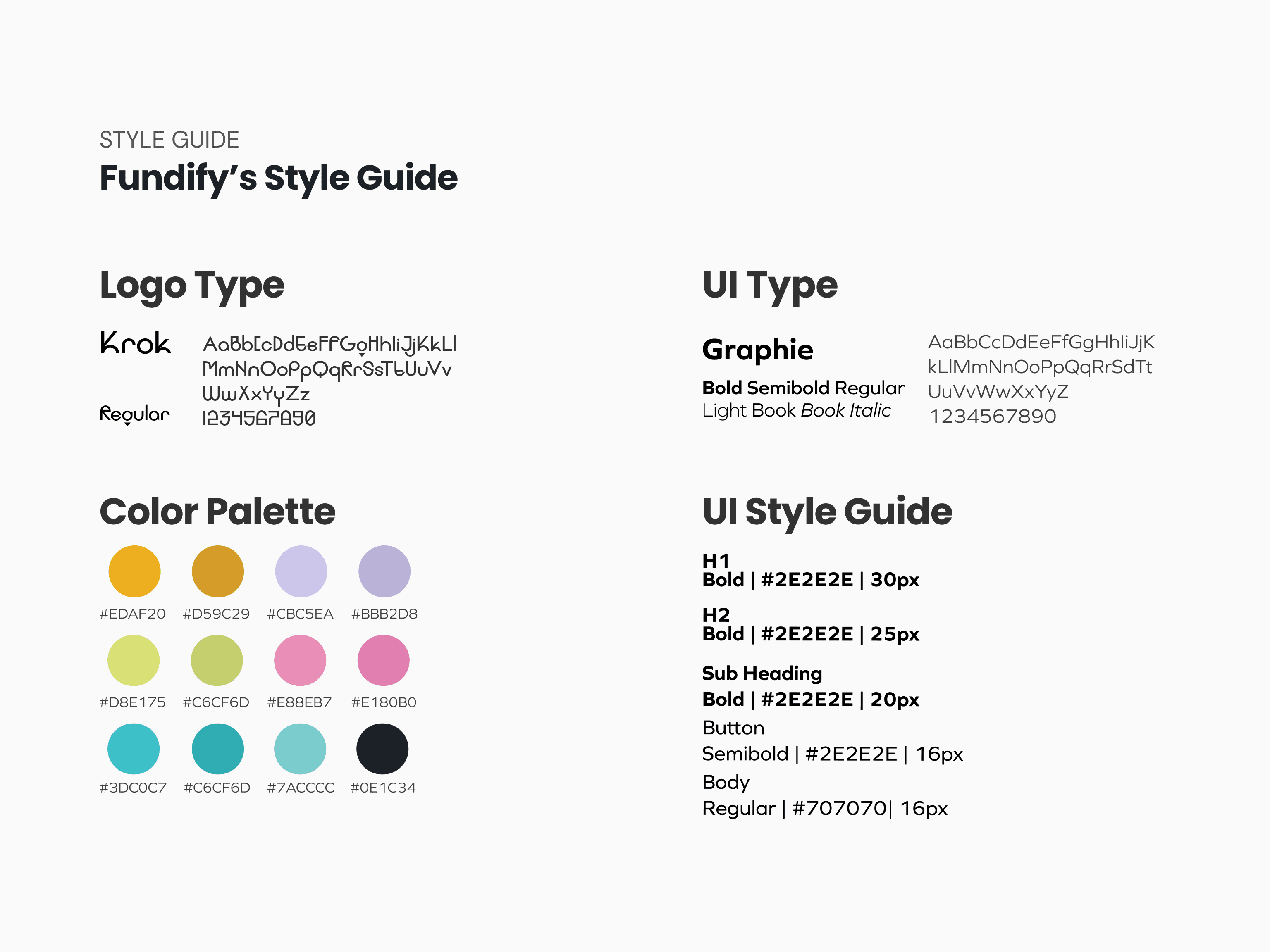

Style Guide

Future Steps

User Testing

Hi-Fidelity Comps

Style Guide

Future Steps

User Testing

Hi-Fidelity Comps

Style Guide

Future Steps

RESEARCH

RESEARCH

RESEARCH

How did I discover the problem?

How did I discover the problem?

How did I discover the problem?

How did I discover the problem?

Data Overview

Data Overview

Gathering Ideas and Discovering Issues

Gathering Ideas and Discovering Issues

The first task was gathering topics of interest that fell into a category of being Disrupting, Optimizing, Expressing, Connecting or Empowering. These categories allowed me to understand the impact the product I wanted to create will have.

The first task was gathering topics of interest that fell into a category of being Disrupting, Optimizing, Expressing, Connecting or Empowering. These categories allowed me to understand the impact the product I wanted to create will have.

Reduce concert ticket purchase stress.

Teach college students the importance of budgeting.

Help students prioritize their mental health.

Data Overview

Survey Data

I conducted surveys to understand students’ current knowledge on finances and their interest in improving it.

The data revealed disinterest in seeking out existing financial apps to help them improve their current budgeting skills. The question I asked myself after was why?

Students found it boring and uninteresting. They saw this as something to worry and learn later.

58.1%

58.1%

of students Strongly Disagreed in seeking out different apps and resources to improve their budgeting skills

60.5%

of students Strongly Agreed that increasing their knowledge about budgeting could help improve their money management

60.5%

Neutral

Agree

Disagree

Strongly Agree

Strongly Disagree

RESEARCH

RESEARCH

The first topic I chose was 'discovering the financial impact college payments have on students' mental health'.

I gathered and analyzed data to focus and refine my initial problem.

The first topic I chose was 'discovering the financial impact college payments have on students' mental health'.

I gathered and analyzed data to focus and refine my initial problem.

I focused on gathering and analyzing data to focus and refine the problem.

The first topic I chose was 'discovering the financial impact college payments have on students' mental health'.

I gathered and analyzed data to focus and refine my initial problem.

Data Overview

Gathering Ideas and Discovering Issues

The first task was gathering topics of interest that fell into a category of being Disrupting, Optimizing, Expressing, Connecting or Empowering. These categories allowed me to understand the impact the product I am creating will have.

Reduce concert ticket purchase stress.

Teach college students the importance of budgeting.

Help students prioritize their mental health.

Survey Data - Financial Impact on Mental Health

Survey Data - Financial Impact on Mental Health

I conducted surveys to understand students’ current knowledge on finances and their interest in improving it.

The data revealed disinterest in seeking out existing financial apps to help them improve their current budgeting skills. The question I asked myself after was why?

Students found it boring and uninteresting. They saw this as something to worry and learn later.

I conducted surveys to understand students’ current knowledge on finances and their interest in improving it.

The data revealed disinterest in seeking out existing financial apps to help them improve their current budgeting skills. The question I asked myself after was why?

Students found it boring and uninteresting. They saw this as something to worry and learn later.

I conducted surveys to understand students’ current knowledge on finances and their interest in improving it.

The data revealed disinterest in seeking out existing financial apps to help them improve their current budgeting skills. The question I asked myself after was why?

Students found it boring and uninteresting. They saw this as something to worry and learn later.

58.1%

58.1%

58.1%

of students Strongly Disagreed in seeking out different apps and resources to improve their budgeting skills

of students Strongly Disagreed in seeking out different apps and resources to improve their budgeting skills

60.5%

60.5%

60.5%

of students Strongly Agreed that increasing their knowledge about budgeting could help improve their money management

of students Strongly Agreed that increasing their knowledge about budgeting could help improve their money management

Neutral

Agree

Disagree

Strongly Agree

Strongly Disagree

Conducting Interviews & Gathering Key Quotes

Conducting Interviews & Gathering Key Quotes

Conducting Interviews & Gathering Key Quotes

I conducted six interviews to get a better understanding of users current knowledge when it comes to financial literacy. Conducting these interviews allowed me to understand the features I should look into for the technological tool I wanted to create and what features would be helpful/useful.

I conducted six interviews to get a better understanding of users current knowledge when it comes to financial literacy. Conducting these interviews allowed me to understand the features I should look into for the technological tool I wanted to create and what features would be helpful/useful.

I conducted six interviews to get a better understanding of users current knowledge when it comes to financial literacy. Conducting these interviews allowed me to understand the features I should look into for the technological tool I wanted to create and what features would be helpful/useful.

Do you have any strategies or tools you use to keep track of your spending to help you save money?

Do you keep track of what you spend in your bank account?

Have you ever considered setting aside goals to save money based on your finances?

Do you have any strategies or tools you use to keep track of your spending to help you save money?

Do you keep track of what you spend in your bank account?

Have you ever considered setting aside goals to save money based on your finances?

Do you have any strategies or tools you use to keep track of your spending to help you save money?

Do you keep track of what you spend in your bank account?

Have you ever considered setting aside goals to save money based on your finances?

Do you have any strategies or tools you use to keep track of your spending to help you save money?

Do you keep track of what you spend in your bank account?

Have you ever considered setting aside goals to save money based on your finances?

After conducting interviews and analyzing the information, I noticed that only two of the students had strategies they follow and budgeting knowledge while the rest of the students didn't.

Below I gathered key quotes and answers from the questions I asked above:

After conducting interviews and analyzing the information, I noticed that only two of the students had strategies they follow and budgeting knowledge while the rest of the students didn't.

Below I gathered key quotes and answers from the questions I asked above:

After conducting interviews and analyzing the information, I noticed that only two of the students had strategies they follow and budgeting knowledge while the rest of the students didn't.

Below I gathered key quotes and answers from the questions I asked above:

"I don't have anything to pay for, so I spend my money freely." (2)

“I don’t keep track of my money. I check to see if I have enough money to pay for school and I do whatever with the rest of my money.” (2)

“I have a hard time budgeting the money, but I haven’t looked into resources to help me out.” (1)

"I know down the line I have to start paying for things, but I want to spend my money on whatever I want and worry about payments later on. I just want to enjoy spending my money now." (3)

"I don't have anything to pay for, so I spend my money freely." (2)

“I don’t keep track of my money. I check to see if I have enough money to pay for school and I do whatever with the rest of my money.” (2)

“I have a hard time budgeting the money, but I haven’t looked into resources to help me out.” (1)

"I know down the line I have to start paying for things, but I want to spend my money on whatever I want and worry about payments later on. I just want to enjoy spending my money now." (3)

"I don't have anything to pay for, so I spend my money freely." (2)

“I don’t keep track of my money. I check to see if I have enough money to pay for school and I do whatever with the rest of my money.” (2)

“I have a hard time budgeting the money, but I haven’t looked into resources to help me out.” (1)

"I know down the line I have to start paying for things, but I want to spend my money on whatever I want and worry about payments later on. I just want to enjoy spending my money now." (3)

"I don't have anything to pay for, so I spend my money freely." (2)

“I don’t keep track of my money. I check to see if I have enough money to pay for school and I do whatever with the rest of my money.” (2)

“I have a hard time budgeting the money, but I haven’t looked into resources to help me out.” (1)

"I know down the line I have to start paying for things, but I want to spend my money on whatever I want and worry about payments later on. I just want to enjoy spending my money now." (3)

After Conducting the Interviews and Surveys I discovered the proposed solution and the problem statement.

After Conducting the Interviews and Surveys I discovered the proposed solution and the problem statement.

After Conducting the Interviews and Surveys I discovered the proposed solution and the problem statement.

What was our proposed solution?

What was our proposed solution?

Designing a mobile application, Fundify. An easily accessible application that focuses on monitoring students' finances which includes income and expenses.

Designing a mobile application, Fundify. An easily accessible application that focuses on monitoring students' finances which includes income and expenses.

Users will be able to set up financial goals, keep track of upcoming payments, and receive timely reminders for upcoming purchases.

This application will help provide students with tips regarding their current financial status.

Our main goal is to help provide students with a convenient and practical tool for them to learn and manage their financial responsibilities effectively while also incorporating a list of resources to further understand and learn more information.

Users will be able to set up financial goals, keep track of upcoming payments, and receive timely reminders for upcoming purchases.

This application will help provide students with tips regarding their current financial status.

Our main goal is to help provide students with a convenient and practical tool for them to learn and manage their financial responsibilities effectively while also incorporating a list of resources to further understand and learn more information.

Key Aspects

Key Aspects

I gathered key insights and a potential list of core features I wanted the application to have

I gathered key insights and a potential list of core features I wanted the application to have

Keep the application as SIMPLE as possible

Students already aren't looking up applications

The simpler the application is the better!

We want to focus on what's important and what users are looking for.

Prioritize Important Finances

Look into linking different sites about finances etc.

Income Flow

Upcoming Bill Payments (reminders/notifs)

Teach students about credit (?)

College students don't understand the implications of free money entirely.

Introduce Goals

Teaching students about short-term, medium & long-term goals.

Rewards

Badges, have users level up or win small items.

Keep the application as SIMPLE as possible

Students already aren't looking up applications

The simpler the application is the better!

We want to focus on what's important and what users are looking for.

Prioritize Important Finances

Look into linking different sites about finances etc.

Income Flow

Upcoming Bill Payments (reminders/notifs)

Teach students about credit (?)

College students don't understand the implications of free money entirely.

Introduce Goals

Teaching students about short-term, medium & long-term goals.

Rewards

Badges, have users level up or win small items.

PERSONAS

PERSONAS

PERSONAS

The Target Audience and Potential Users

The Target Audience and Potential Users

The Target Audience and Potential Users

The Target Audience and Potential Users

WHO IS FUNDIFY FOR?

WHO IS FUNDIFY FOR?

WHO IS FUNDIFY FOR?

Our Potential Users

Our Potential Users

Our Potential Users

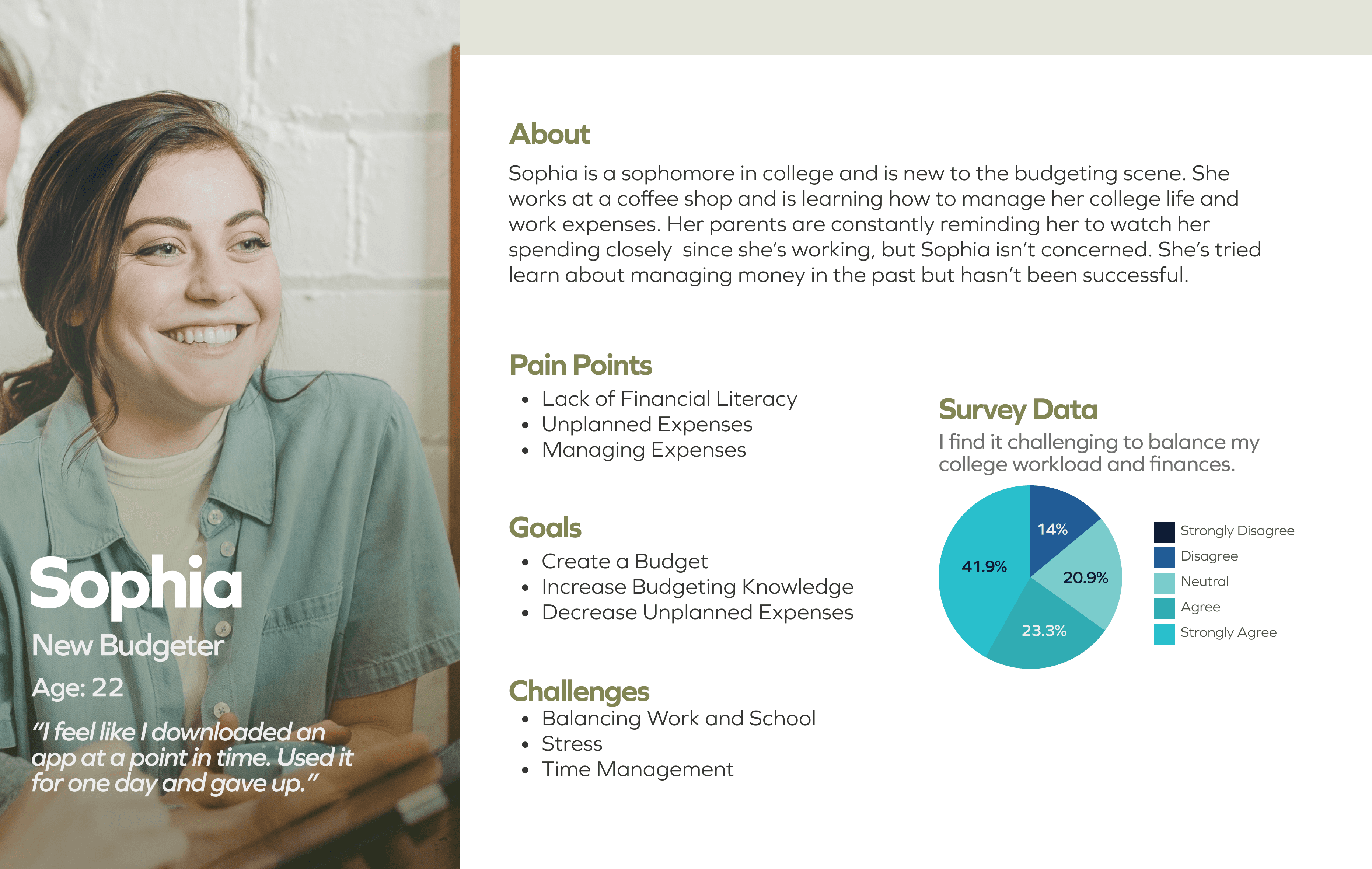

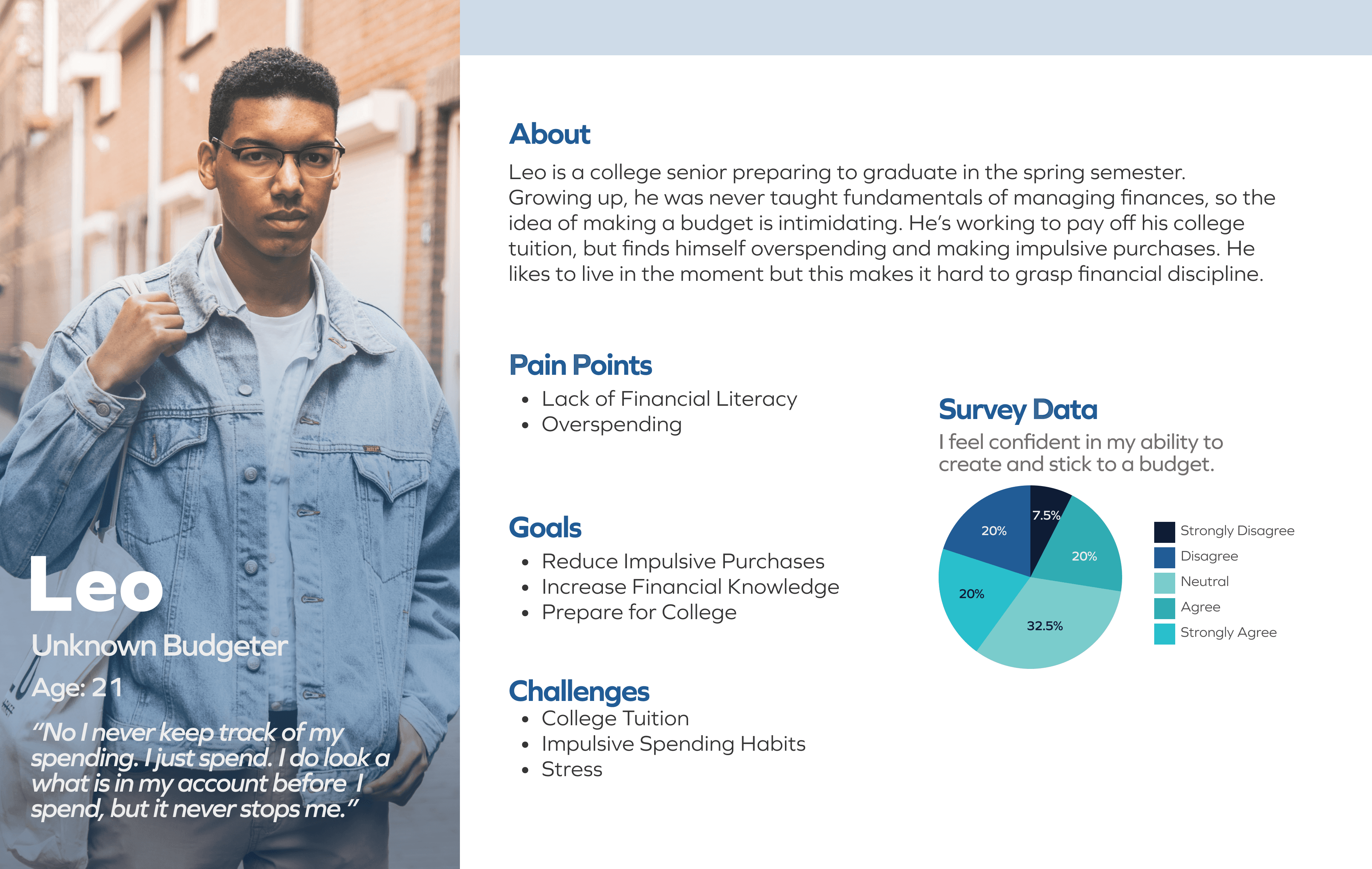

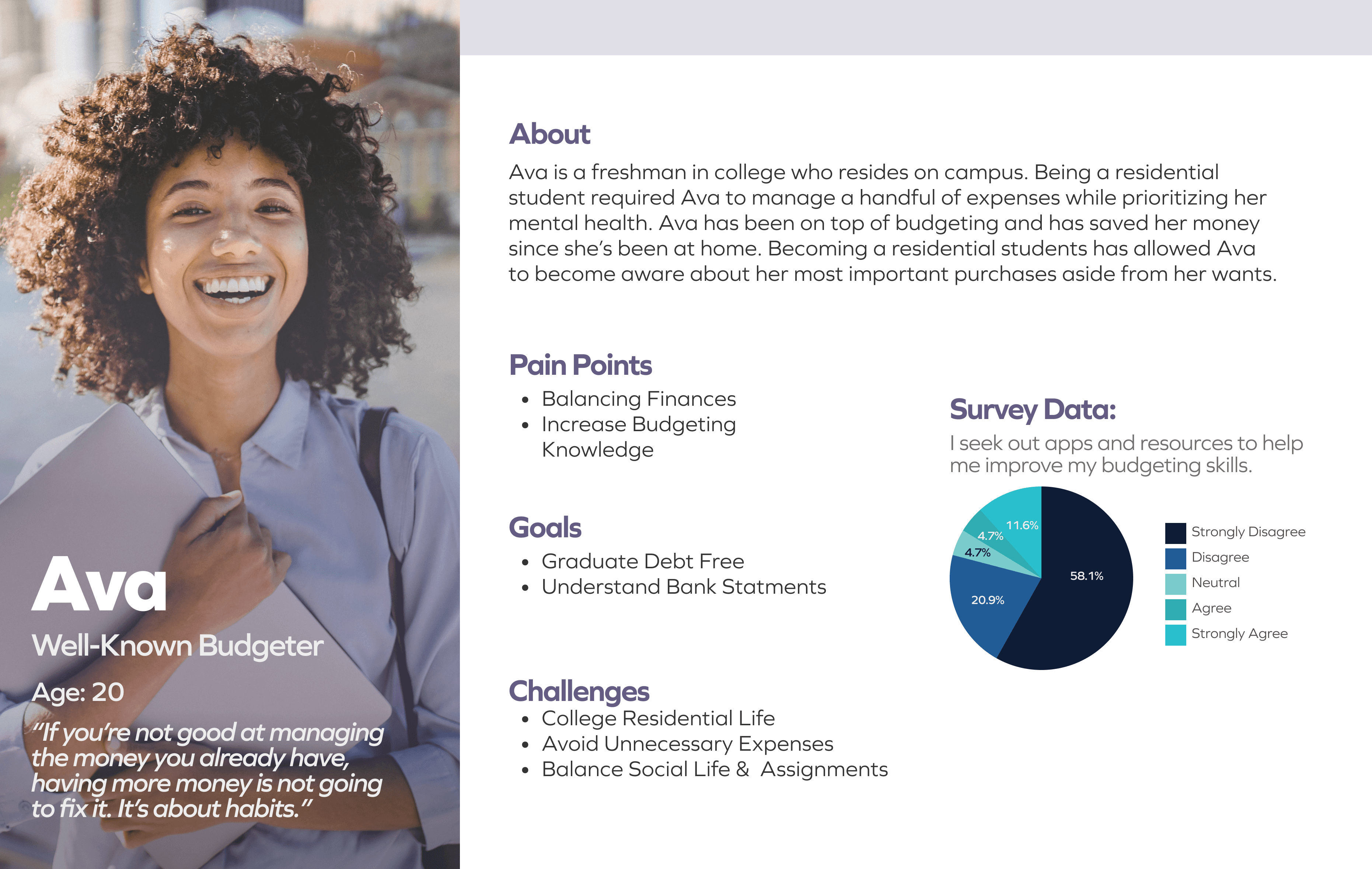

After conducting interviews and surveys, I discovered my top three users: New Budgeters, Intermediate Budgeters, and Advanced Budgeters.

The three represent college students who are either unfamiliar with budgeting and have no care for it, a student who has some form of knowledge for budgeting, and a student who is familiar with with the budgeting scene.

After conducting interviews and surveys, I discovered my top three users: New Budgeters, Intermediate Budgeters, and Advanced Budgeters.

The three represent college students who are either unfamiliar with budgeting and have no care for it, a student who has some form of knowledge for budgeting, and a student who is familiar with with the budgeting scene.

After conducting interviews and surveys, I discovered my top three users: New Budgeters, Intermediate Budgeters, and Advanced Budgeters.

The three represent college students who are either unfamiliar with budgeting and have no care for it, a student who has some form of knowledge for budgeting, and a student who is familiar with with the budgeting scene.

New Budgeter

New Budgeter

Students completely new to budgeting, with minor knowledge about financial literacy

Students completely new to budgeting, with minor knowledge about financial literacy

Intermediate Budgeter

Intermediate Budgeter

Students with some form of knowledge on goal setting and creating budgets.

Students with some form of knowledge on goal setting and creating budgets.

Advanced Budgeters

Advanced Budgeters

Students who are familiar with financial literacy but still want to keep track of everything

Students who are familiar with financial literacy but still want to keep track of everything

Unknown Budgeter

Students completely new to budgeting, with minor knowledge about financial literacy

New Budgeters

Students with some form of knowledge on goal setting and creating budgets.

Advanced Budgeters

Students who are familiar with financial literacy but still want to keep track of everything

Introducing our Personas

Introducing our Personas

Introducing our Personas

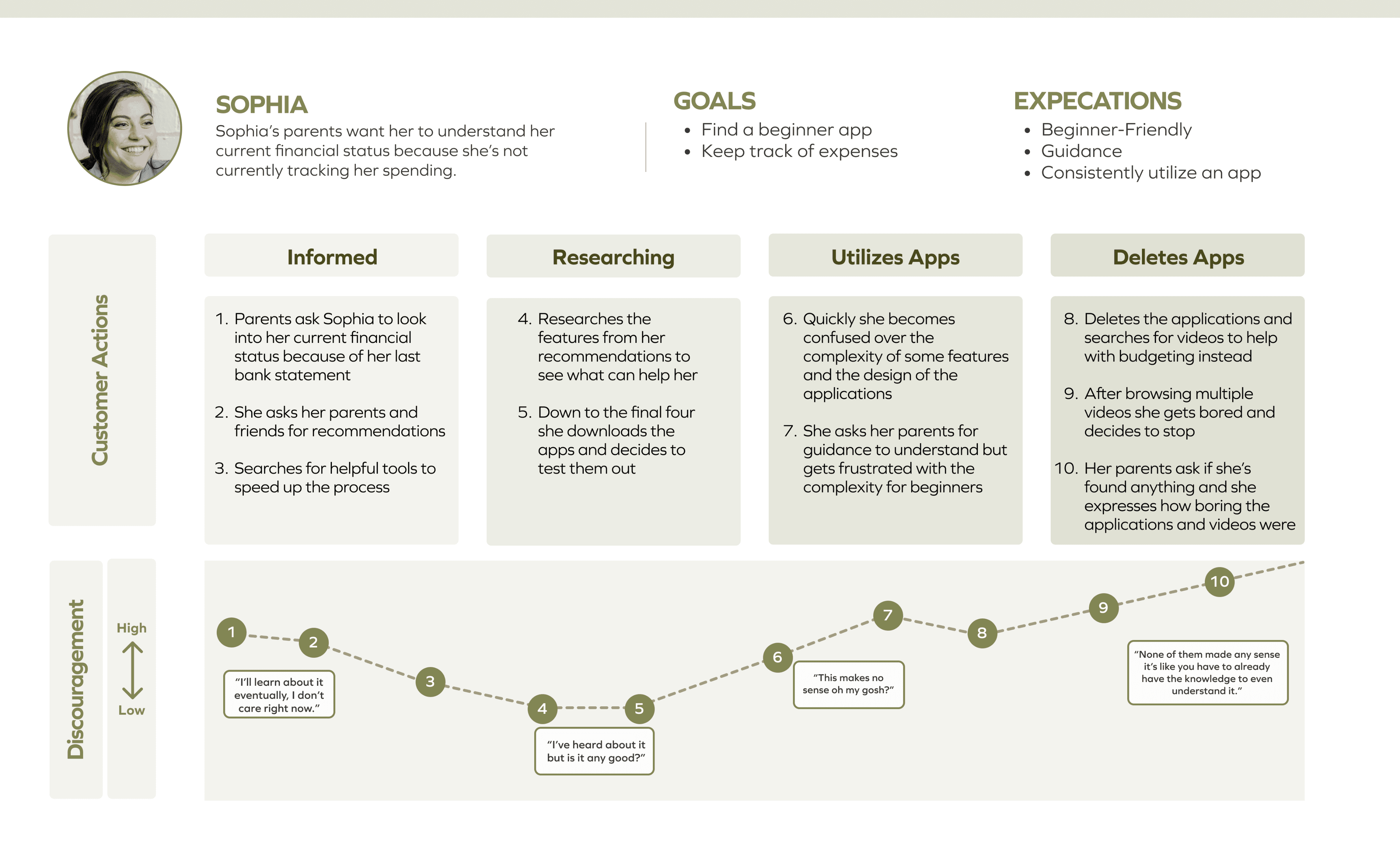

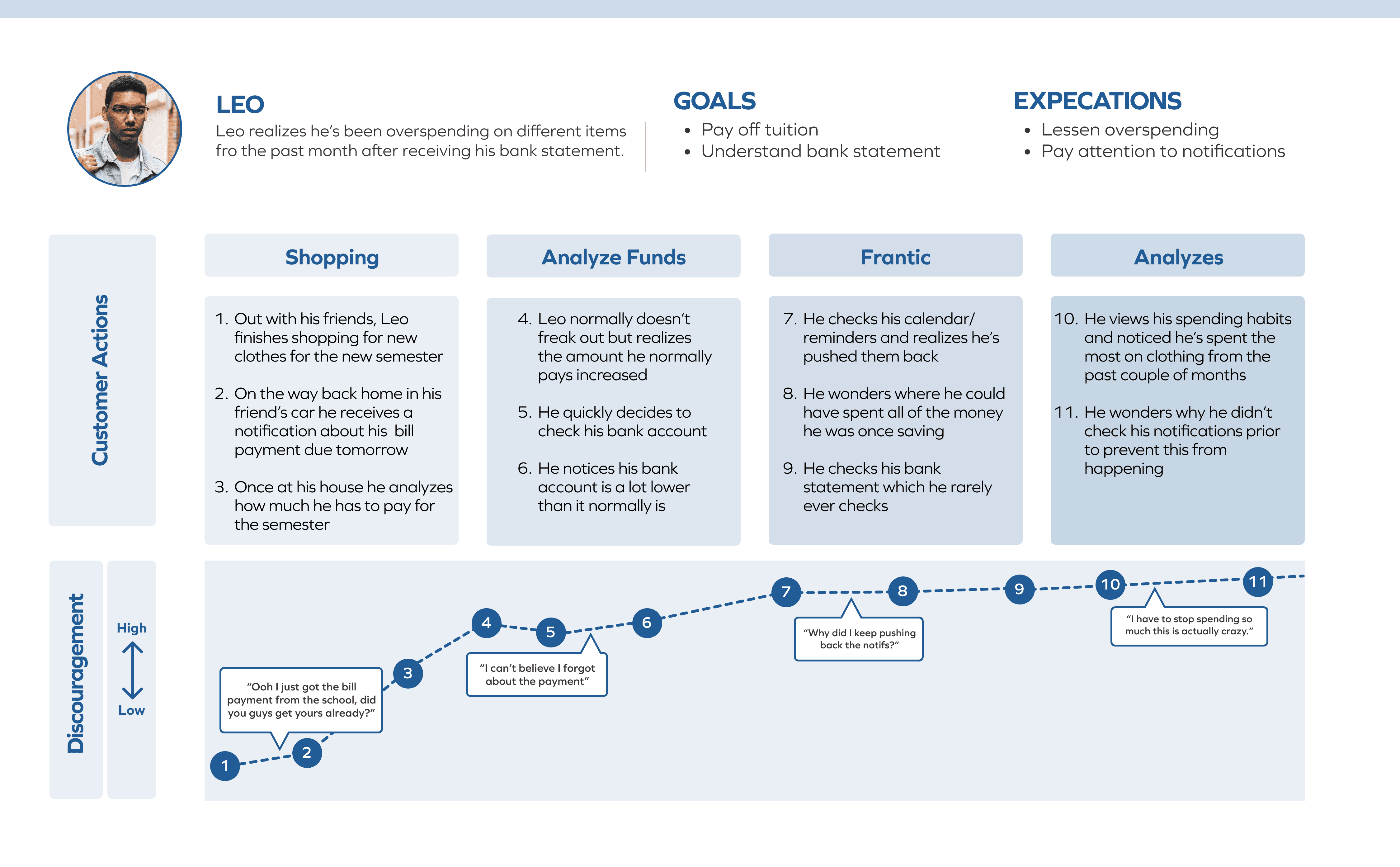

When creating Fundify, I focused on Sophia the New Budgeter and Leo the Unknown Budgeter. Both students know about budgeting but they don't care for it. From surveys and interviews I discovered only a few amount of students had a budget or financial literacy knowledge. I wanted the walkthrough of the application to focus on a student who is new to budgeting.

When creating Fundify, I focused on Sophia the New Budgeter and Leo the Unknown Budgeter. Both students know about budgeting but they don't care for it. From surveys and interviews I discovered only a few amount of students had a budget or financial literacy knowledge. I wanted the walkthrough of the application to focus on a student who is new to budgeting.

When creating Fundify, I focused on Sophia the New Budgeter and Leo the Unknown Budgeter. Both students know about budgeting but they don't care for it. From surveys and interviews I discovered only a few amount of students had a budget or financial literacy knowledge. I wanted the walkthrough of the application to focus on a student who is new to budgeting.

What was our proposed solution?

Designing an easily accessible application, Fundify, that focuses on monitoring students' finances which includes income and expenses.

Users will be able to set up financial goals, keep track of upcoming payments, and receive timely reminders for upcoming purchases.

This application will help provide students with tips regarding their current financial status.

Our main goal is to help provide students with a convenient and practical tool for them to learn and manage their financial responsibilities effectively while also incorporating a list of resources to further understand and learn more information.

Key Aspects

I gathered key insights and a potential list of core features I wanted the application to have

Keep the application as SIMPLE as possible

Students already aren't looking up applications

The simpler the application is the better!

We want to focus on what's important and what users are looking for.

Prioritize Important Finances

Look into linking different sites about finances etc.

Income Flow

Upcoming Bill Payments (reminders/notifs)

Teach students about credit (?)

College students don't understand the implications of free money entirely.

Introduce Goals

Teaching students about short-term, medium & long-term goals.

Rewards

Badges, have users level up or win small items.

FINALIZING MY SOLUTION

FINALIZING MY SOLUTION

FINALIZING MY SOLUTION

Creating a mobile application for current college students and incoming students to understand the fundamentals of budgeting and goal-setting.

Creating a mobile application for current college students and incoming students to understand the fundamentals of budgeting and goal-setting.

Creating a mobile application for current college students and incoming students to understand the fundamentals of budgeting and goal-setting.

Creating a mobile application for current college students and incoming students to understand the fundamentals of budgeting and goal-setting.

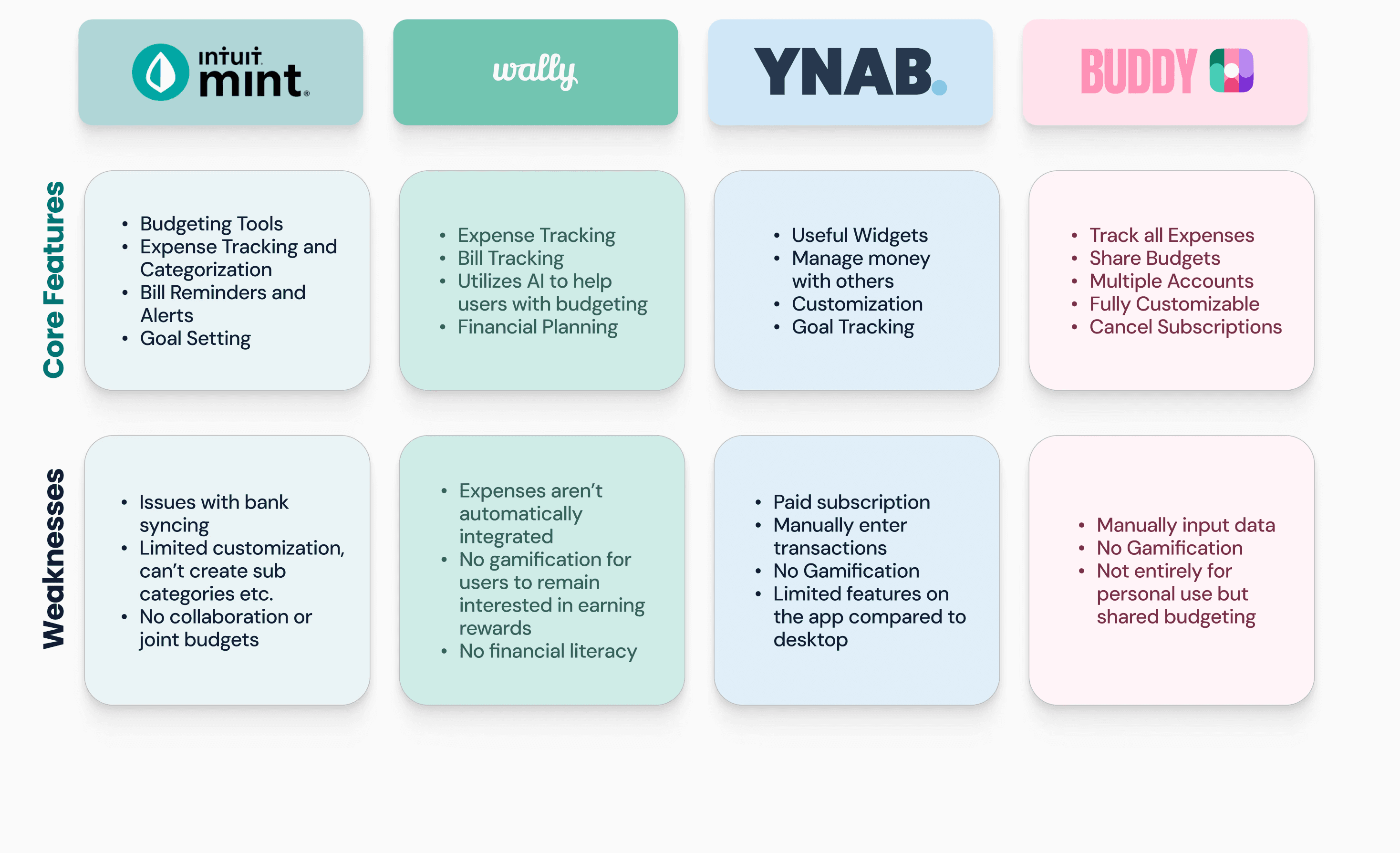

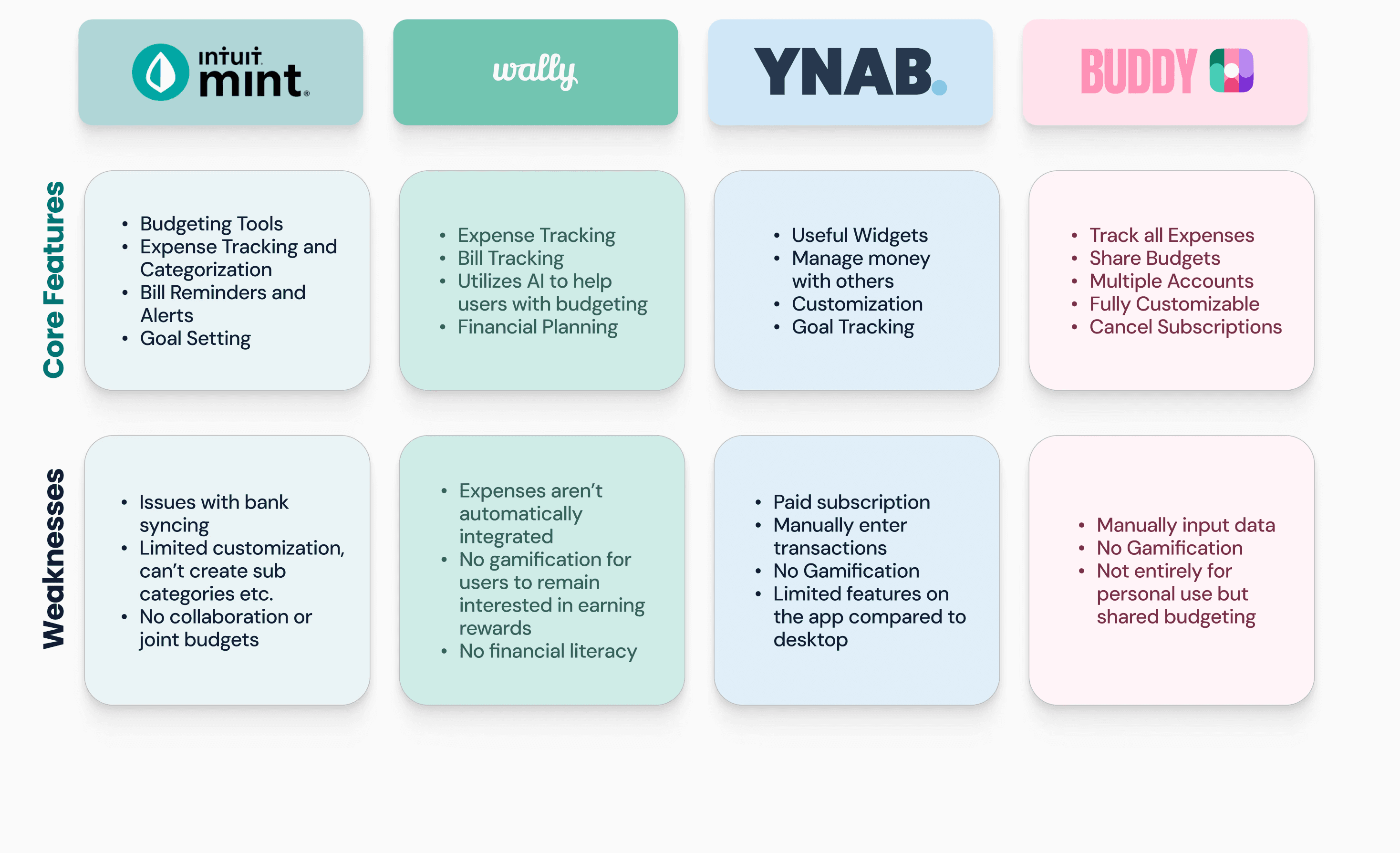

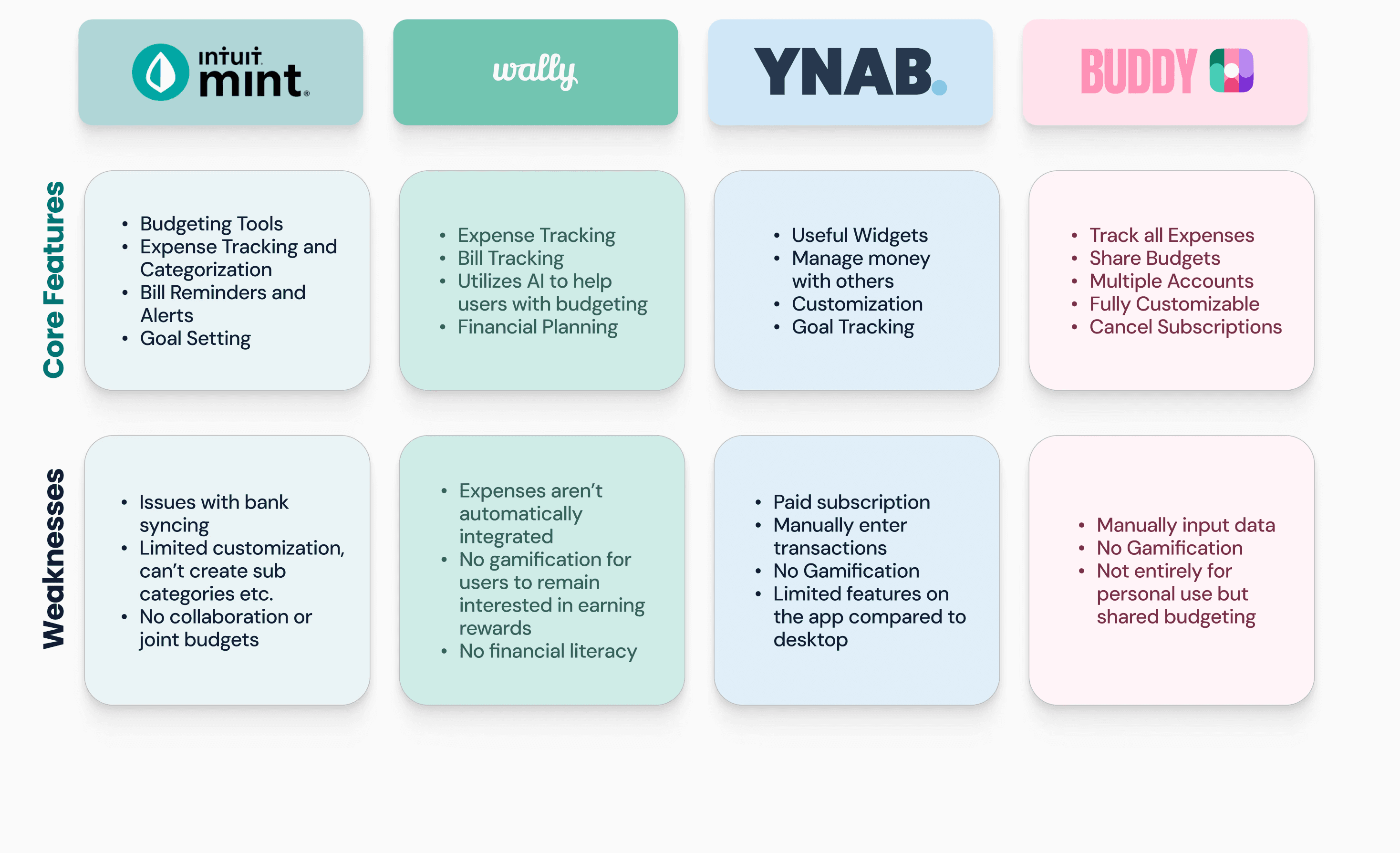

After finalizing my solution, I created a Competitive Analysis

After finalizing my solution, I created a Competitive Analysis

After finalizing my solution, I created a Competitive Analysis

I analyzed current applications core features and weaknesses. I wanted to discover what current users liked and disliked about them and sought to see if college students have used them before.

I analyzed current applications core features and weaknesses. I wanted to discover what current users liked and disliked about them and sought to see if college students have used them before.

I analyzed current applications core features and weaknesses. I wanted to discover what current users liked and disliked about them and sought to see if college students have used them before.

Discovering a name for our app!

Discovering a name for our app!

When coming up with a name I compiled a list of the top ones I found and discussed which name would suit the app I was creating best with students in my class.

When coming up with a name I compiled a list of the top ones I found and discussed which name would suit the app I was creating best with students in my class.

I used ChatGPT to help me discover names, and asked potential users about their input!

I used ChatGPT to help me discover names, and asked potential users about their input!

FrugalFox - Kind of long and didn't give fun

Moola - The name may have a different meaning elsewhere

Fundify - Focuses on Funds, sounds fun

FundU - University vibes

SpendU - Gave off an app to spend money instead of saving

FrugalFox - Kind of long and didn't give fun

Moola - The name may have a different meaning elsewhere

Fundify - Focuses on Funds, sounds fun

FundU - University vibes

SpendU - Gave off an app to spend money instead of saving

Fundify's Finalized Key Features

Fundify's Finalized Key Features

Fundify's Finalized Key Features

I developed a list of features based on students feedback from another survey. I asked them if there were features they wished/wanted in their current banking app that aren't included.

These features will help students understand their current financial status while implementing a fun way for them to earn and save!

I developed a list of features based on students feedback from another survey. I asked them if there were features they wished/wanted in their current banking app that aren't included.

These features will help students understand their current financial status while implementing a fun way for them to earn and save!

I developed a list of features based on students feedback from another survey. I asked them if there were features they wished/wanted in their current banking app that aren't included.

These features will help students understand their current financial status while implementing a fun way for them to earn and save!

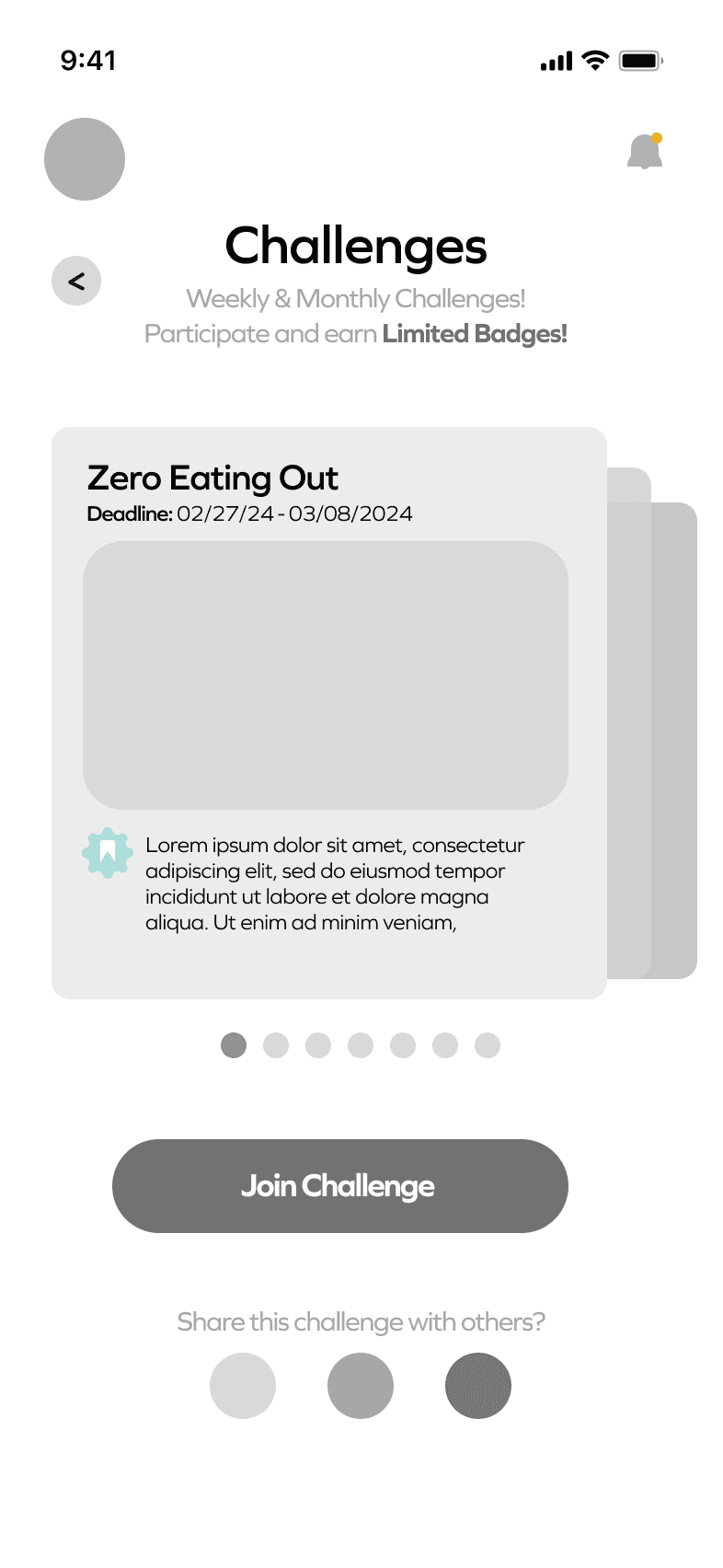

📝 Create a Budget:

Create a weekly budget to follow and keep track of to earn badges.

Understand their weekly spending habits in a shortened method

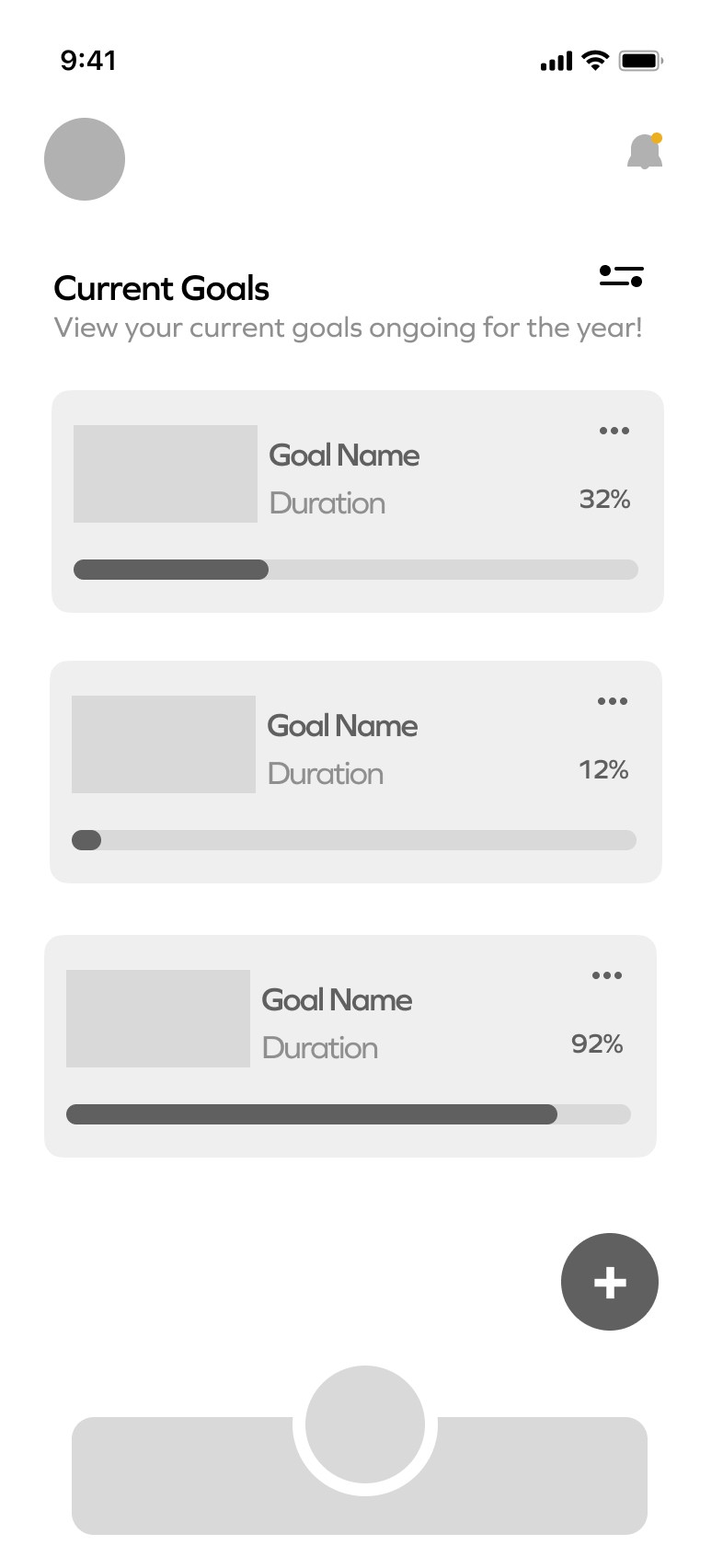

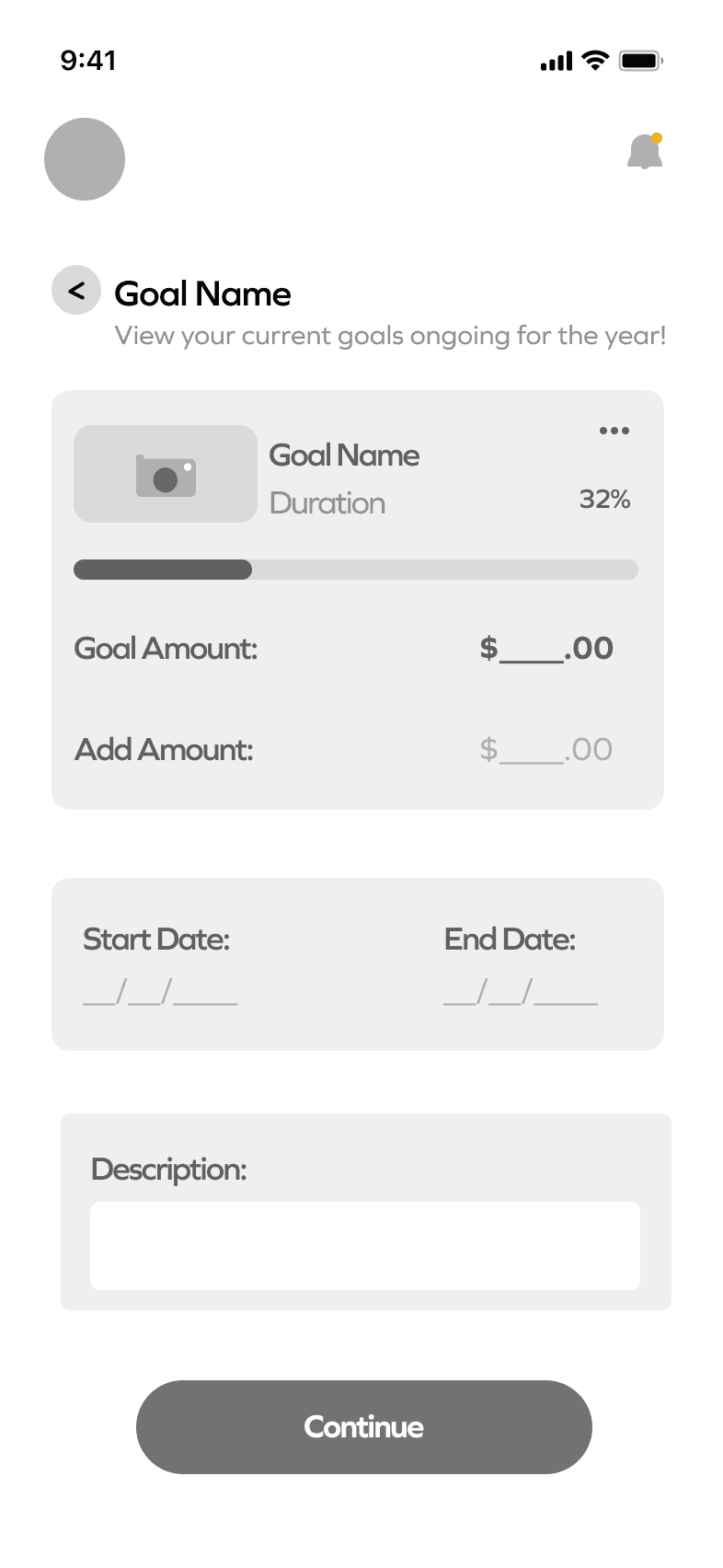

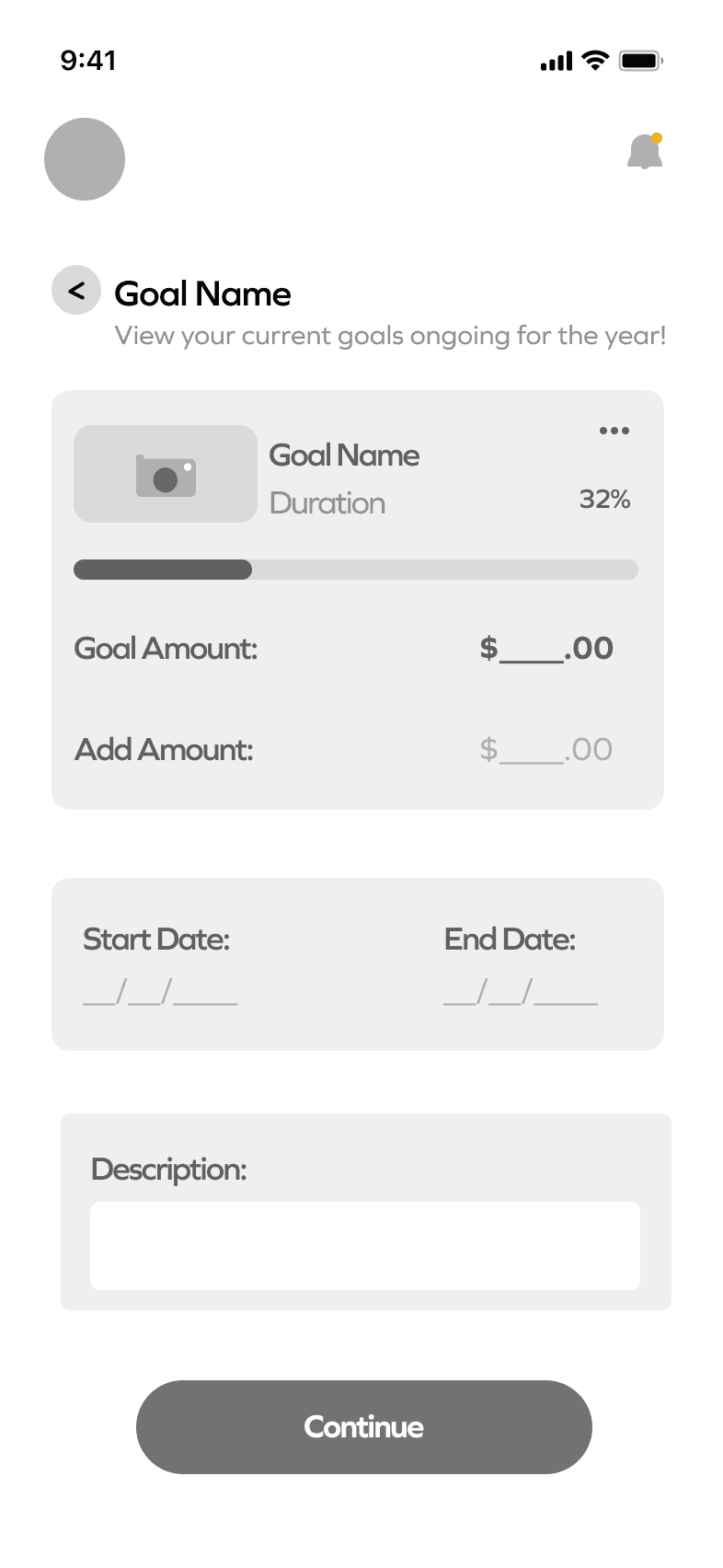

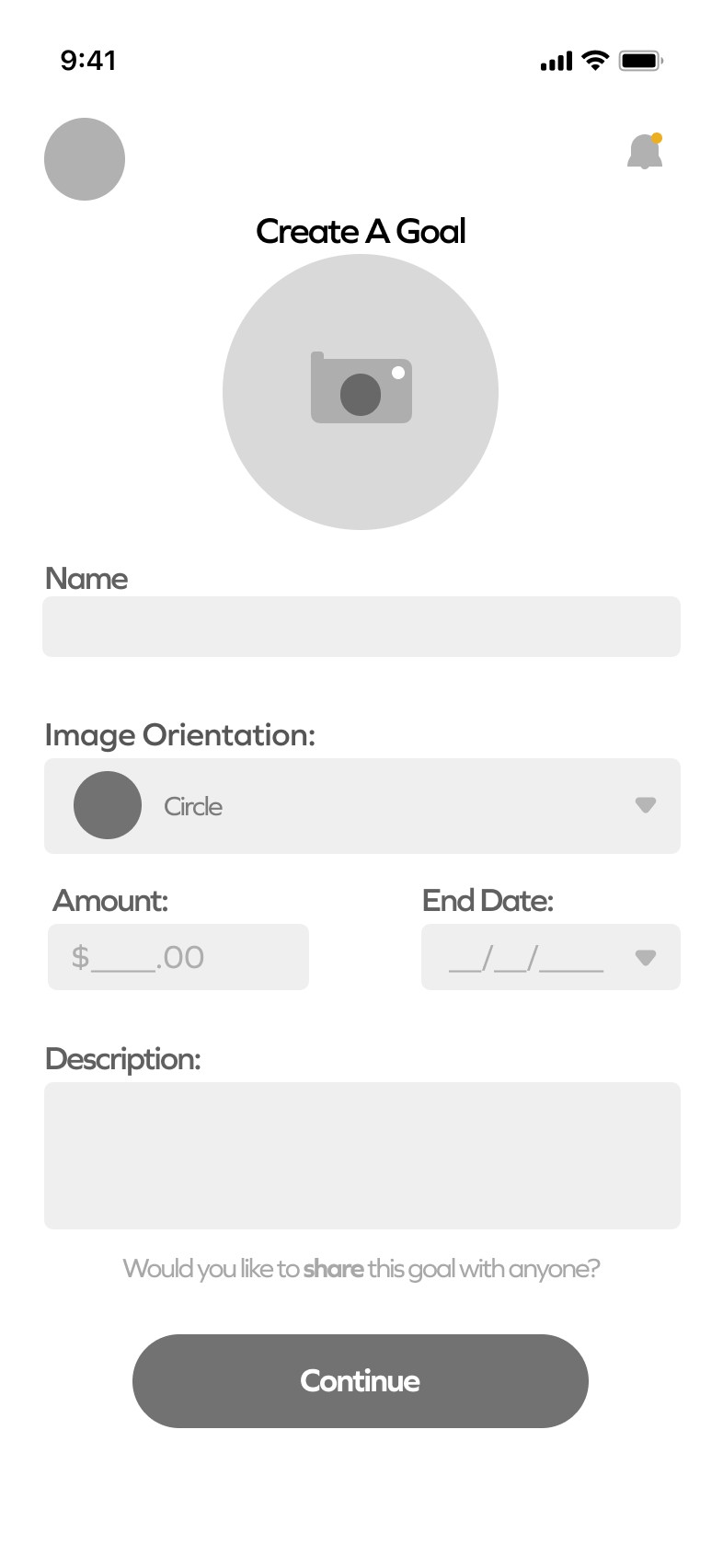

🎯 Create a Goal:

Goal setting which may be helpful for students to earn and save for items they want to purchase.

📌 Tips & Tricks

Users can share their money-management tips with others.

They can access challenges to earn badges which serves as a reward and a goal incentive.

📝 Create a Budget:

Create a weekly budget to follow and keep track of to earn badges.

Understand their weekly spending habits in a shortened method

🎯 Create a Goal:

Goal setting which may be helpful for students to earn and save for items they want to purchase.

📌 Tips & Tricks

Users can share their money-management tips with others.

They can access challenges to earn badges which serves as a reward and a goal incentive.

📝 Create a Budget:

Create a weekly budget to follow and keep track of to earn badges.

Understand their weekly spending habits in a shortened method

🎯 Create a Goal:

Goal setting which may be helpful for students to earn and save for items they want to purchase.

📌 Tips & Tricks

Users can share their money-management tips with others.

They can access challenges to earn badges which serves as a reward and a goal incentive.

📝 Create a Budget:

Create a weekly budget to follow and keep track of to earn badges.

Understand their weekly spending habits in a shortened method

🎯 Create a Goal:

Goal setting which may be helpful for students to earn and save for items they want to purchase.

📌 Tips & Tricks

Users can share their money-management tips with others.

They can access challenges to earn badges which serves as a reward and a goal incentive.

🛍️ Spending Habits

Analyze spending habits for the week

Understand which category they've spent the most money on for the current week.

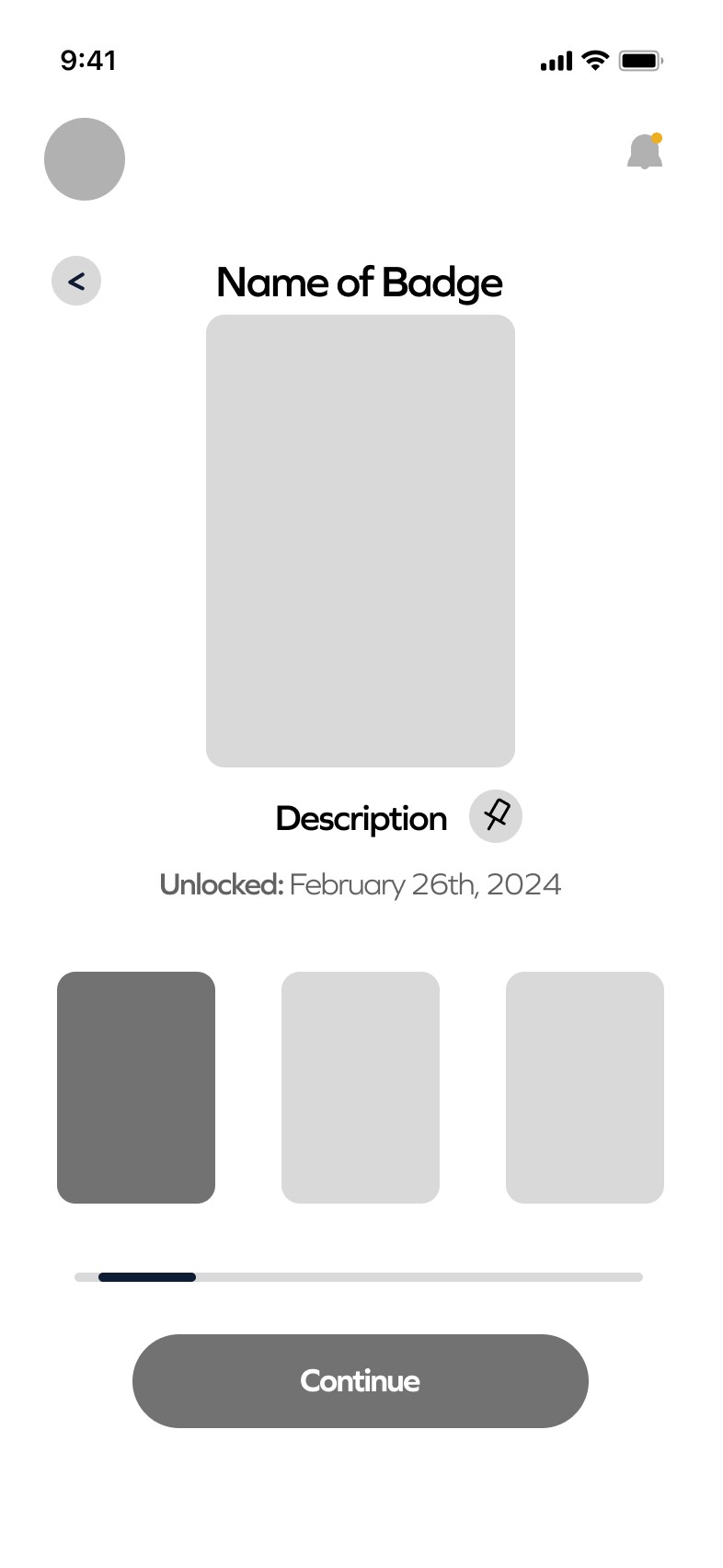

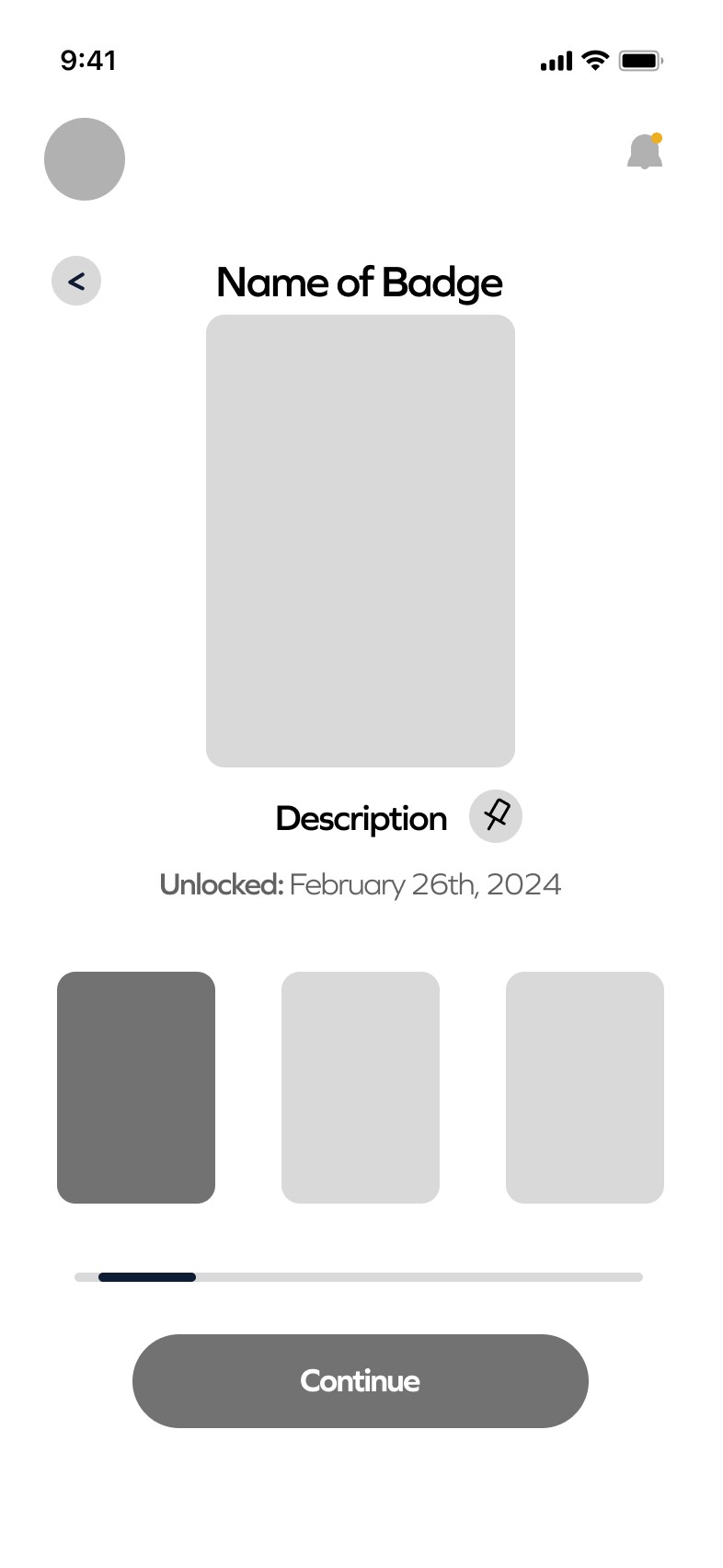

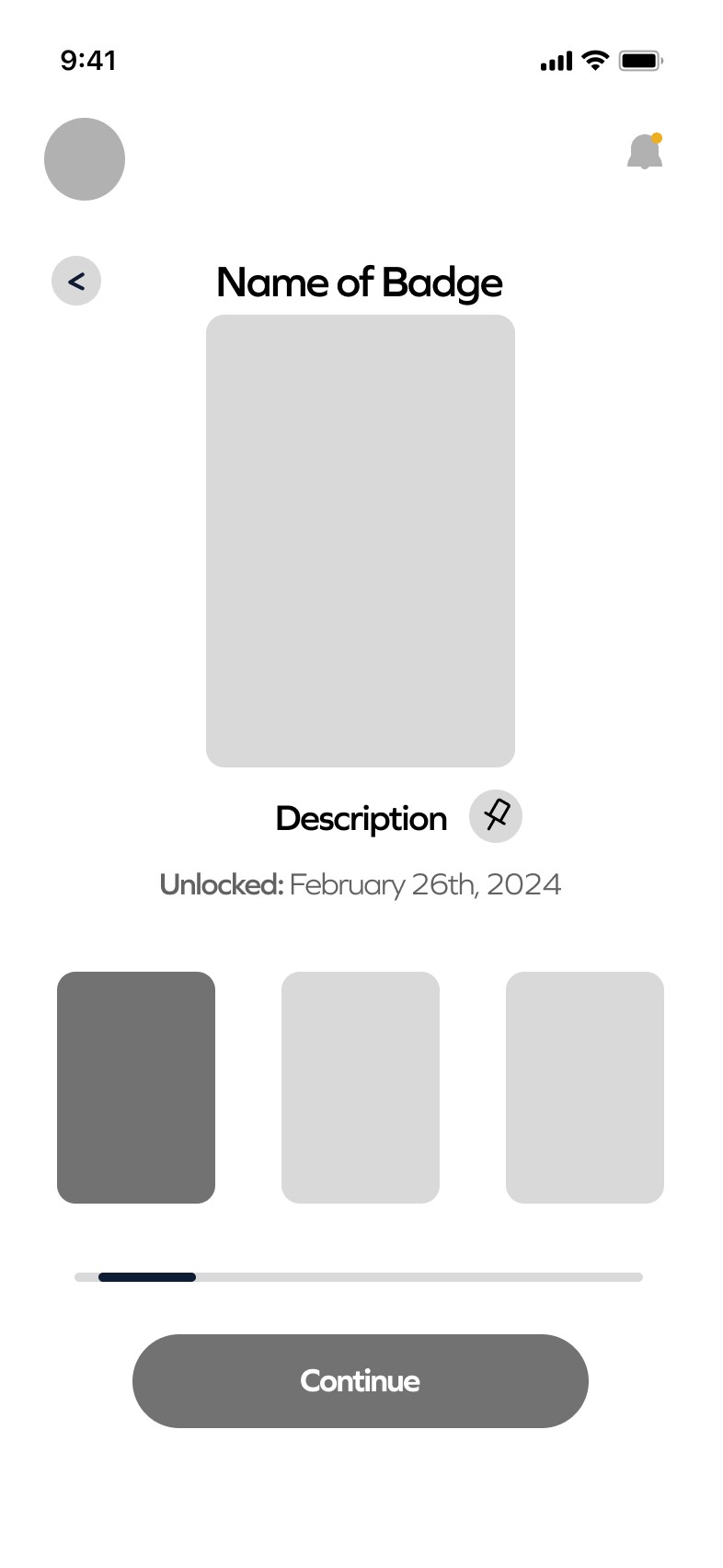

⭐ Badges

Users can earn badges as incentives and can display their favorite badge on their profile.

The first badge earned through onboarding is color-coded to match the color chosen for their sprite during onboarding.

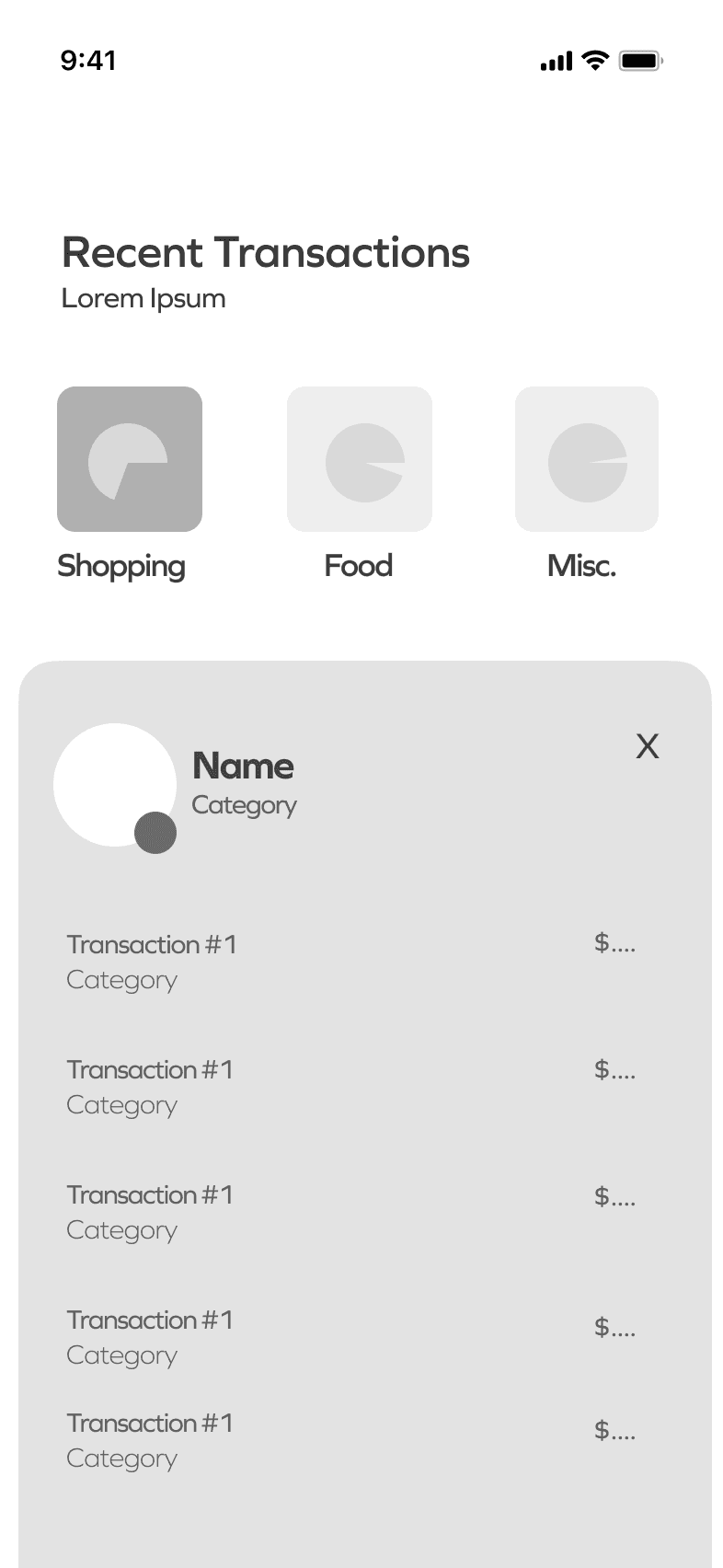

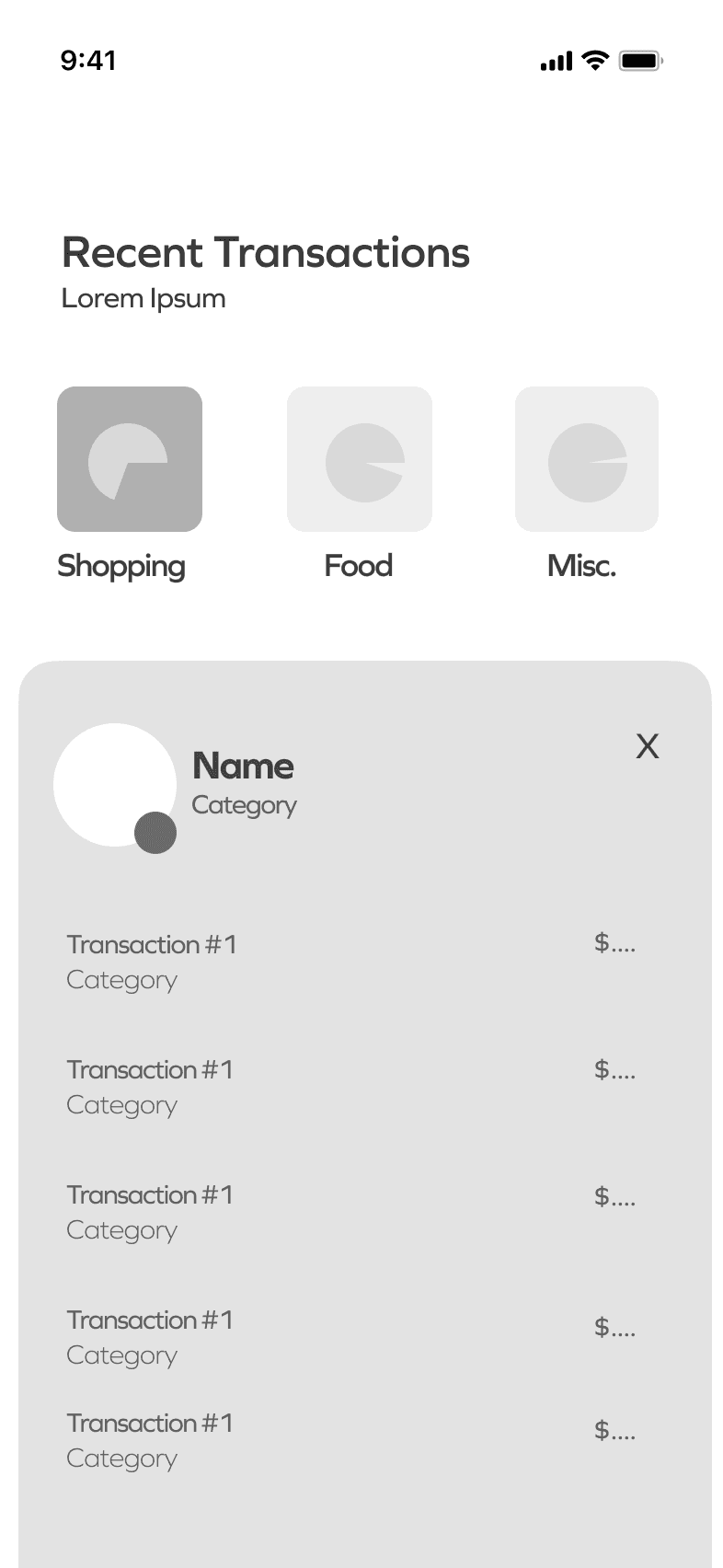

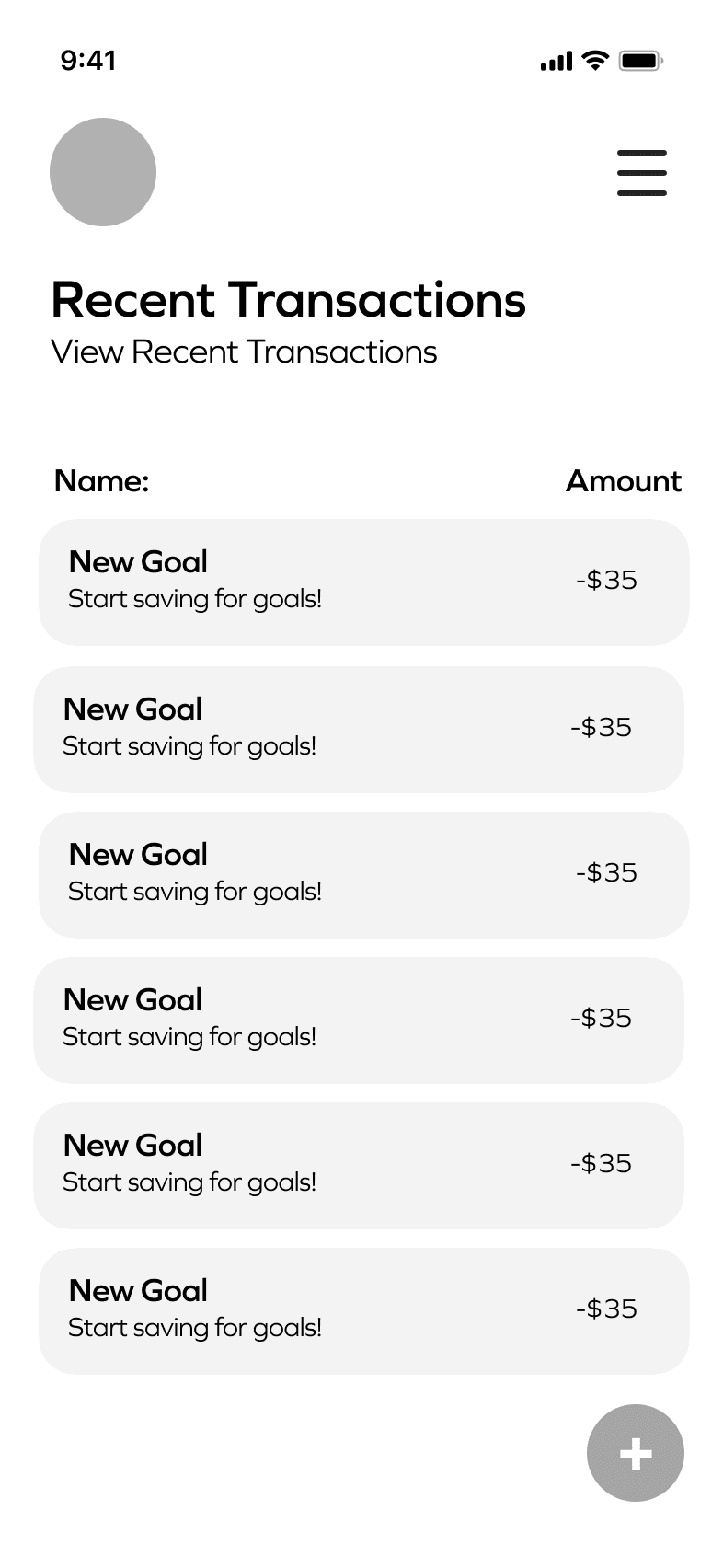

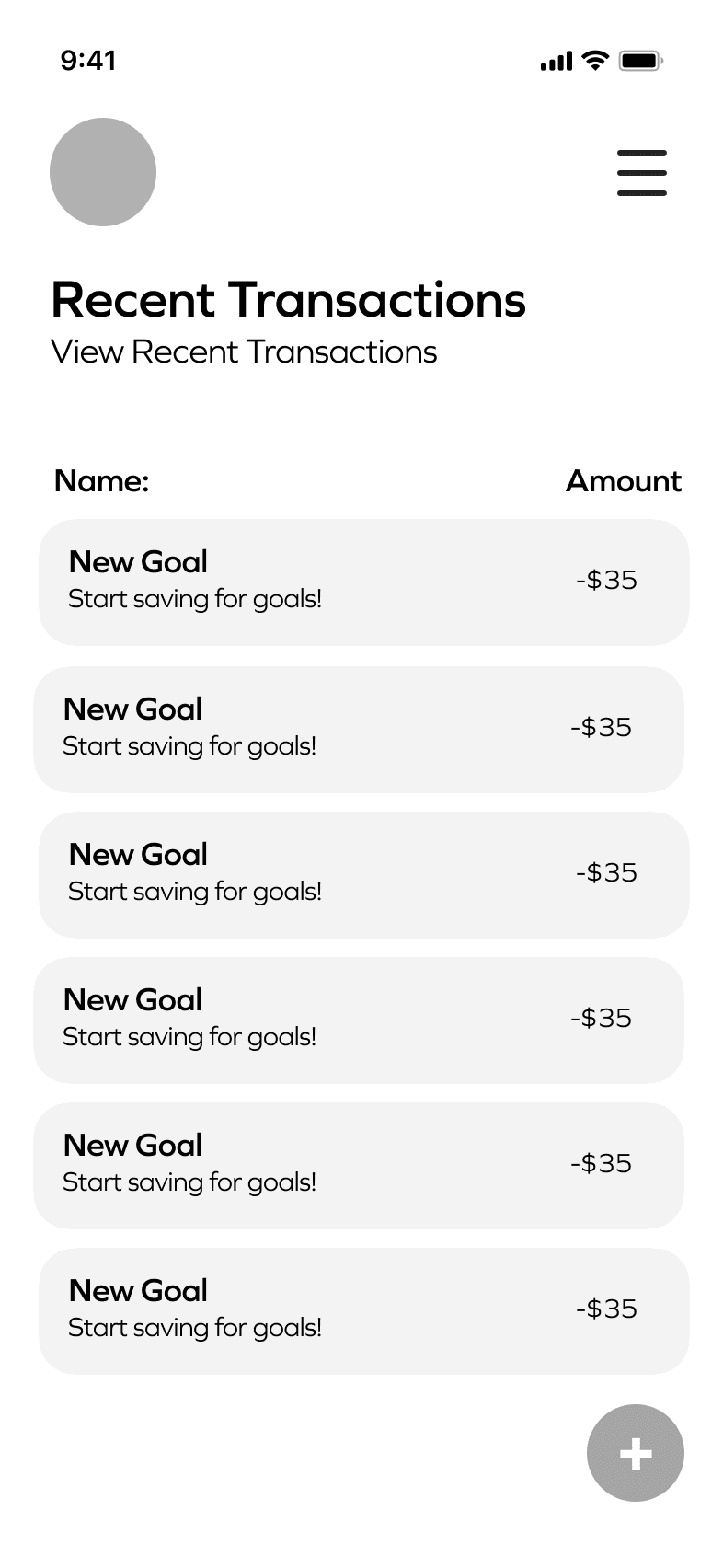

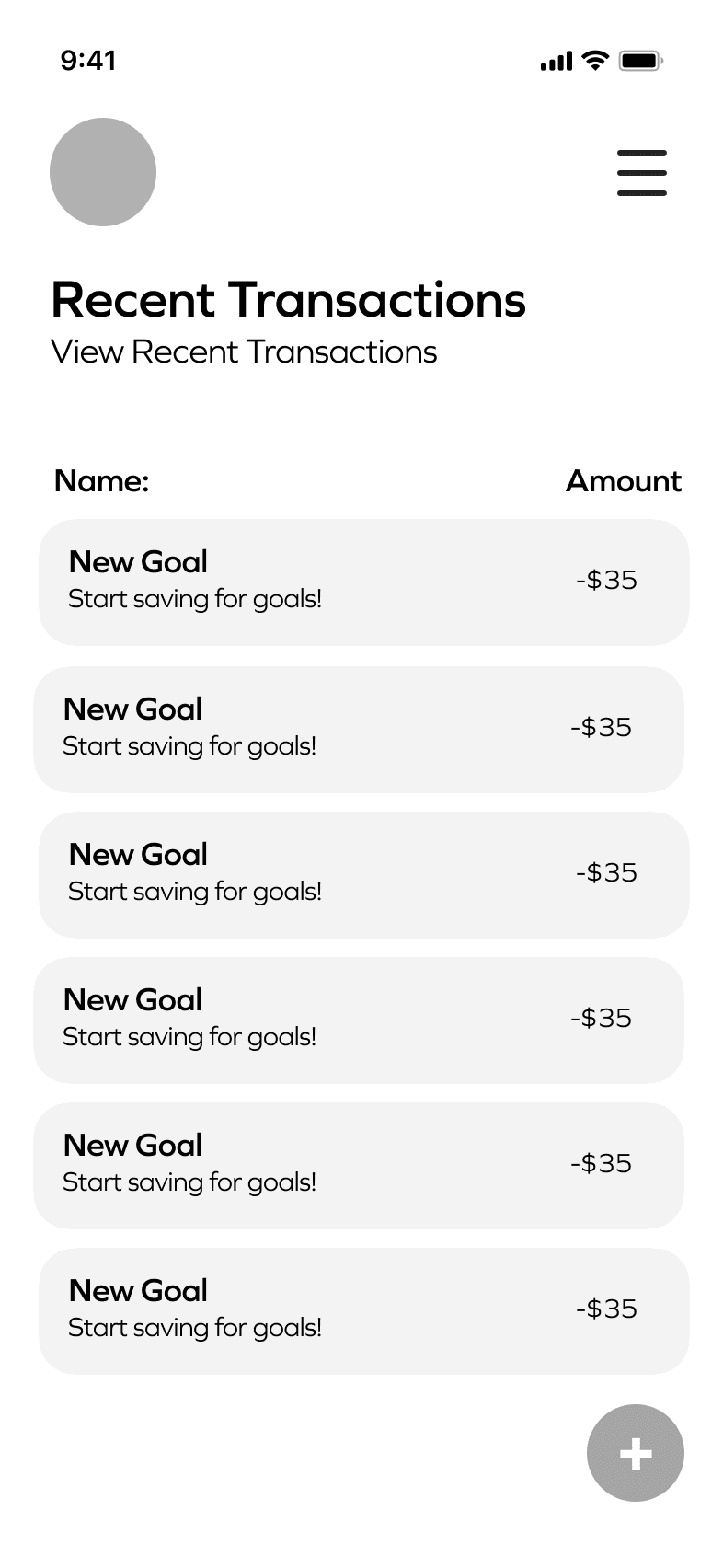

🧾 Transactions

View their weekly transactions to keep track of how much they've spent in a week

The highest category where they've spent the most will be displayed at the top

🛍️ Spending Habits

Analyze spending habits for the week

Understand which category they've spent the most money on for the current week.

⭐ Badges

Users can earn badges as incentives and can display their favorite badge on their profile.

The first badge earned through onboarding is color-coded to match the color chosen for their sprite during onboarding.

🧾 Transactions

View their weekly transactions to keep track of how much they've spent in a week

The highest category where they've spent the most will be displayed at the top

🛍️ Spending Habits

Analyze spending habits for the week

Understand which category they've spent the most money on for the current week.

⭐ Badges

Users can earn badges as incentives and can display their favorite badge on their profile.

The first badge earned through onboarding is color-coded to match the color chosen for their sprite during onboarding.

🧾 Transactions

View their weekly transactions to keep track of how much they've spent in a week

The highest category where they've spent the most will be displayed at the top

🛍️ Spending Habits

Analyze spending habits for the week

Understand which category they've spent the most money on for the current week.

⭐ Badges

Users can earn badges as incentives and can display their favorite badge on their profile.

The first badge earned through onboarding is color-coded to match the color chosen for their sprite during onboarding.

🧾 Transactions

View their weekly transactions to keep track of how much they've spent in a week

The highest category where they've spent the most will be displayed at the top

UI WORKFLOW

UI WORKFLOW

UI WORKFLOW

Understanding and developing the UI Workflow

Understanding and developing the UI Workflow

Understanding and developing the UI Workflow

Understanding and developing the UI Workflow

Discovering a name for our app!

When coming up with a name I compiled a list of the top ones I found and discussed which name would suit the app I was creating best with students in my class.

I used ChatGPT to help me discover names, and asked potential users about their input!

FrugalFox - Kind of long and didn't give fun

Moola - The name may have a different meaning elsewhere

Fundify - Focuses on Funds, sounds fun

FundU - University vibes

SpendU - Gave off an app to spend money instead of saving

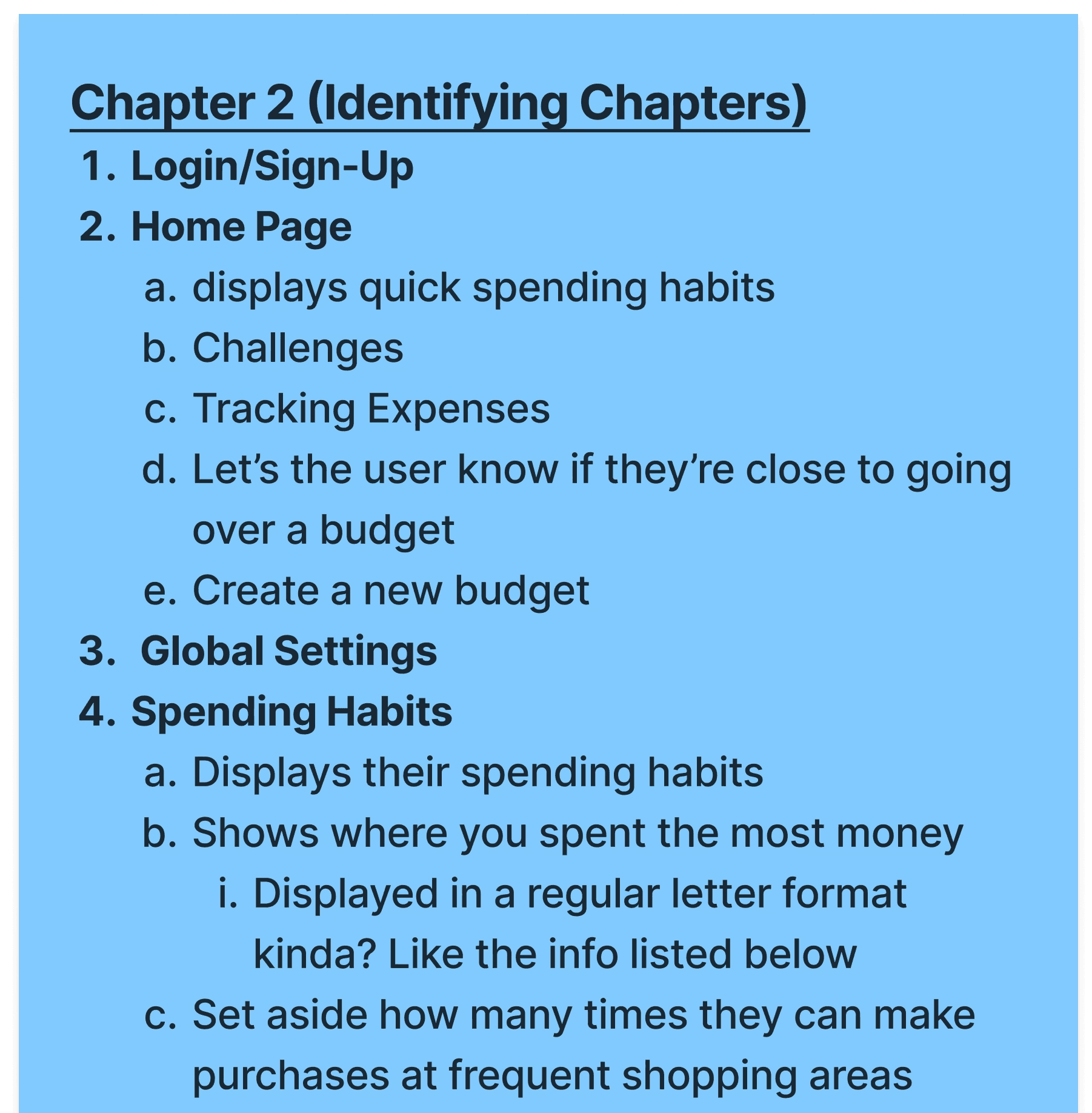

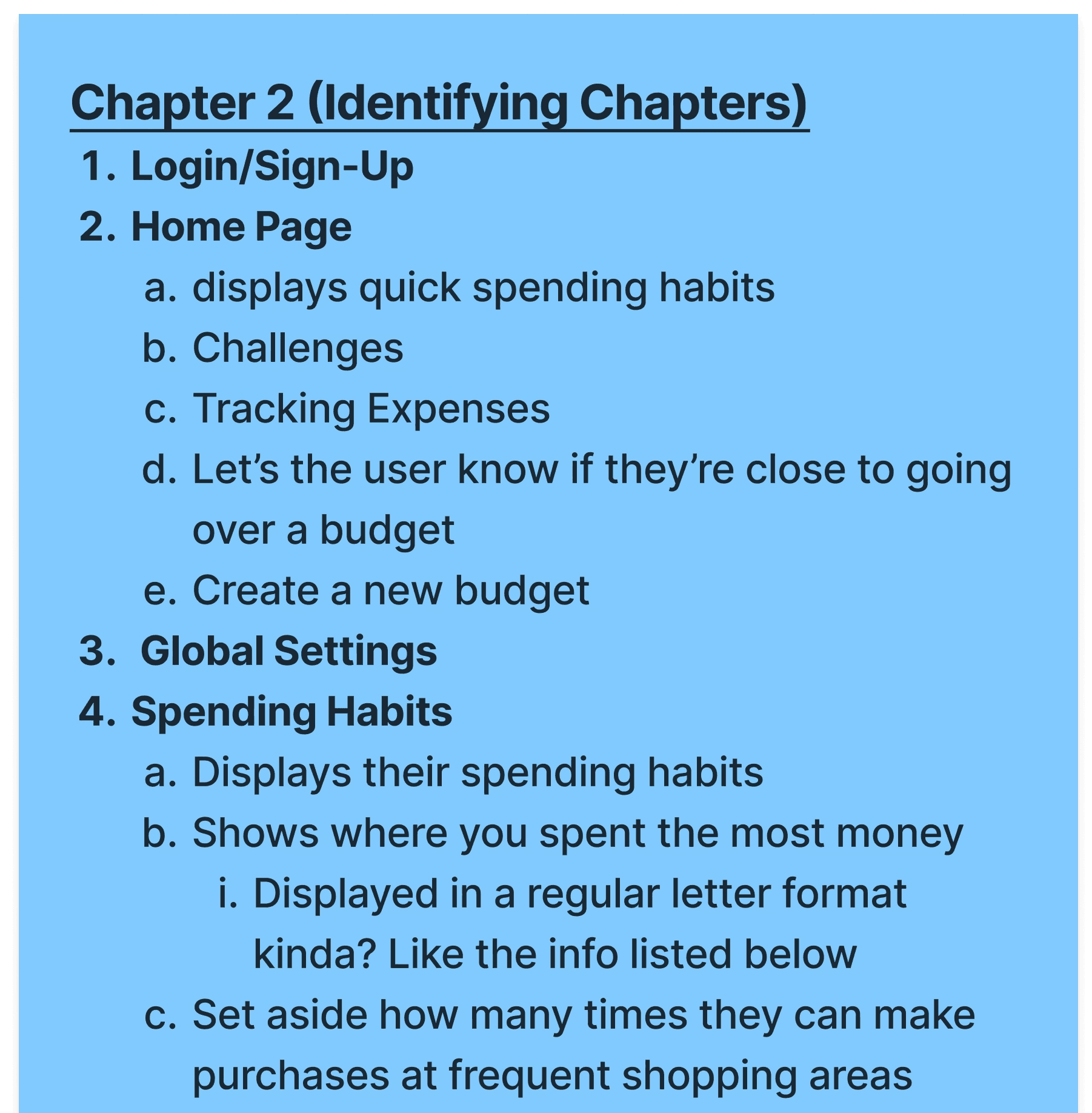

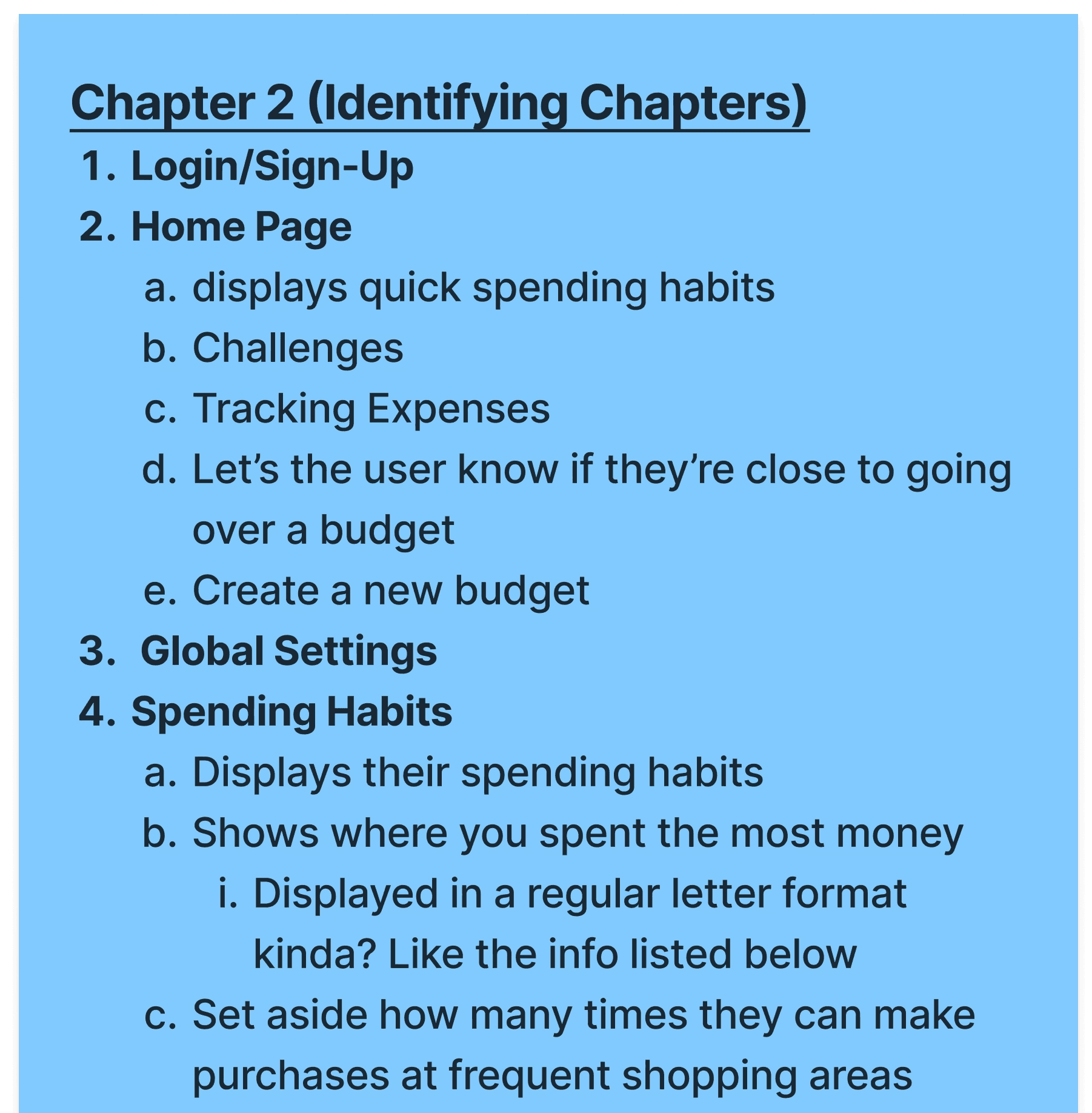

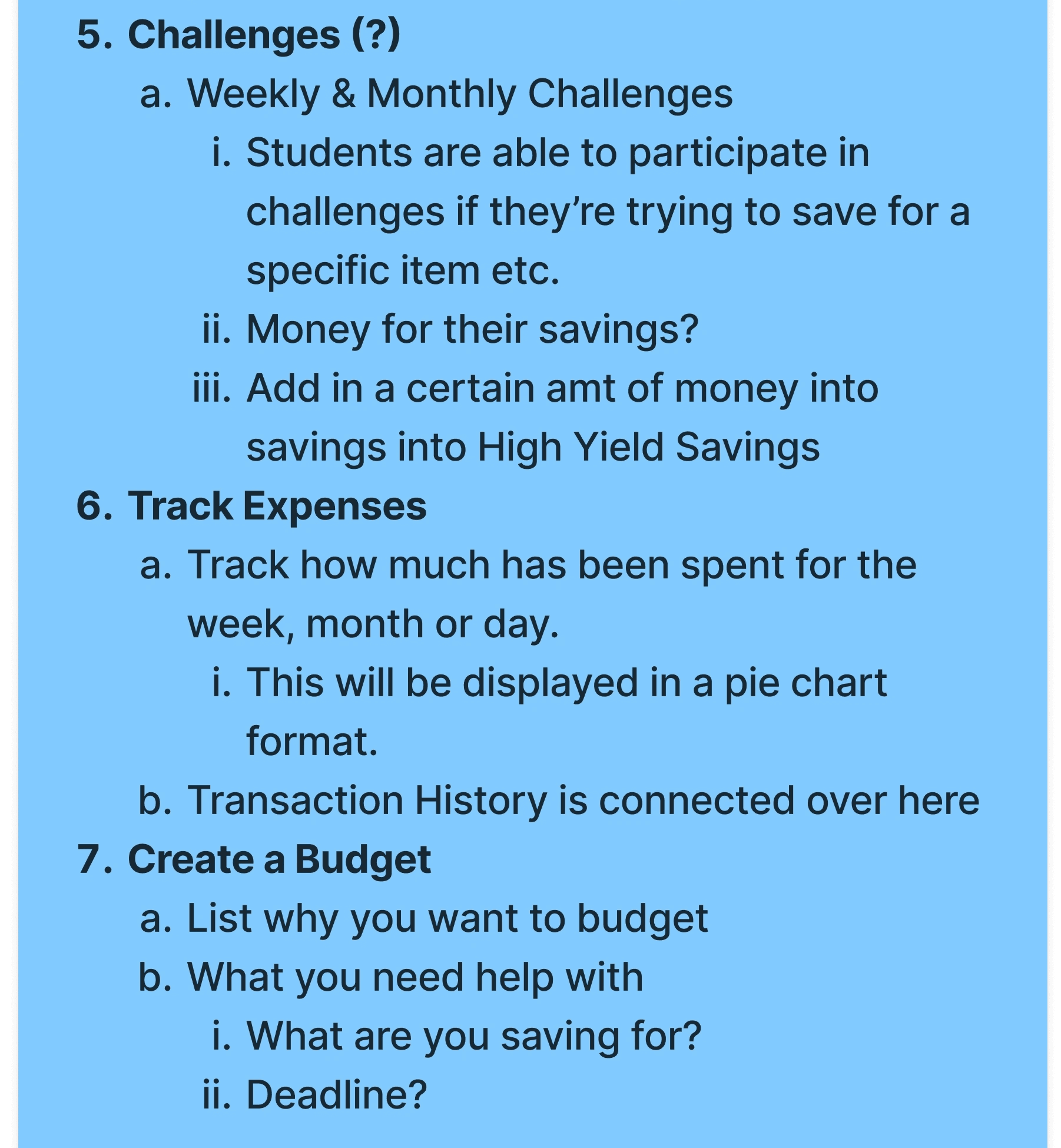

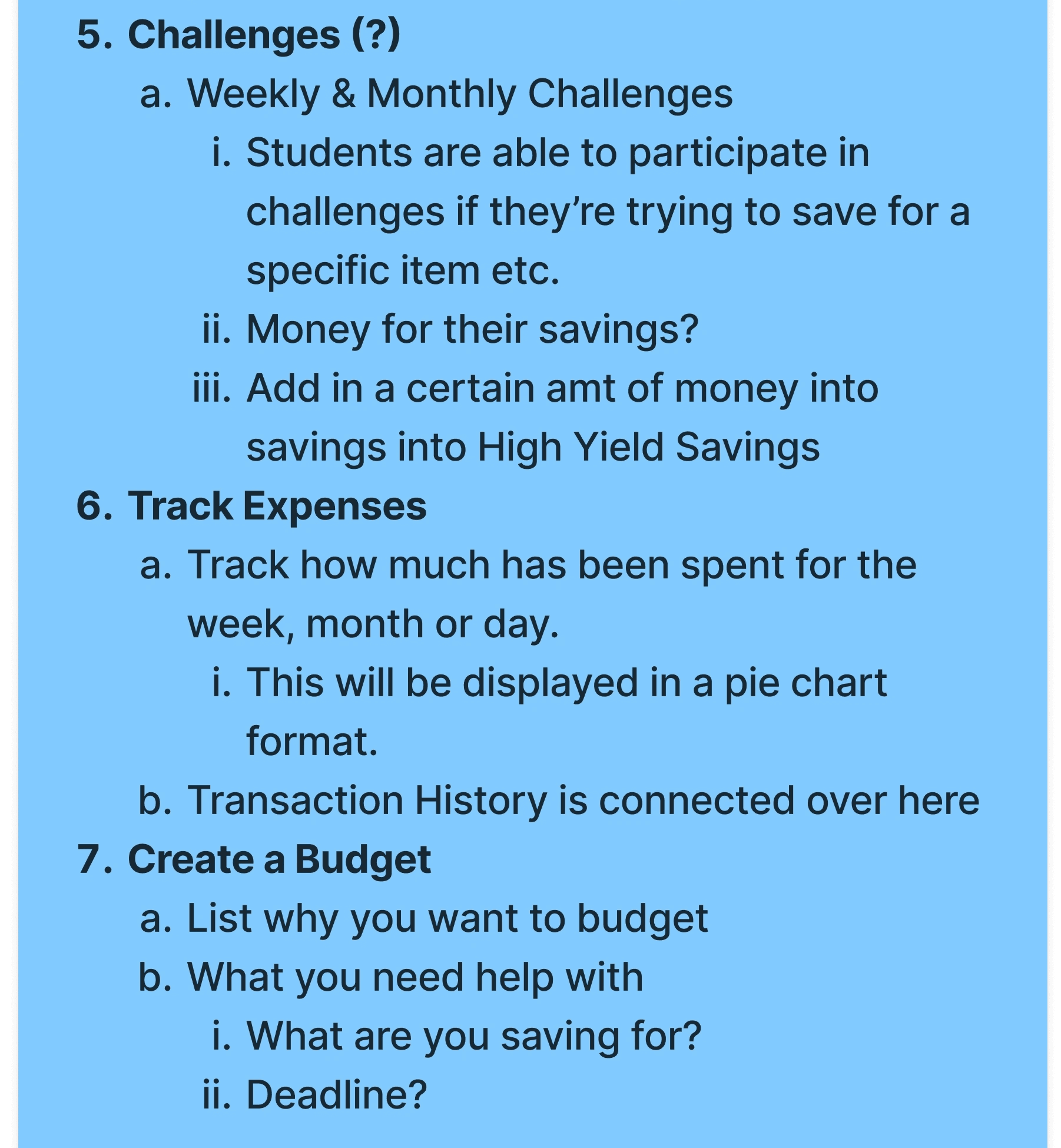

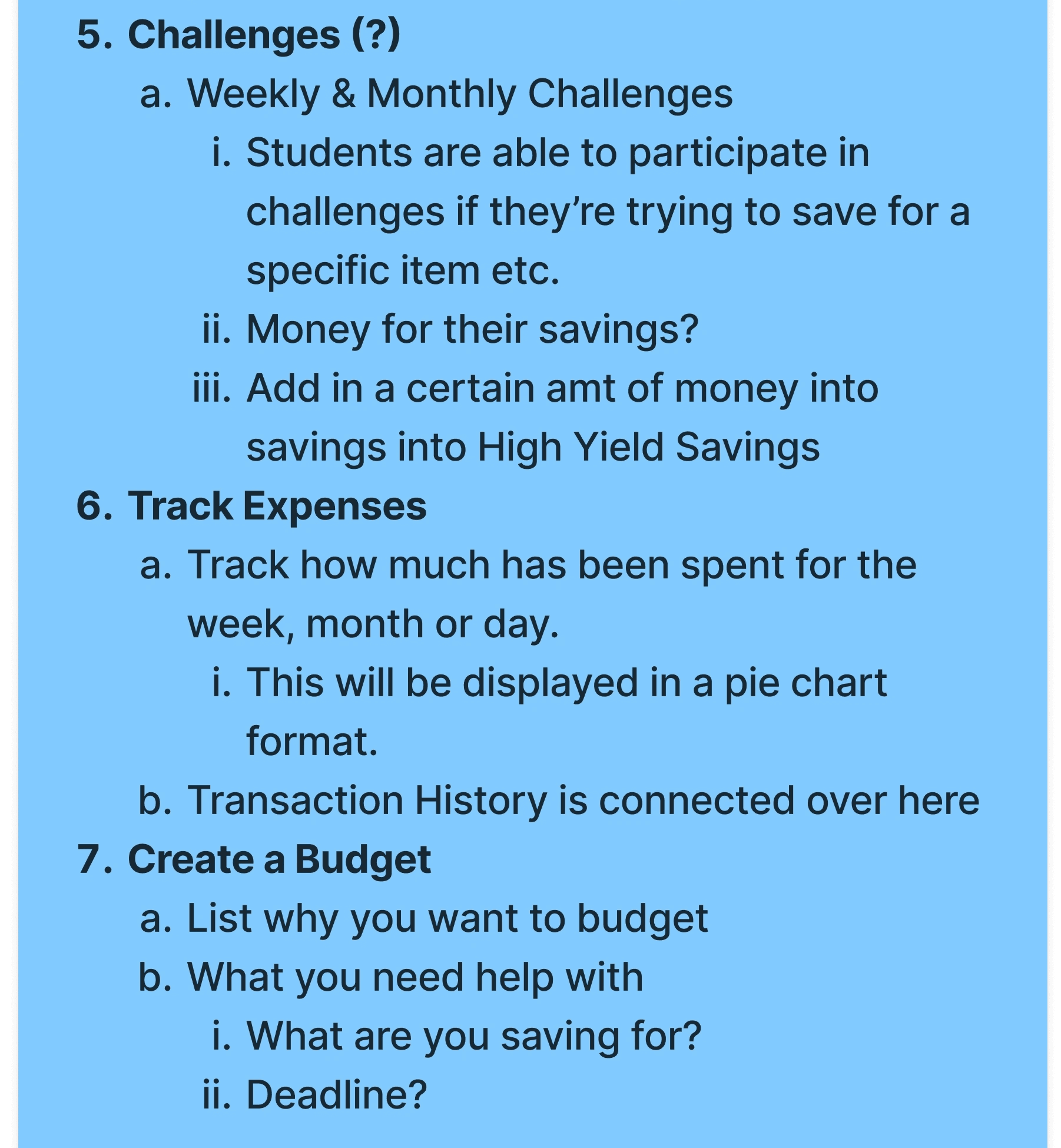

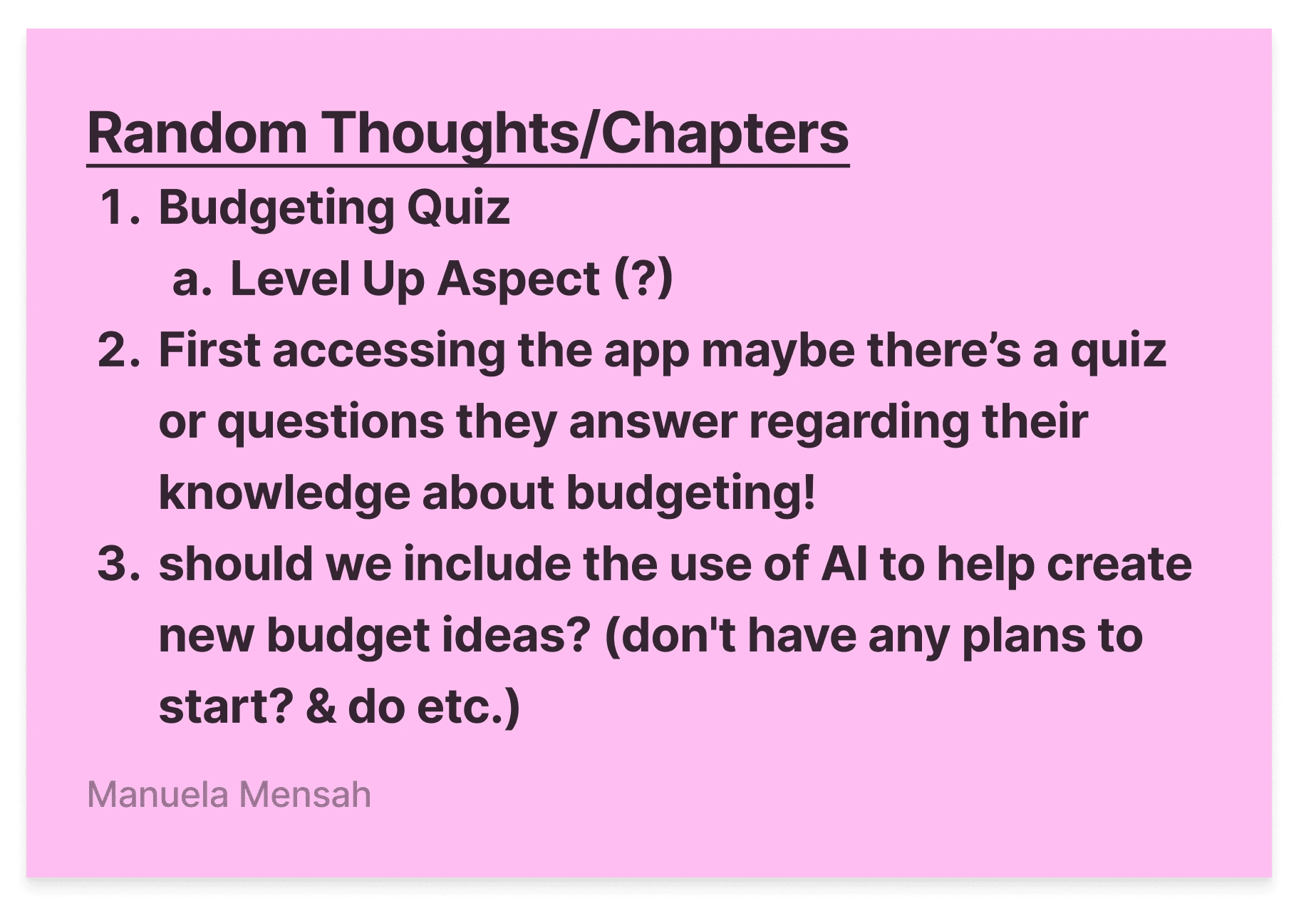

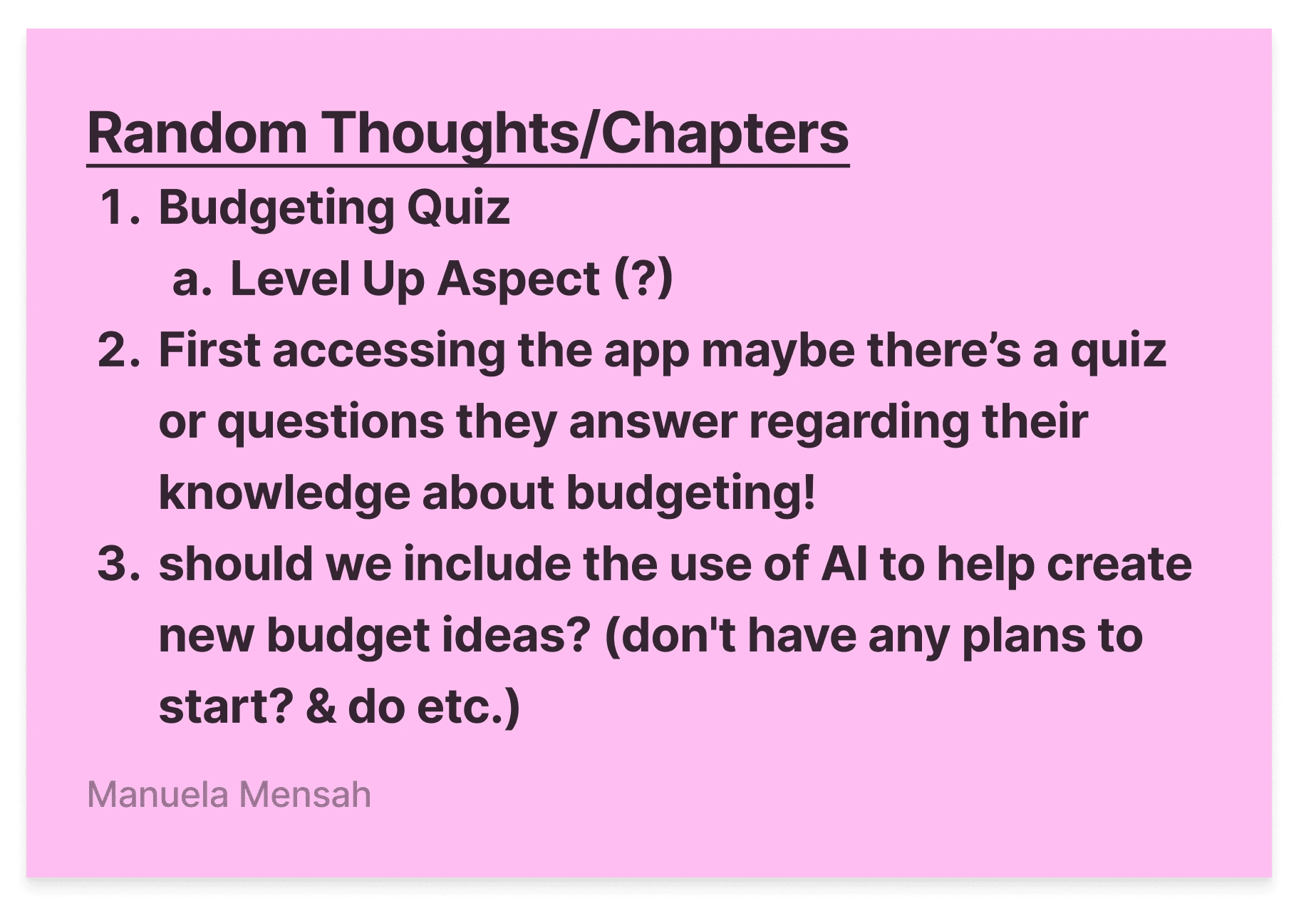

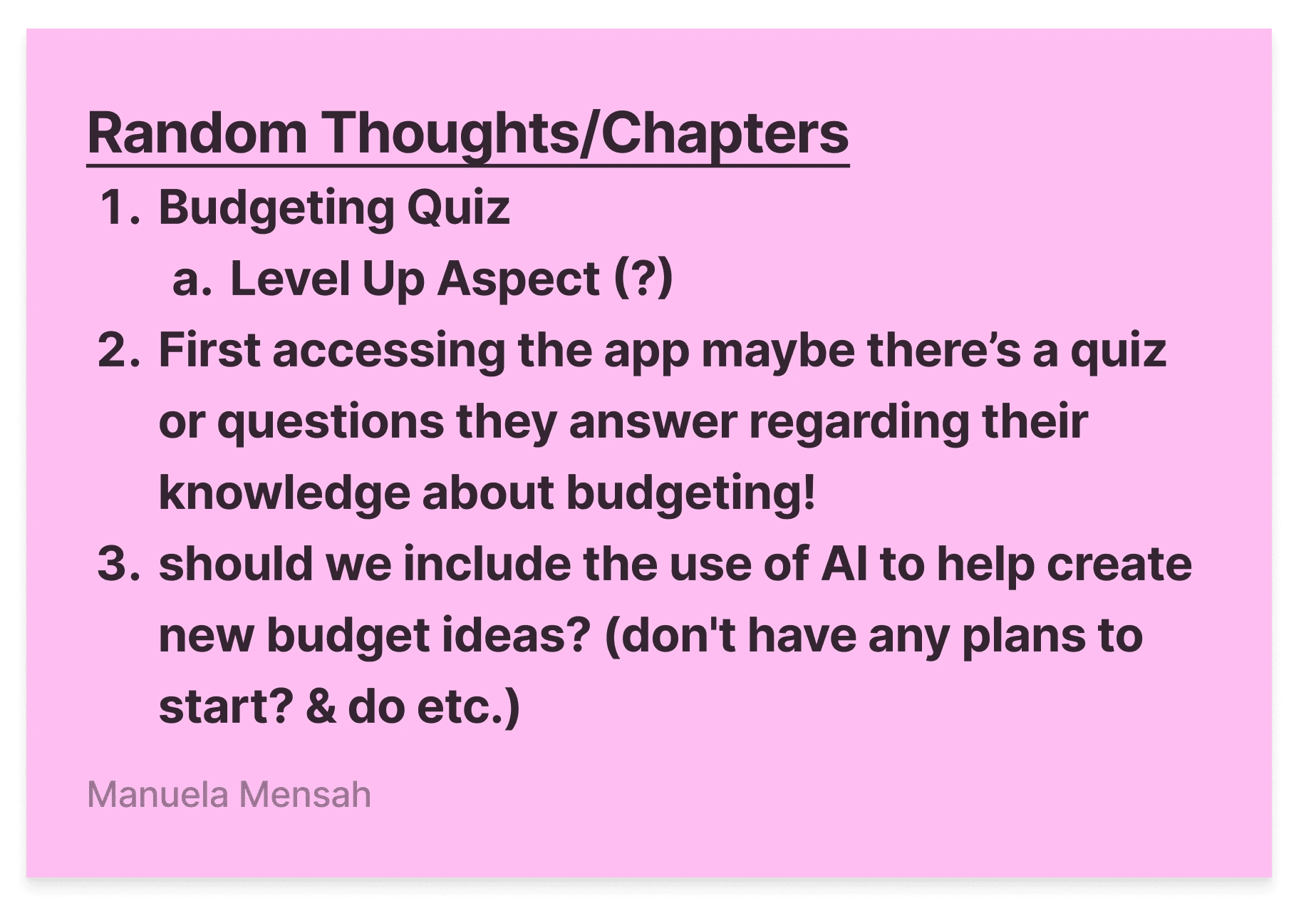

Identifying important chapters and key features

Identifying important chapters and key features

Identifying important chapters and key features

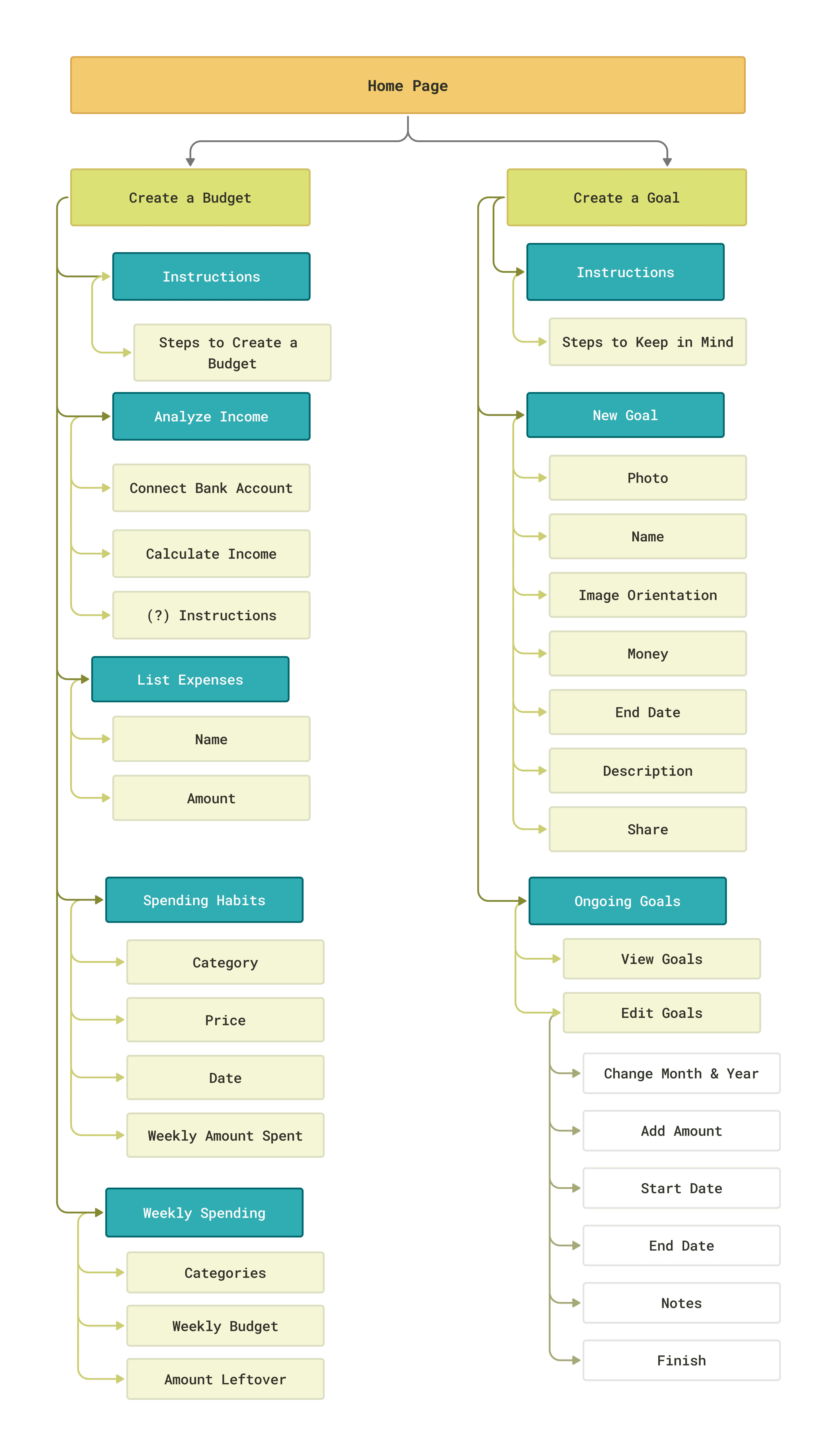

I created a list of chapters to understand the flow of Fundify and how the features would be labeled. After creating and putting together the list I began developing the user flow, information architecture and site map.

I created a list of chapters to understand the flow of Fundify and how the features would be labeled. After creating and putting together the list I began developing the user flow, information architecture and site map.

I created a list of chapters to understand the flow of Fundify and how the features would be labeled. After creating and putting together the list I began developing the user flow, information architecture and site map.

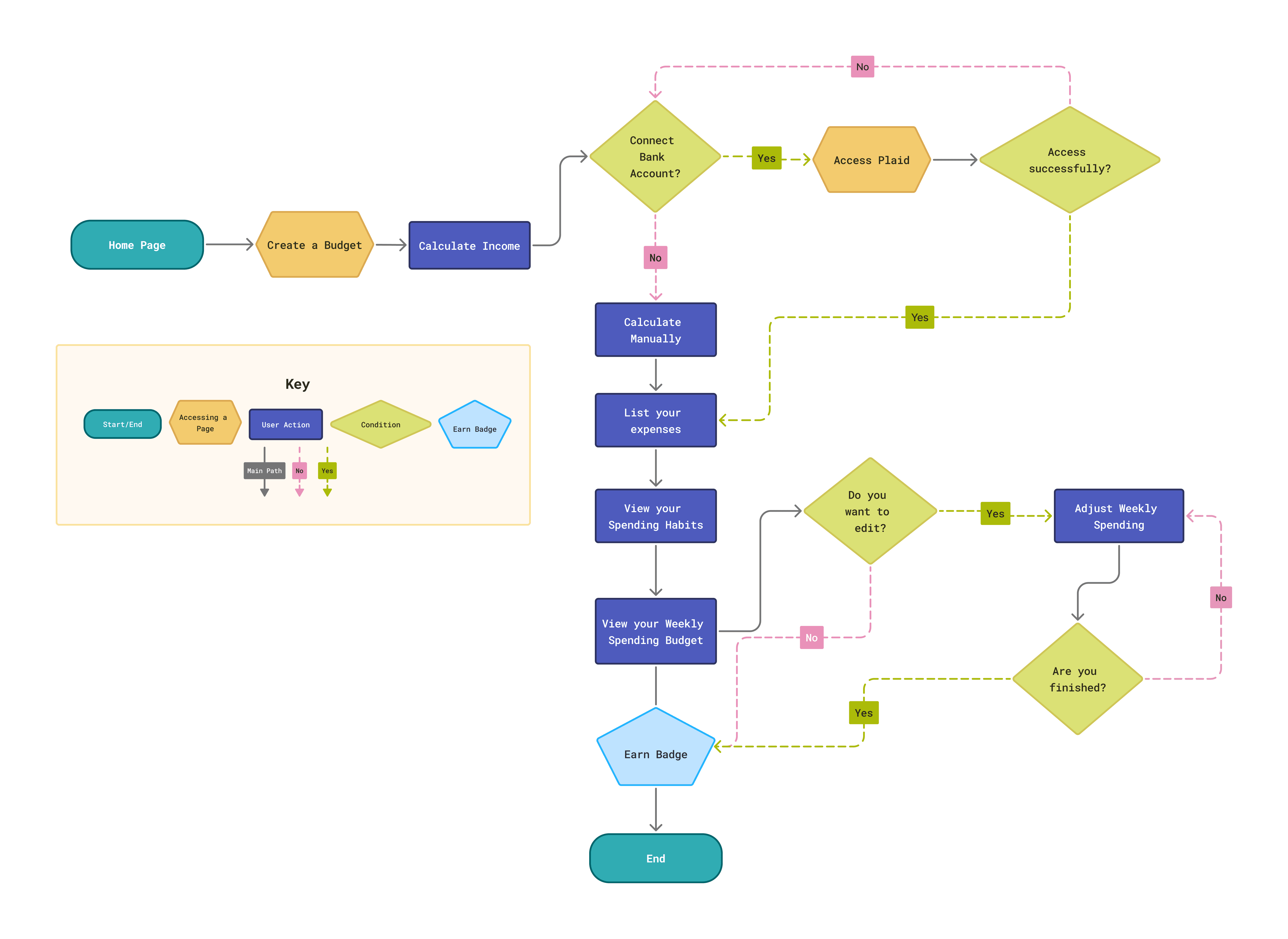

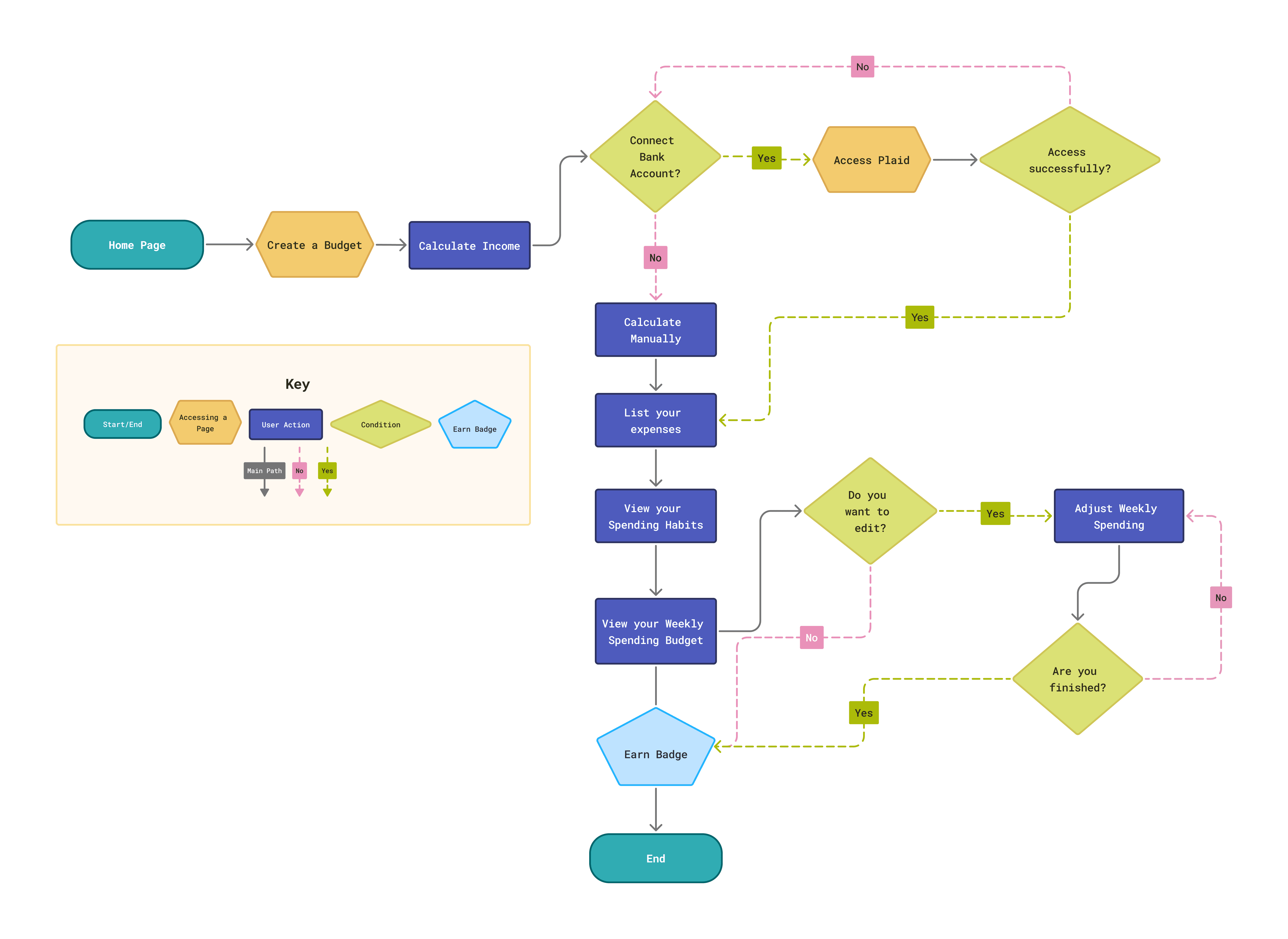

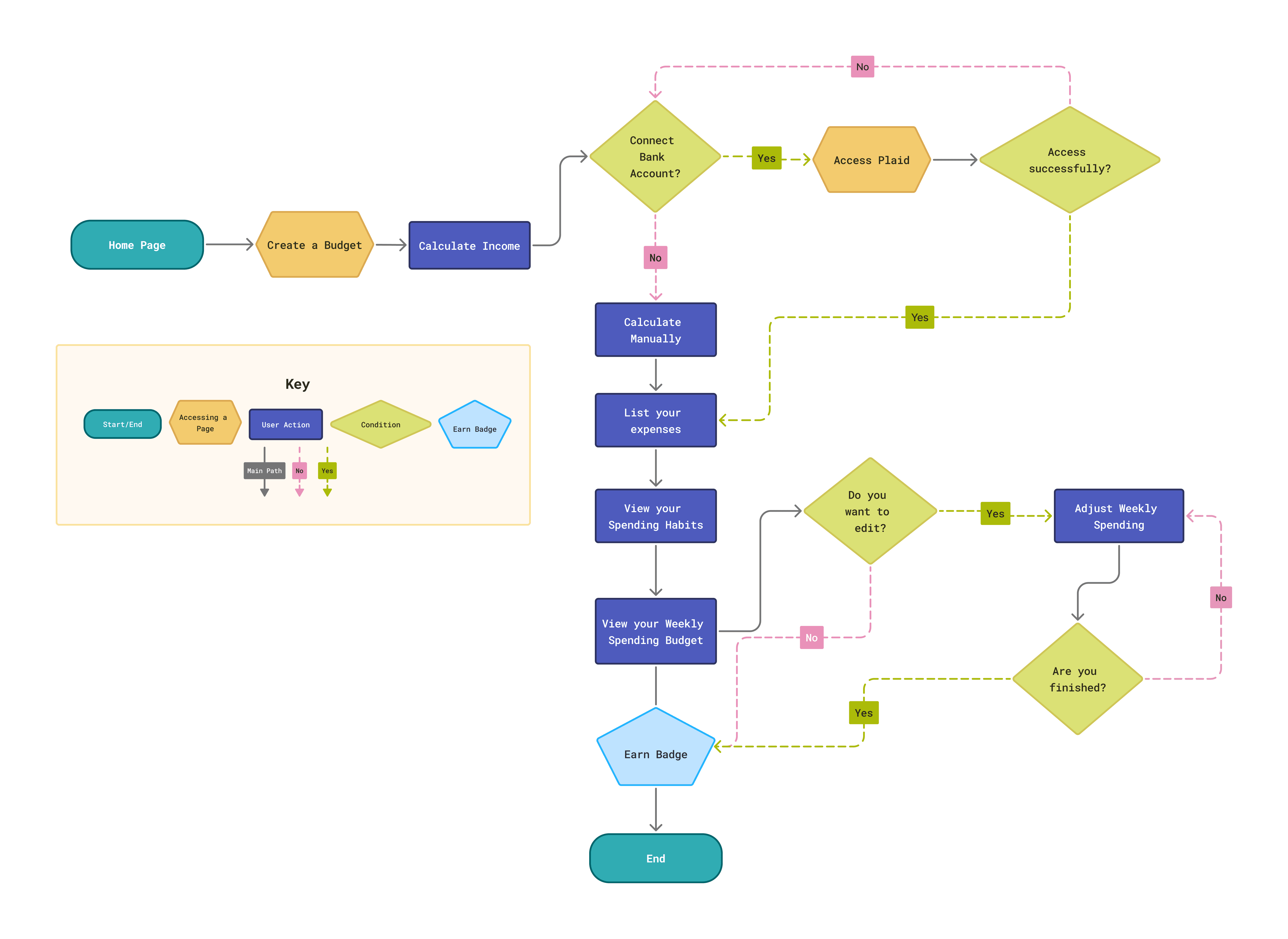

User Flow - Create a Budget

User Flow - Create a Budget

User Flow - Create a Budget

Create a Budget is one of the most important features. It allows users to analyze their spending habits and income to create a personalized weekly budget.

Create a Budget is one of the most important features. It allows users to analyze their spending habits and income to create a personalized weekly budget.

Create a Budget is one of the most important features. It allows users to analyze their spending habits and income to create a personalized weekly budget.

Create a Budget is one of the most important features. It allows users to analyze their spending habits and income to create a personalized weekly budget.

Below shows how a user would access the onboarding process for Create a Budget. Once completed they're able to earn and add a badge to their collection.

Below shows how a user would access the onboarding process for Create a Budget. Once completed they're able to earn and add a badge to their collection.

Below shows how a user would access the onboarding process for Create a Budget. Once completed they're able to earn and add a badge to their collection.

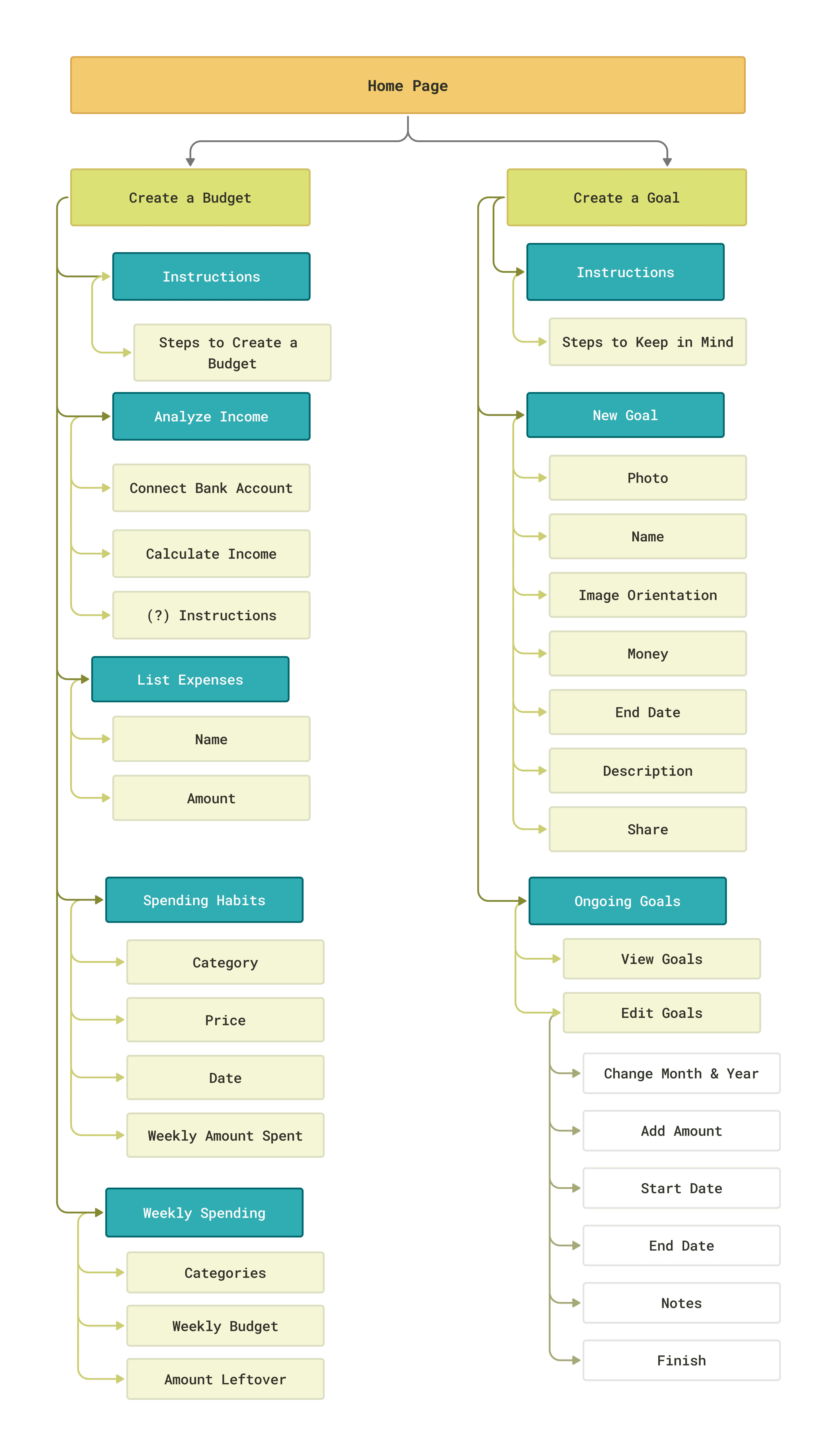

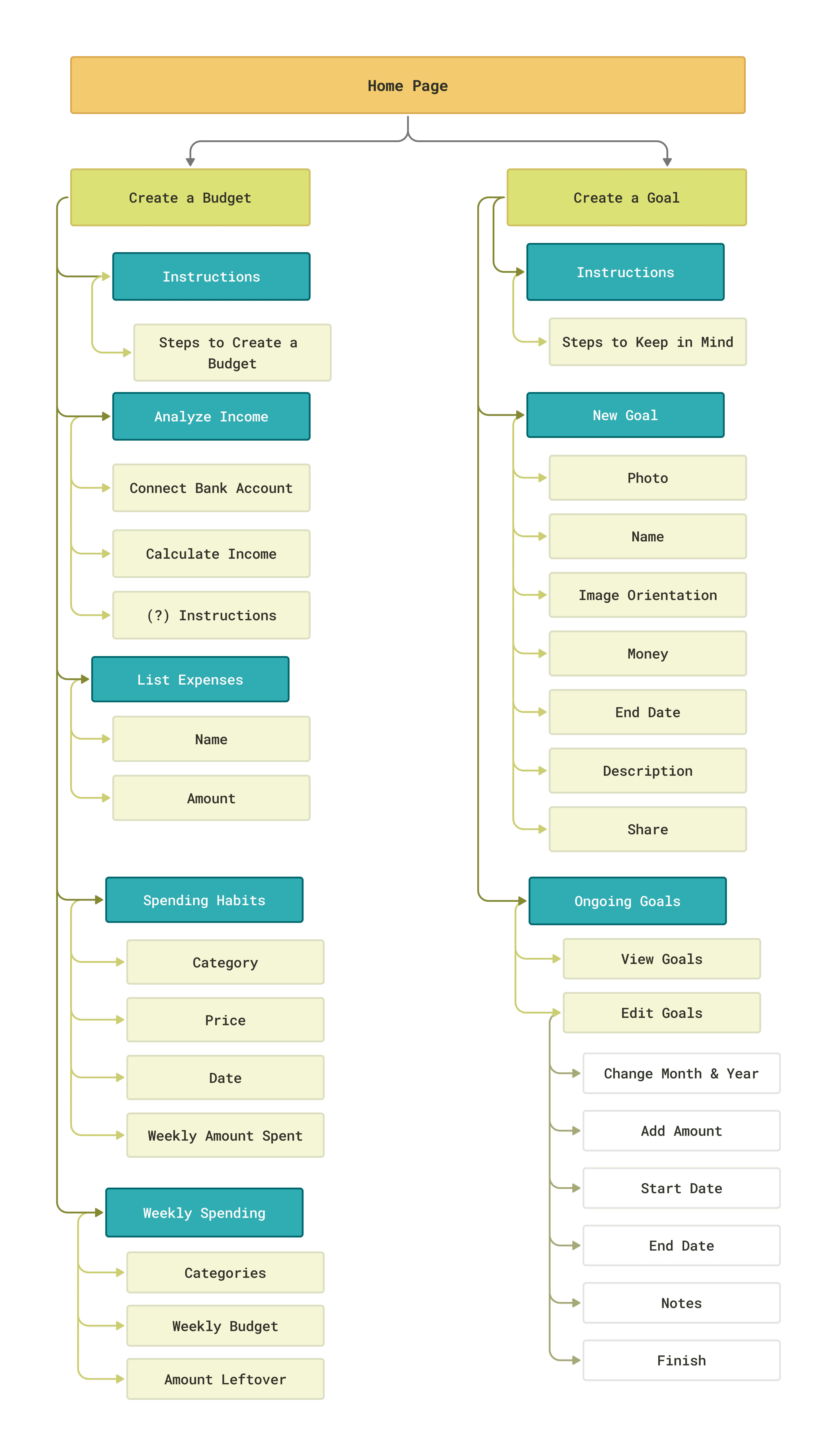

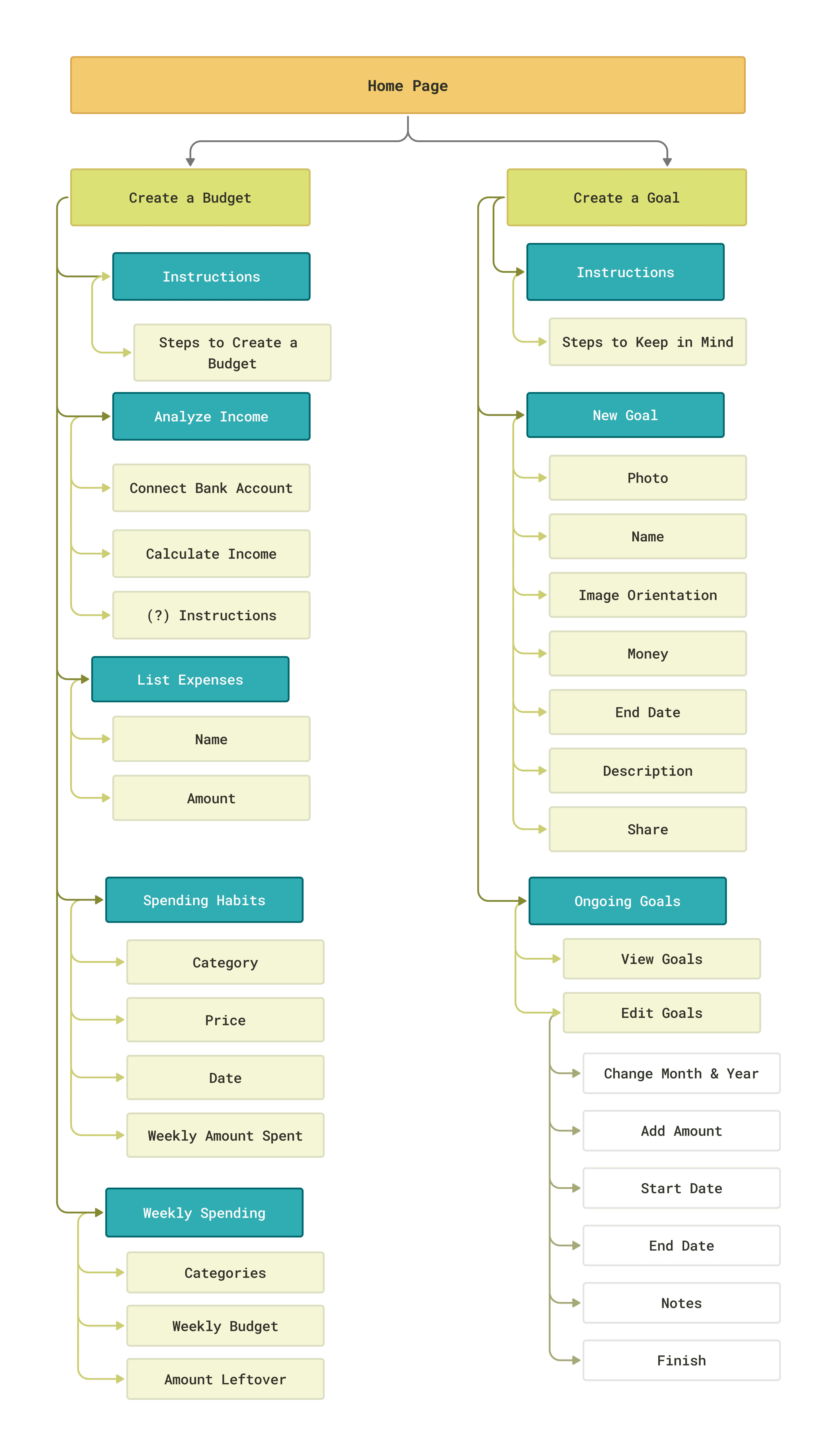

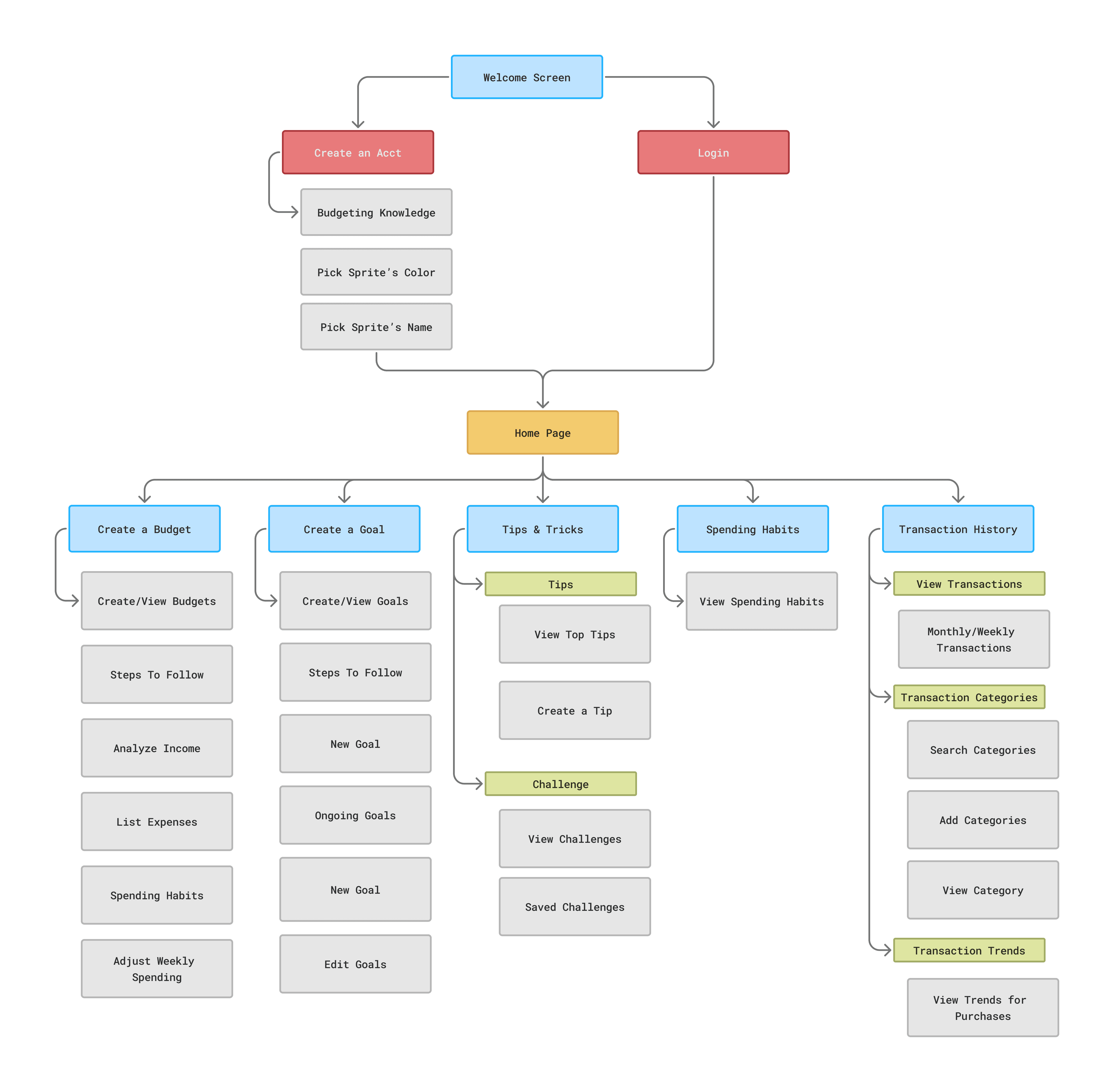

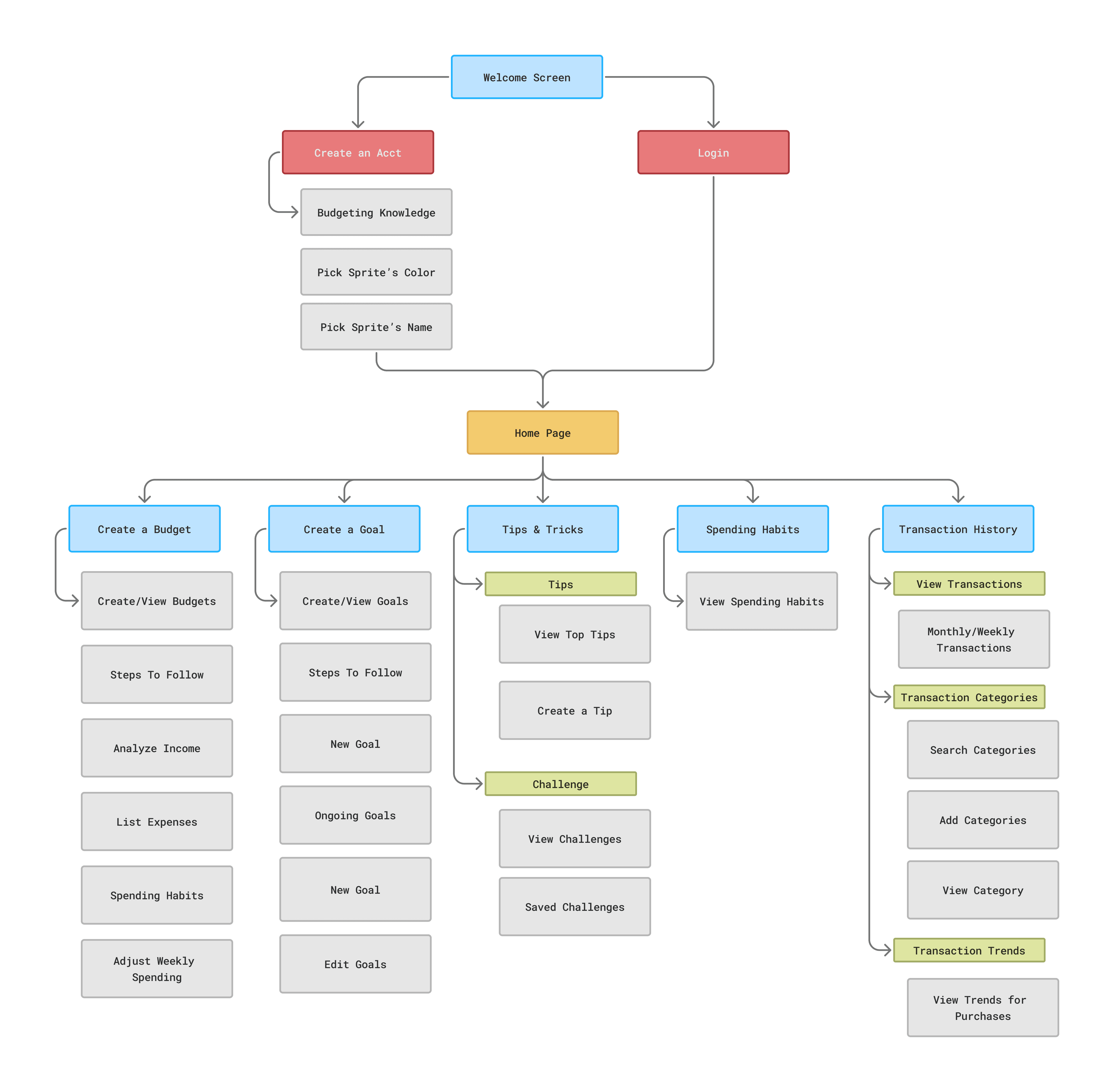

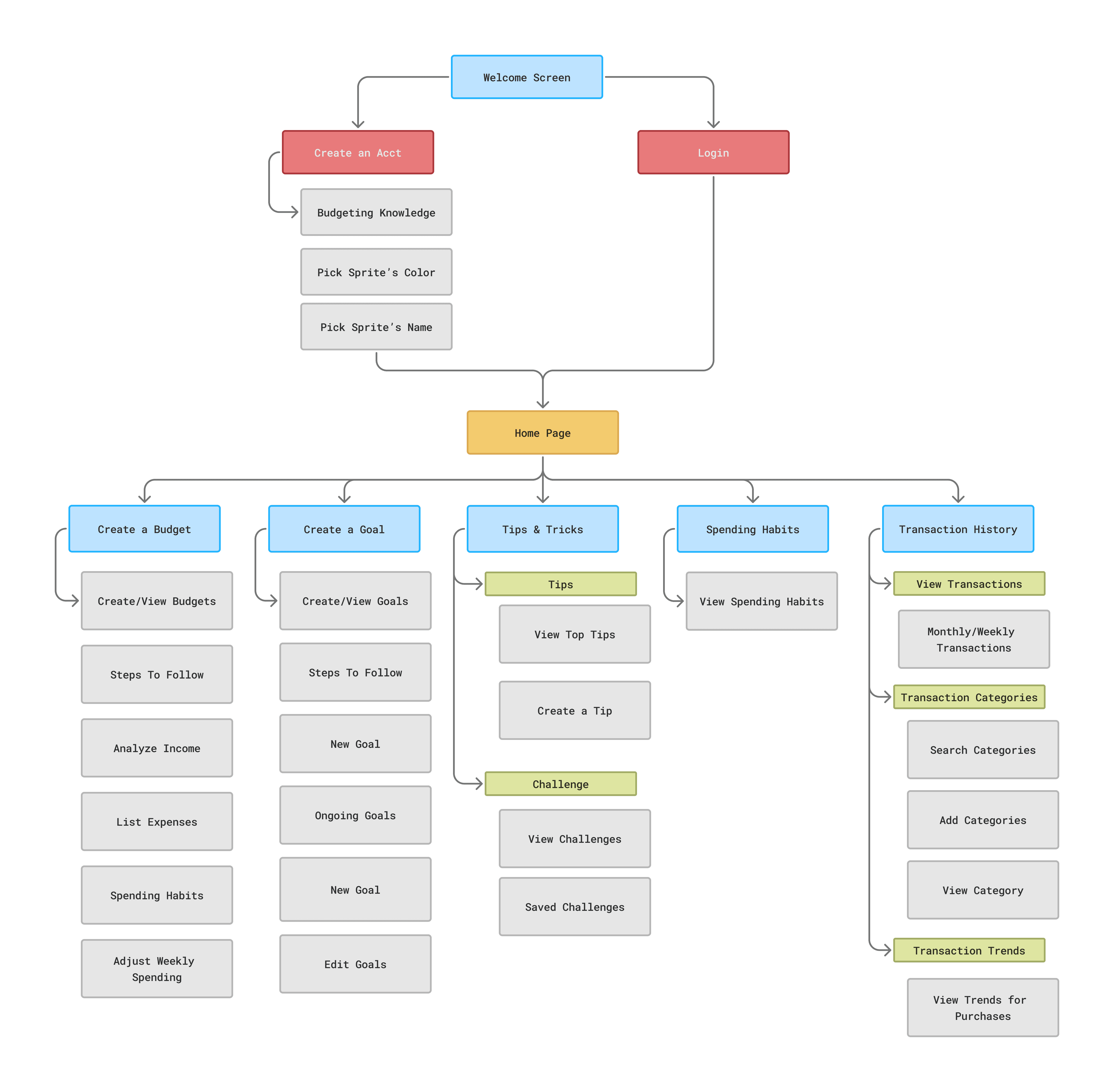

Information Architecture

Information Architecture

The Information Architecture explained the user requirements and workflow when using the application. These were different features a user would and can access when creating a budget in fundify or creating a budget.

The Information Architecture explained the user requirements and workflow when using the application. These were different features a user would and can access when creating a budget in fundify or creating a budget.

Fundify's Sitemap

Fundify's Sitemap

Fundify's Sitemap

The sitemap allowed me to understand the main pages Fundify has to offer and the features a user would come across when using the application.

The sitemap allowed me to understand the main pages Fundify has to offer and the features a user would come across when using the application.

The sitemap allowed me to understand the main pages Fundify has to offer and the features a user would come across when using the application.

The sitemap allowed me to understand the main pages Fundify has to offer and the features a user would come across when using the application.

Information Architecture

The Information Architecture explained the user requirements and workflow when using the application.

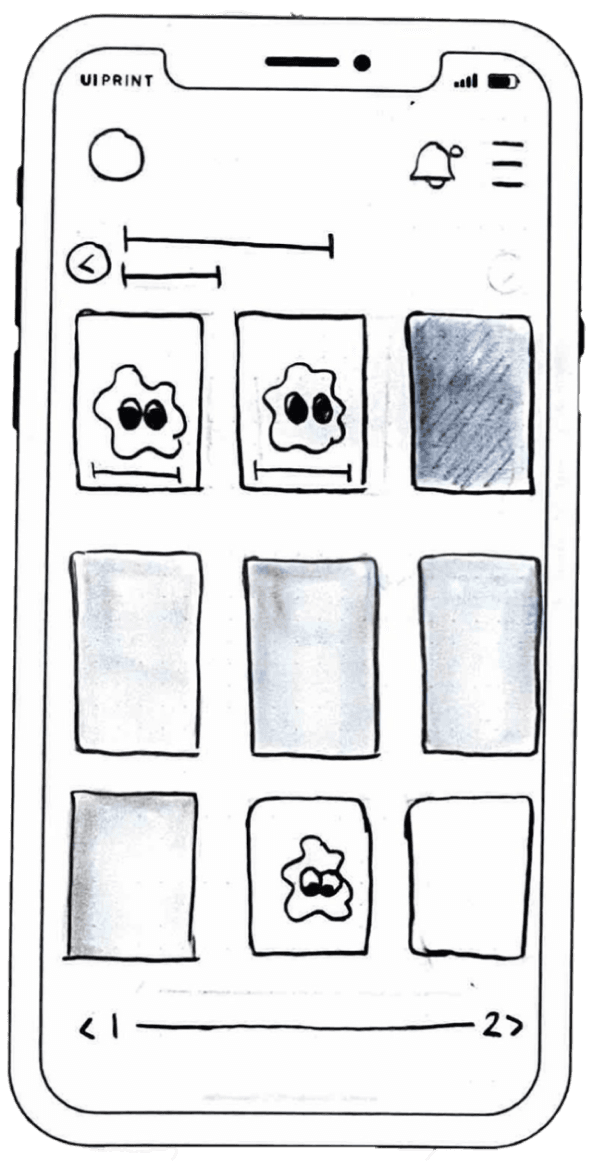

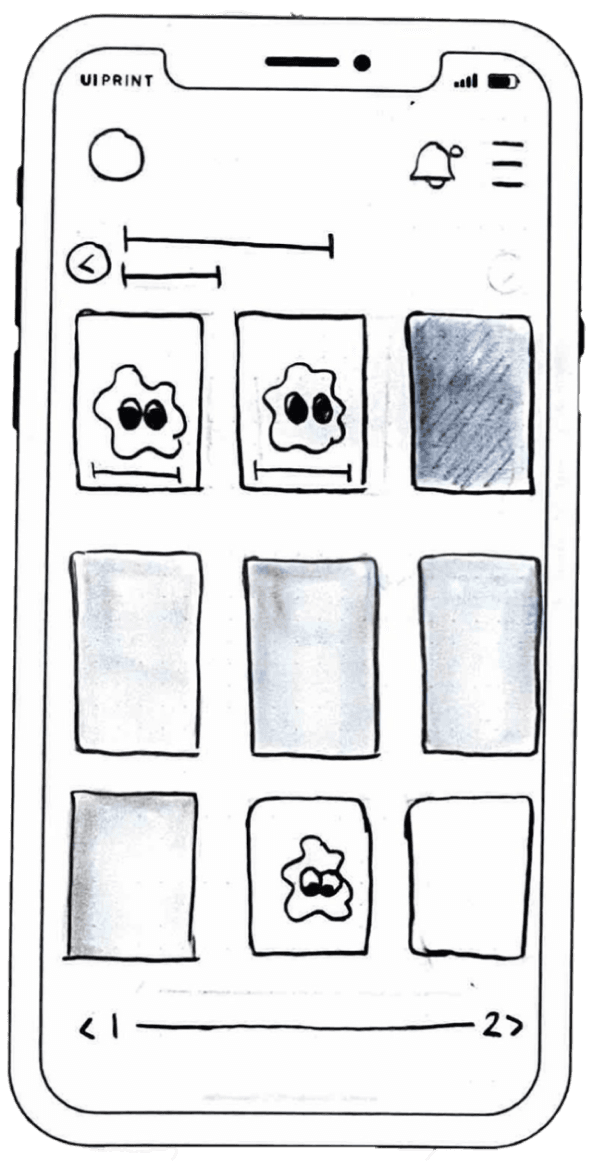

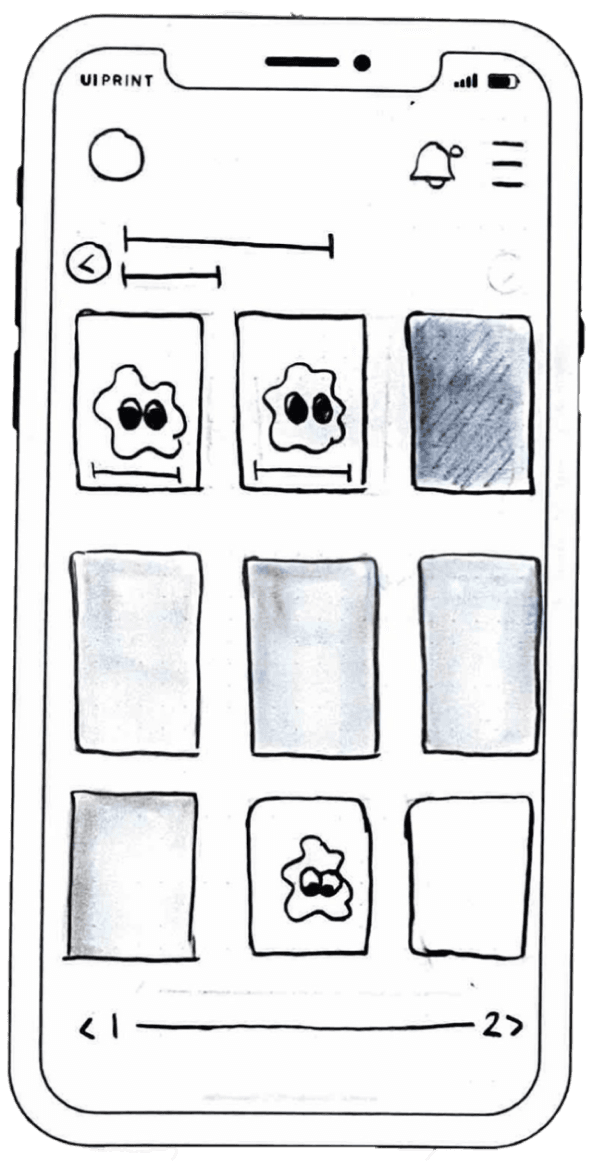

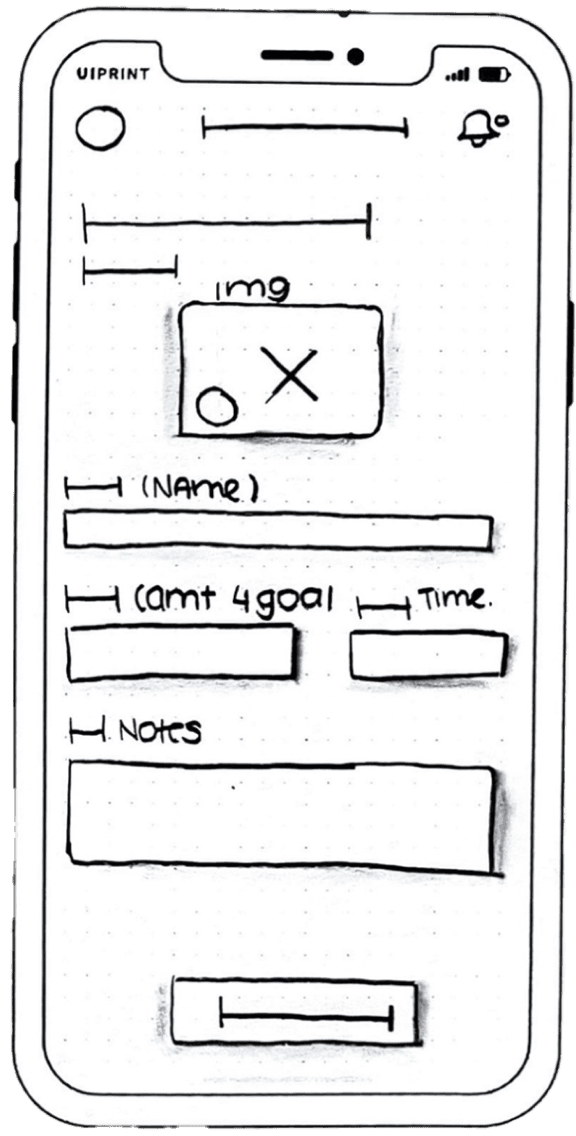

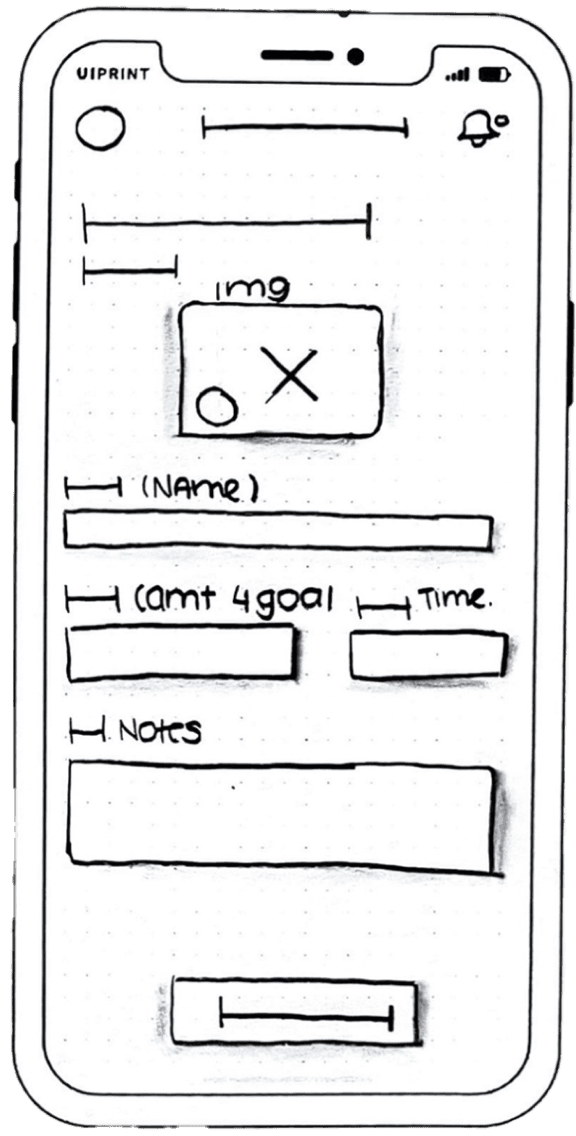

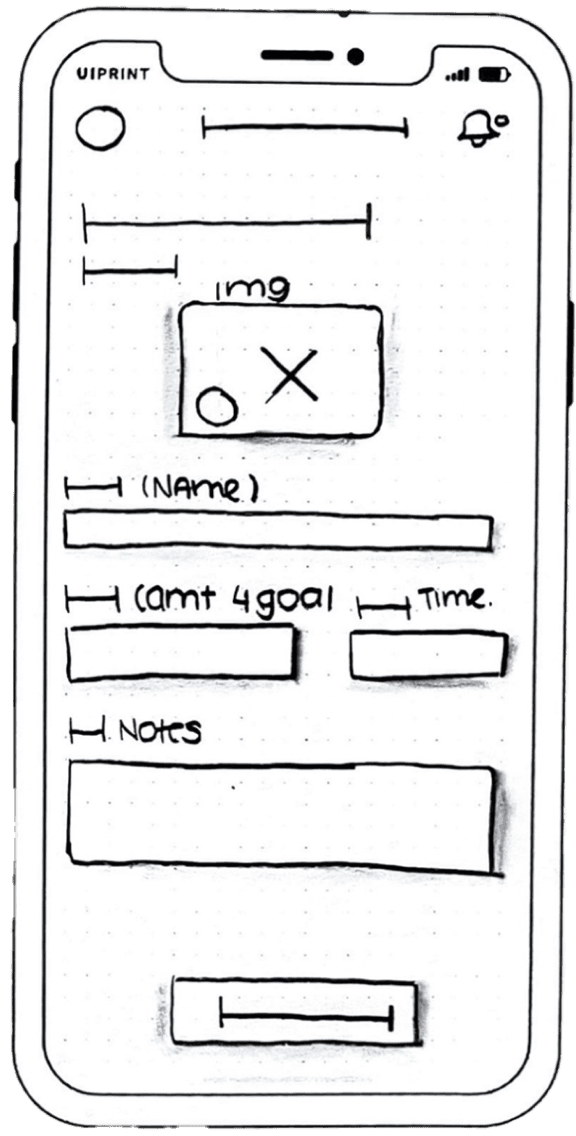

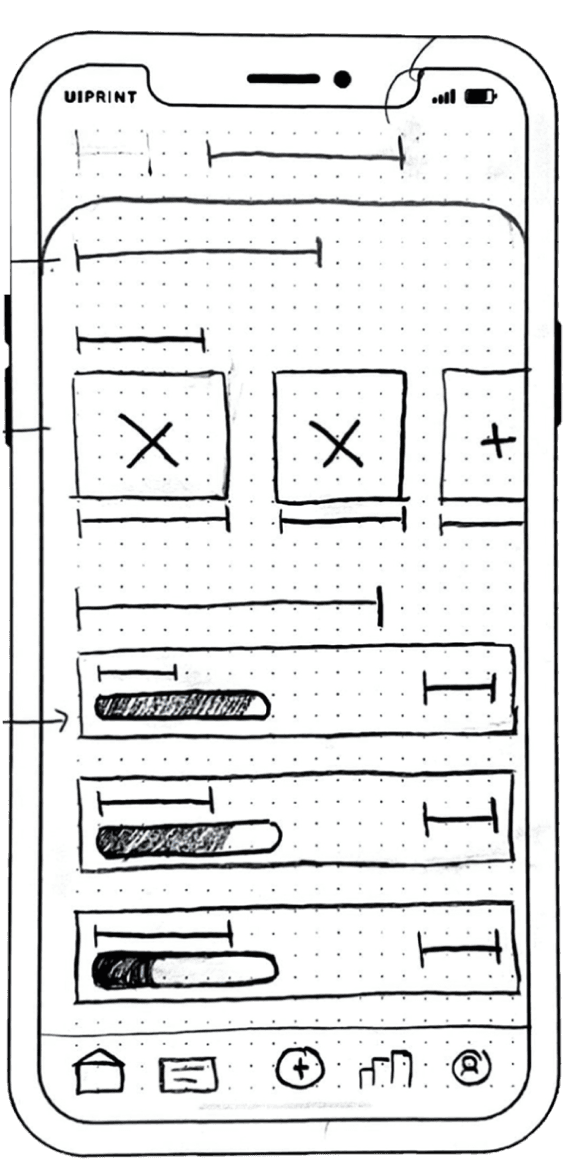

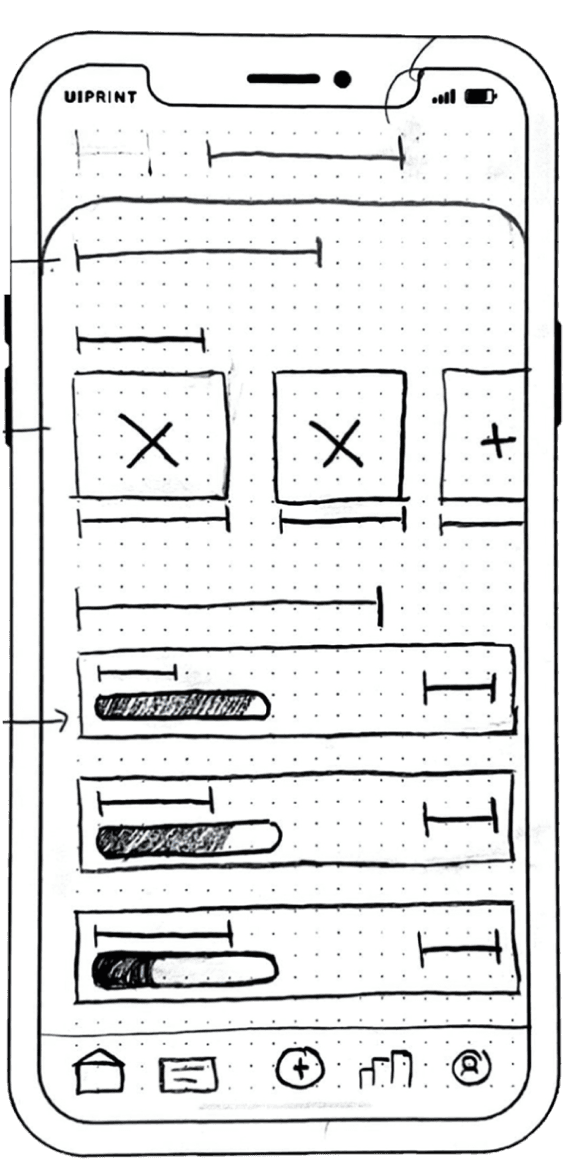

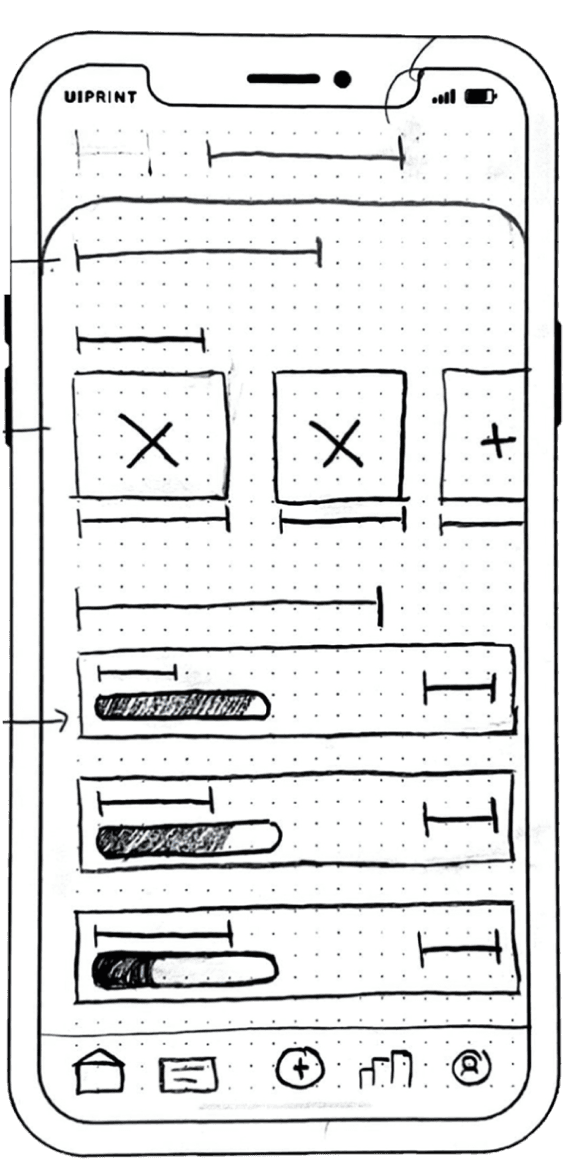

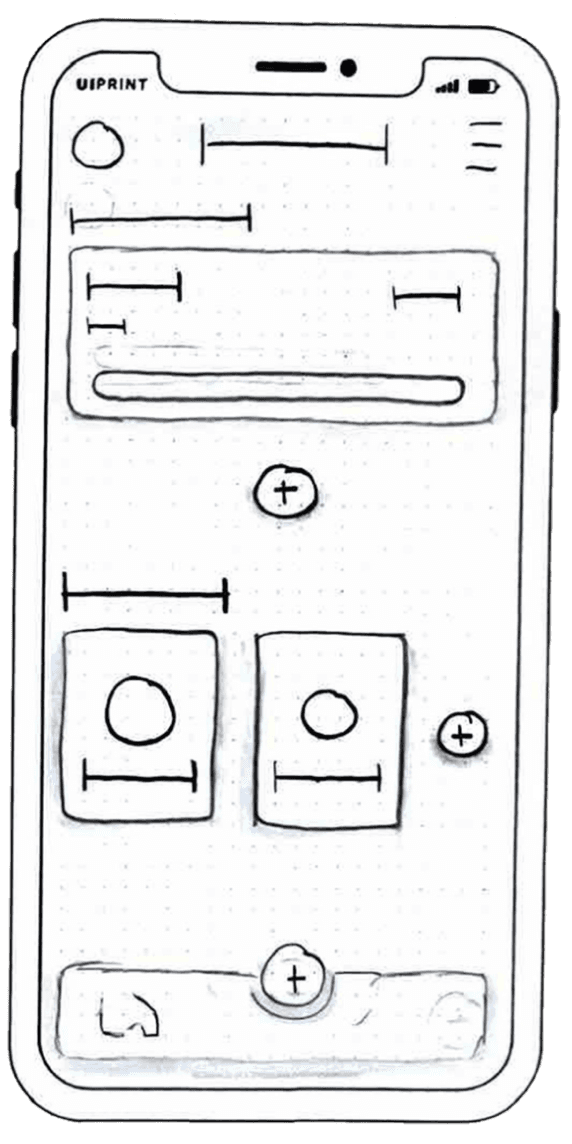

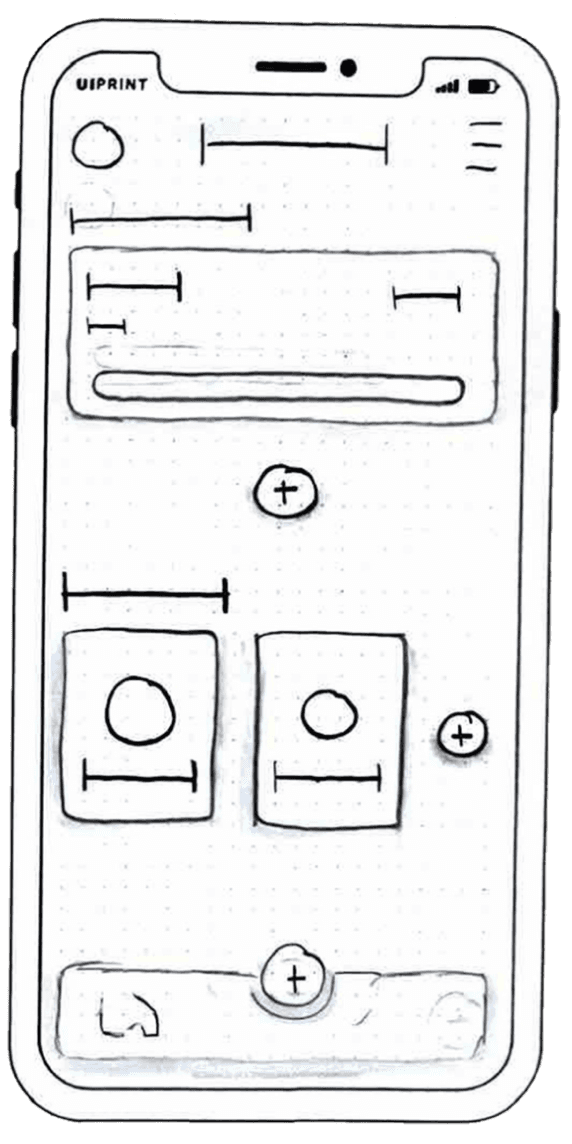

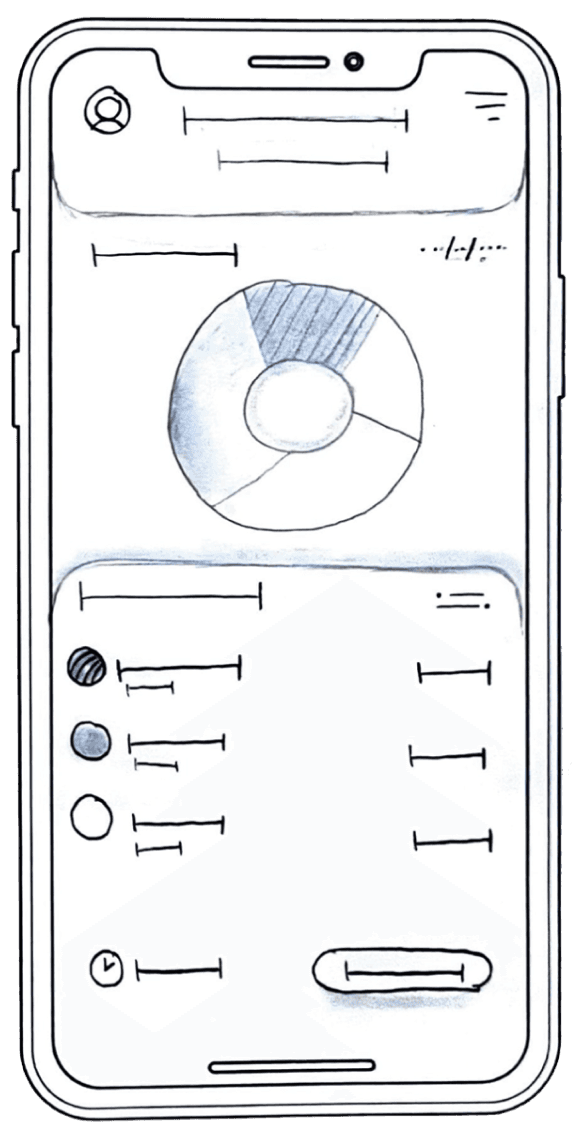

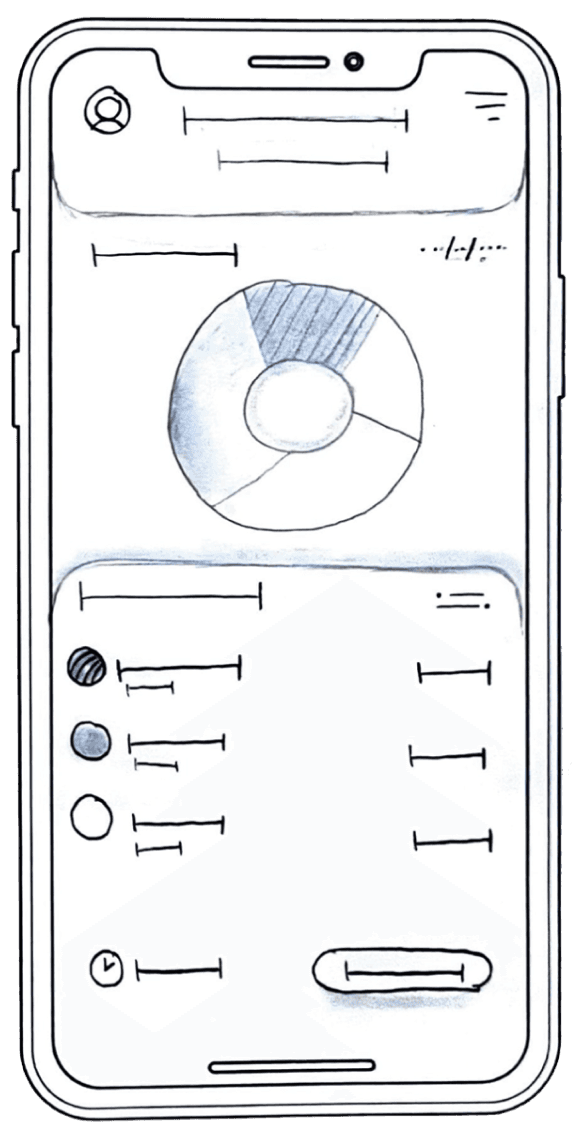

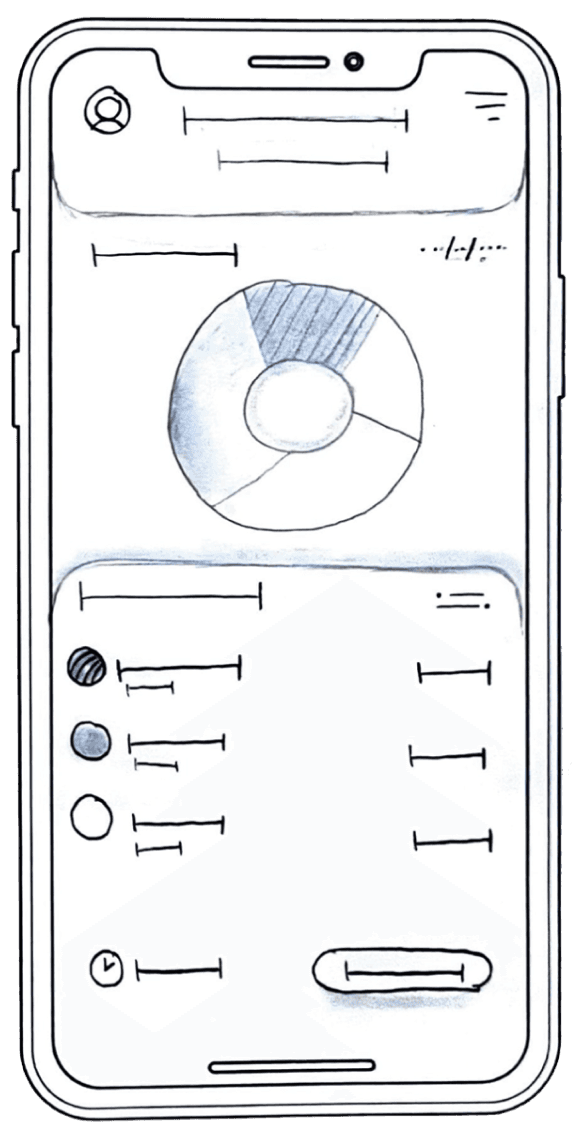

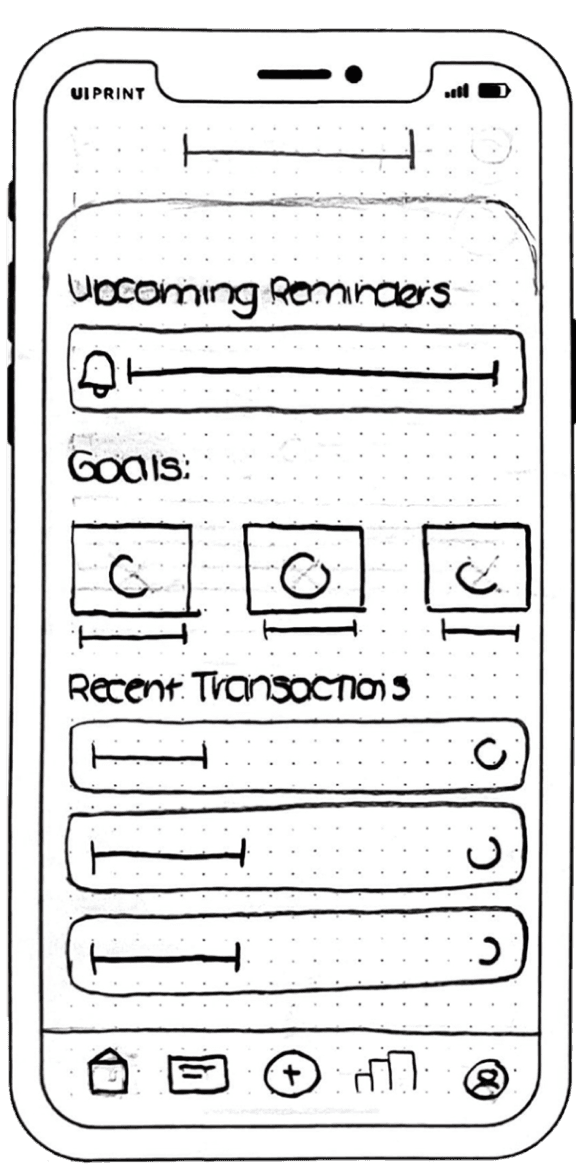

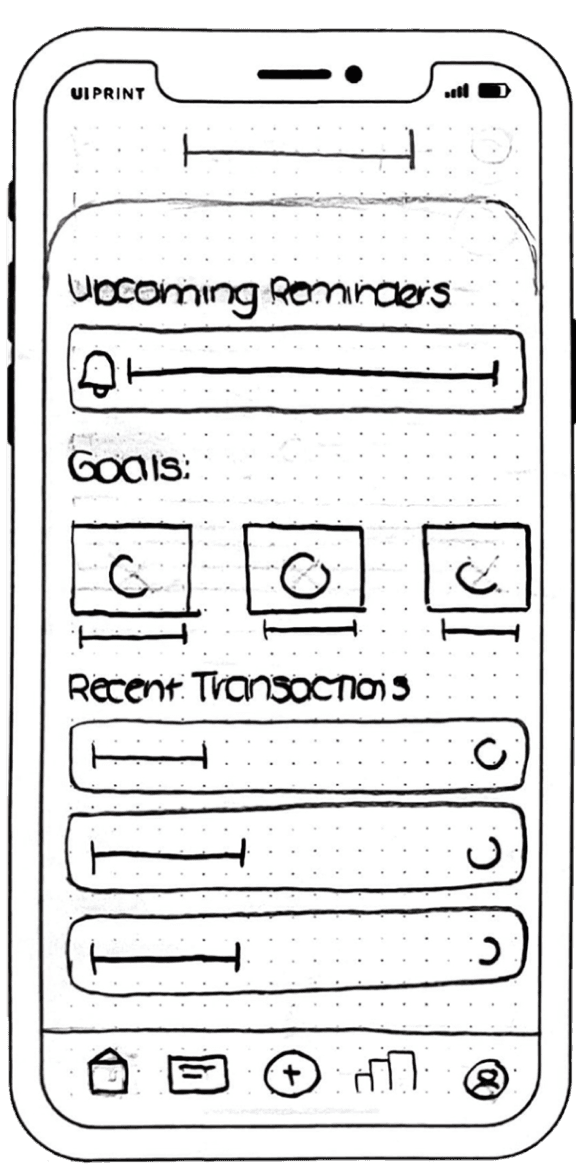

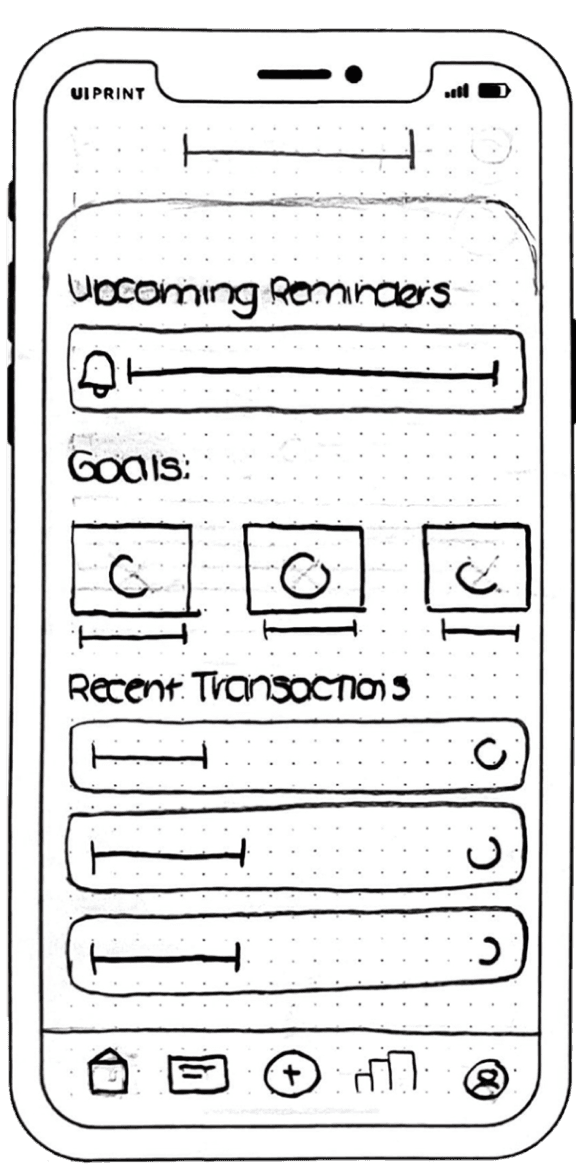

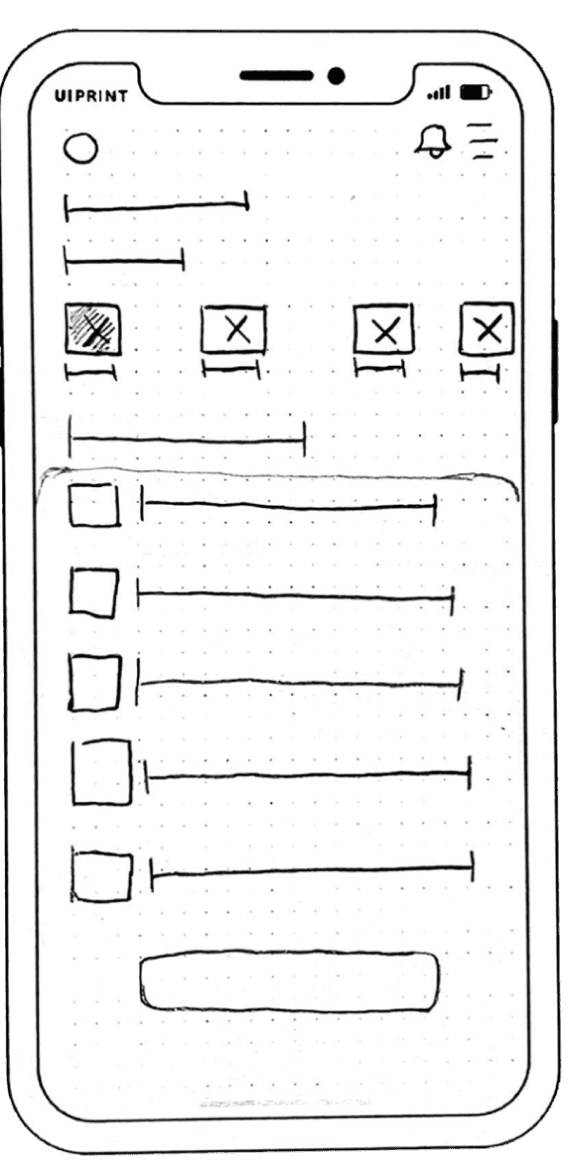

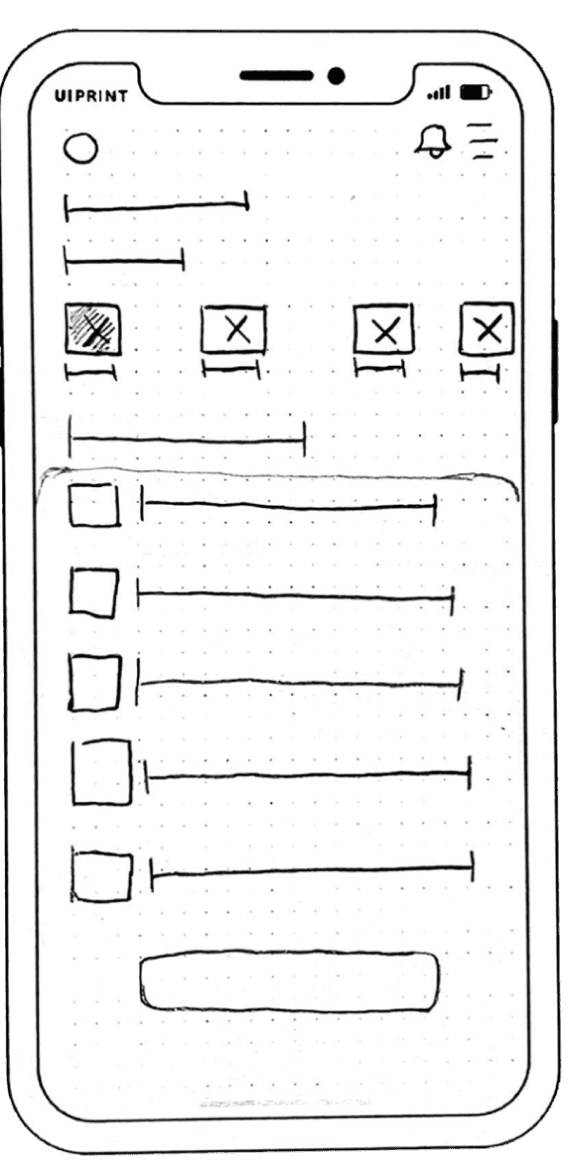

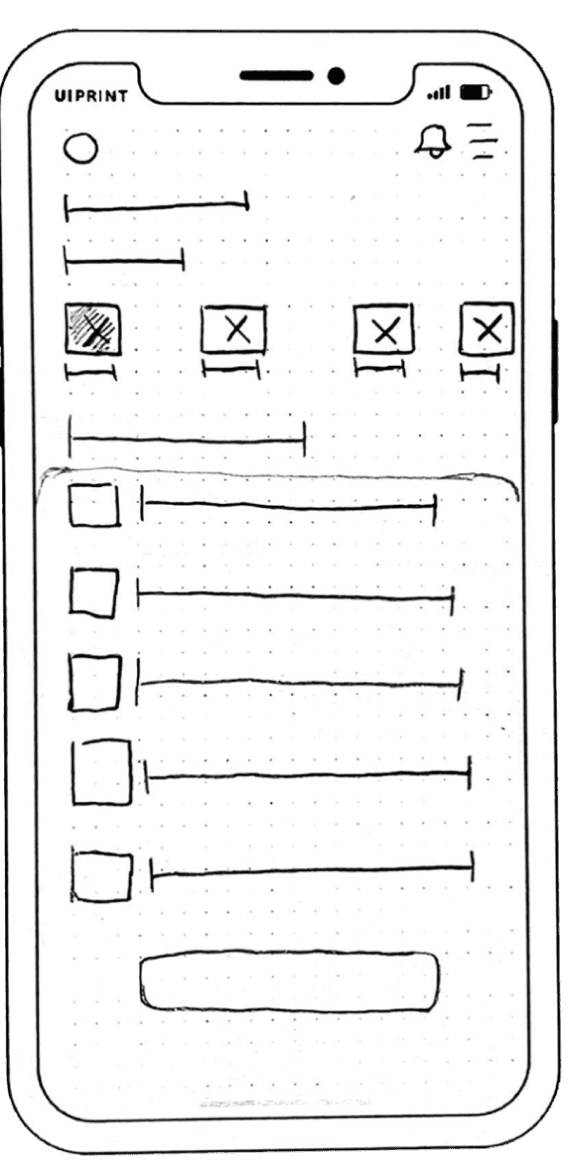

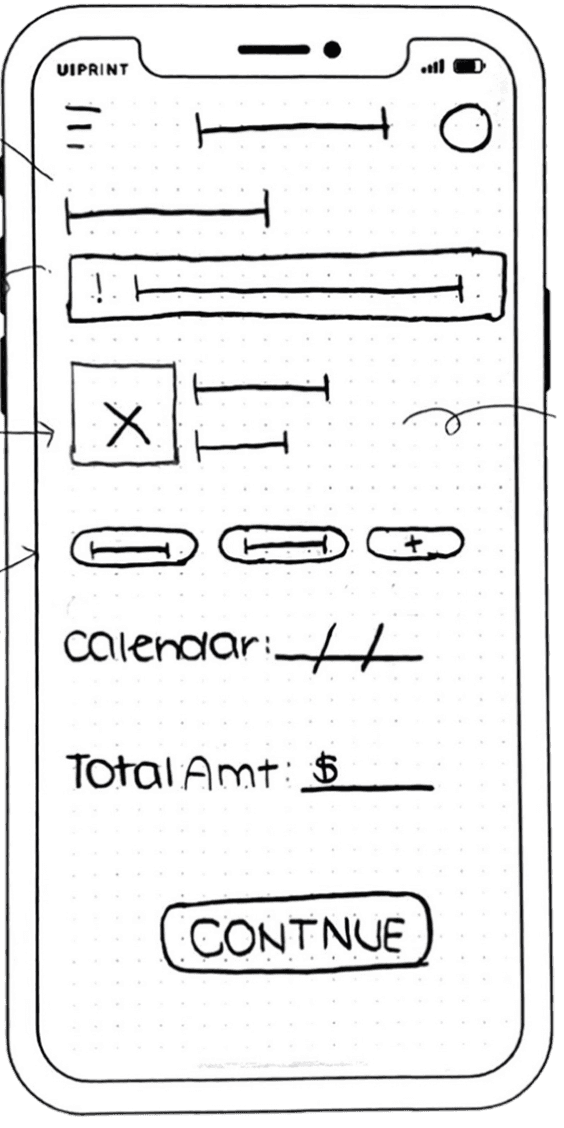

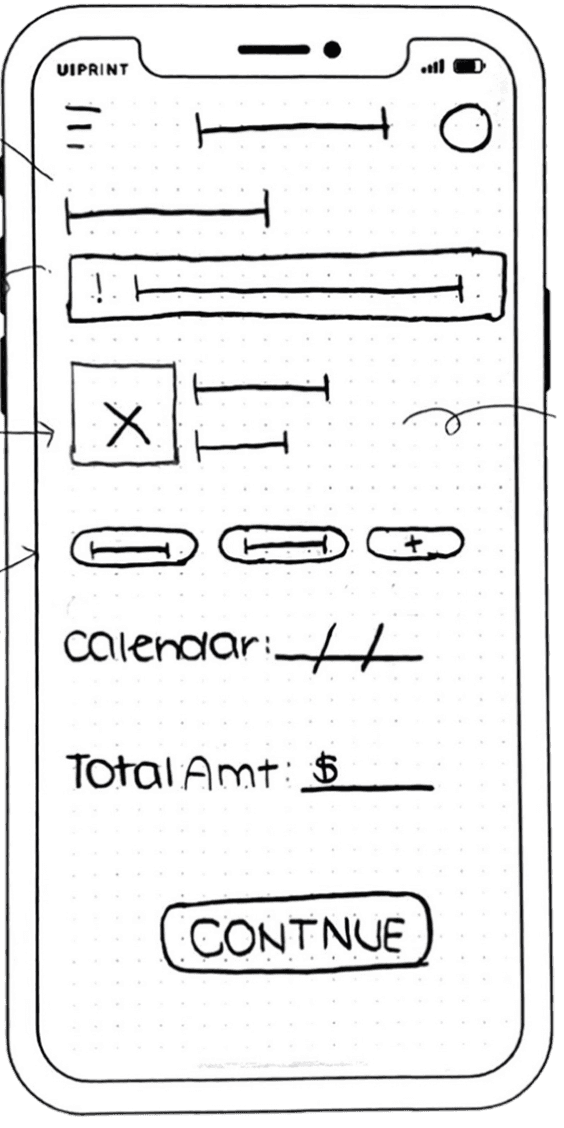

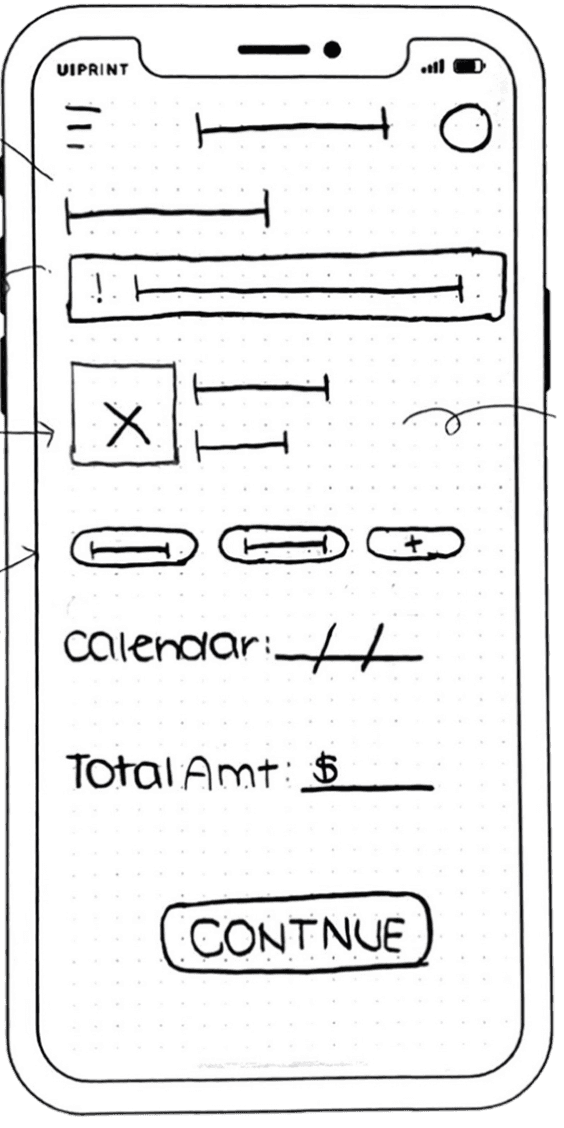

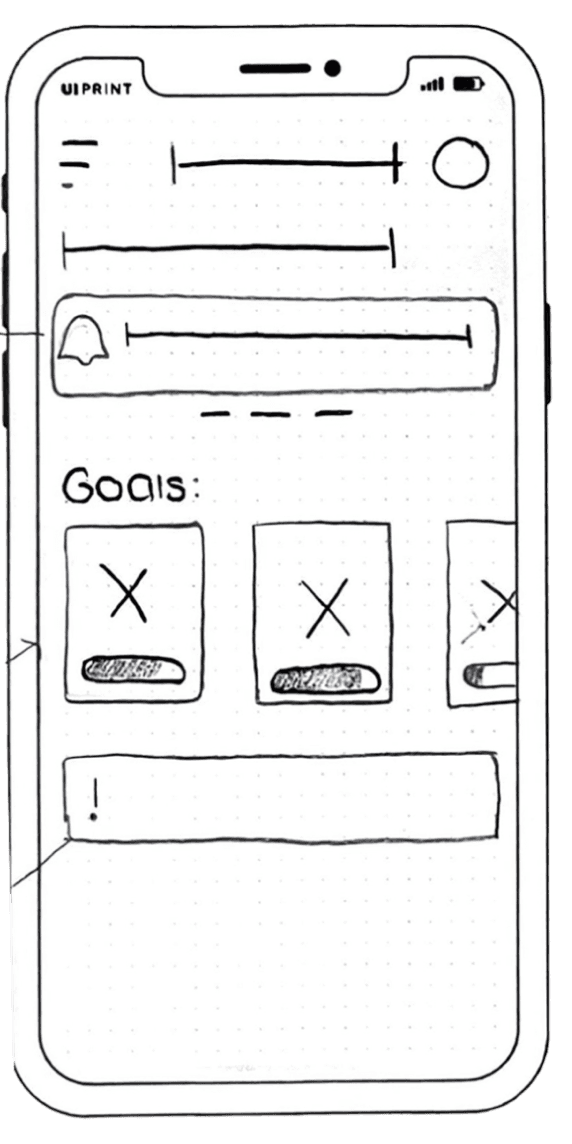

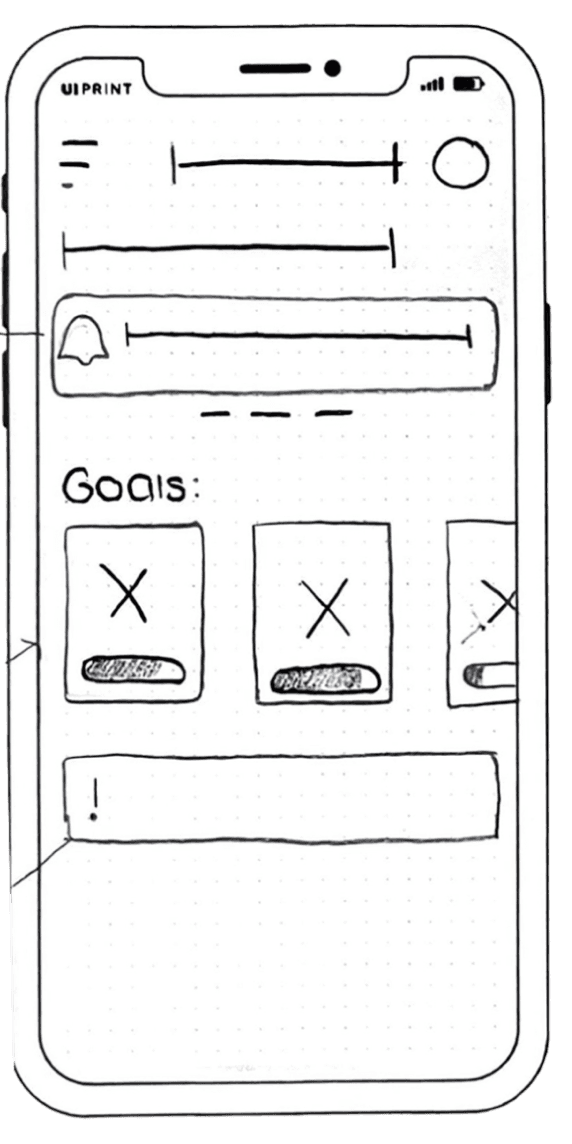

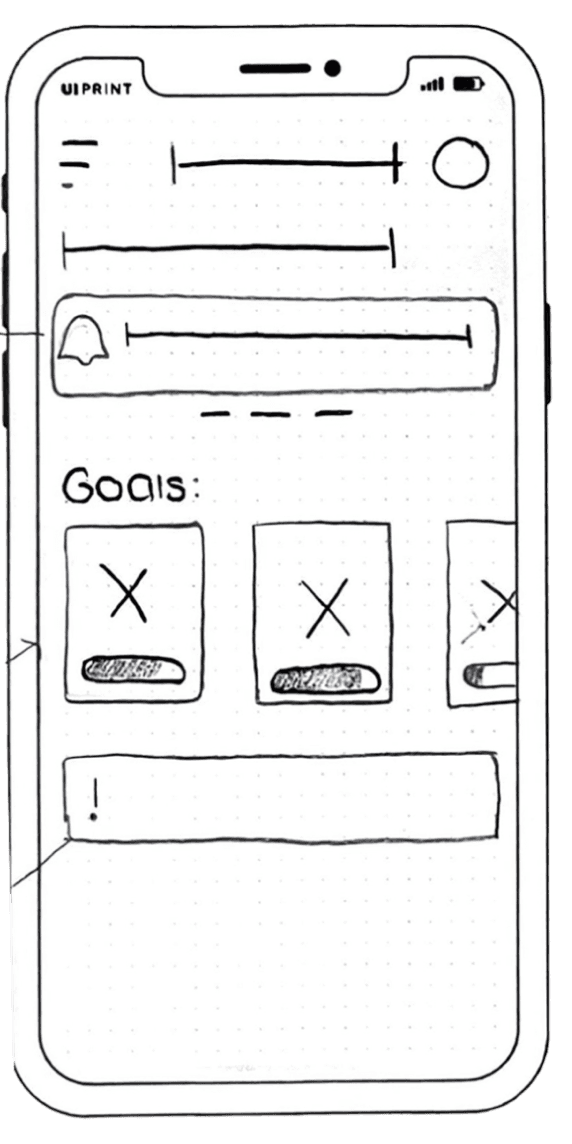

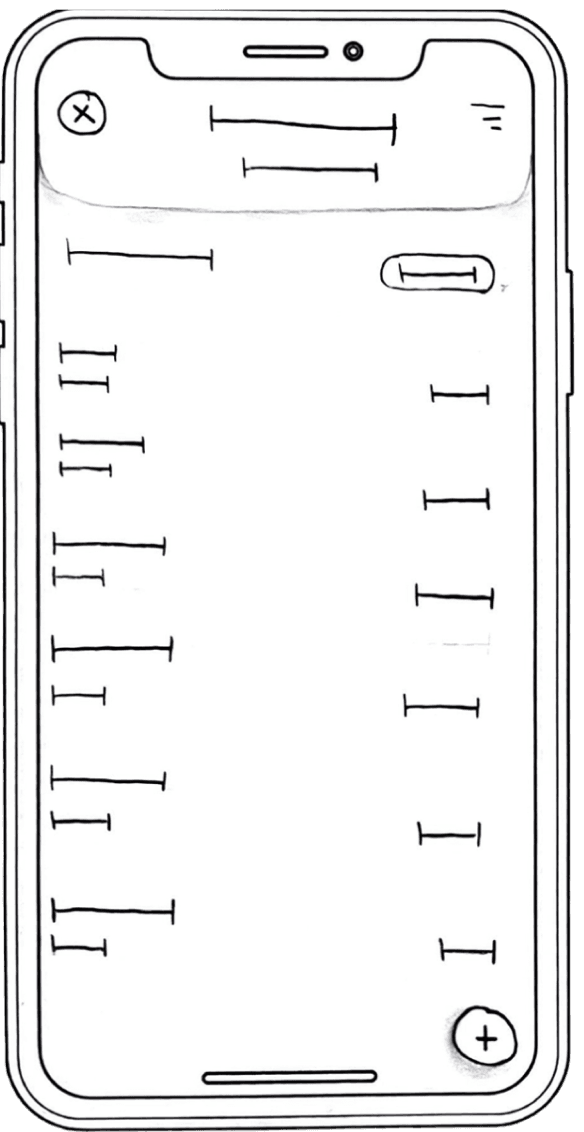

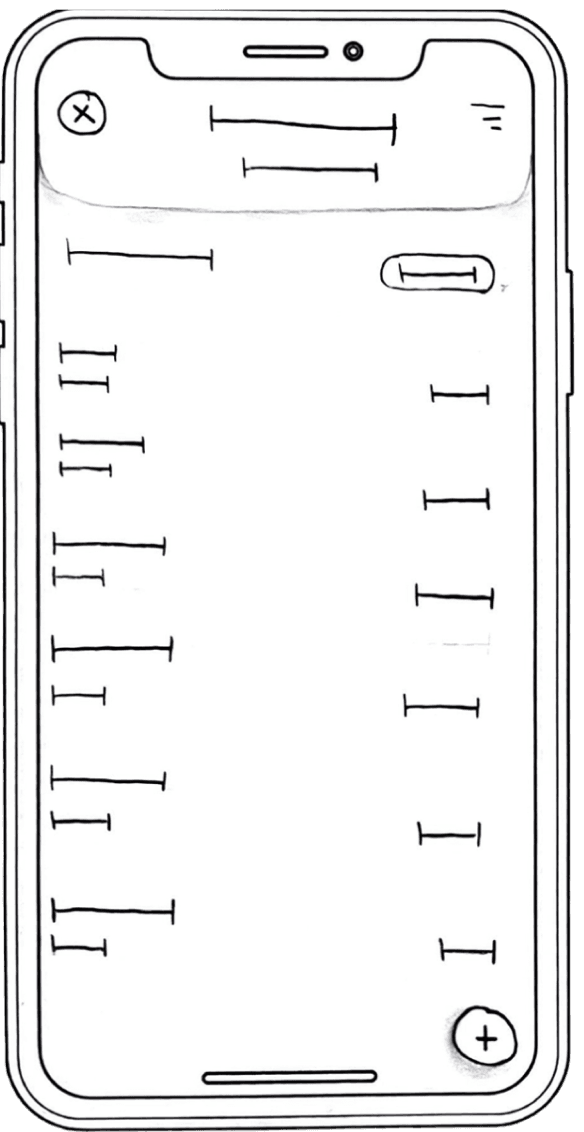

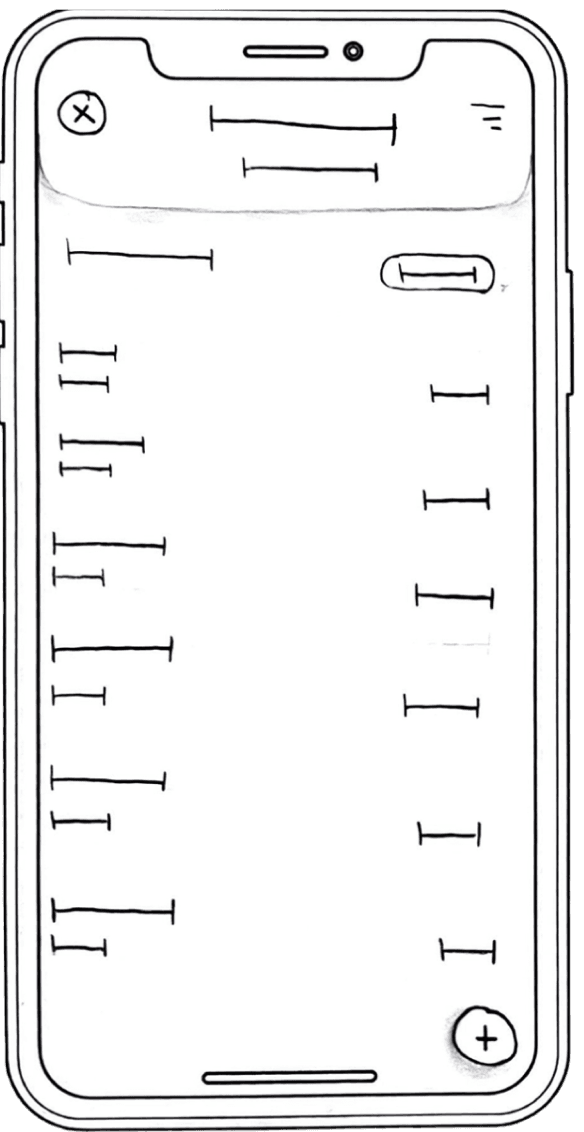

Sketches & Initial Ideas

Sketches & Initial Ideas

Sketches & Initial Ideas

Sketches & Ideas

Fundify underwent plentiful design iterations to achieve it’s final design. The sketches focused heavily on different features students would utilize or want in a budgeting application.

Fundify underwent plentiful design iterations to achieve it’s final design. The sketches focused heavily on different features students would utilize or want in a budgeting application.

Fundify underwent plentiful design iterations to achieve it’s final design. The sketches focused heavily on different features students would utilize or want in a budgeting application.

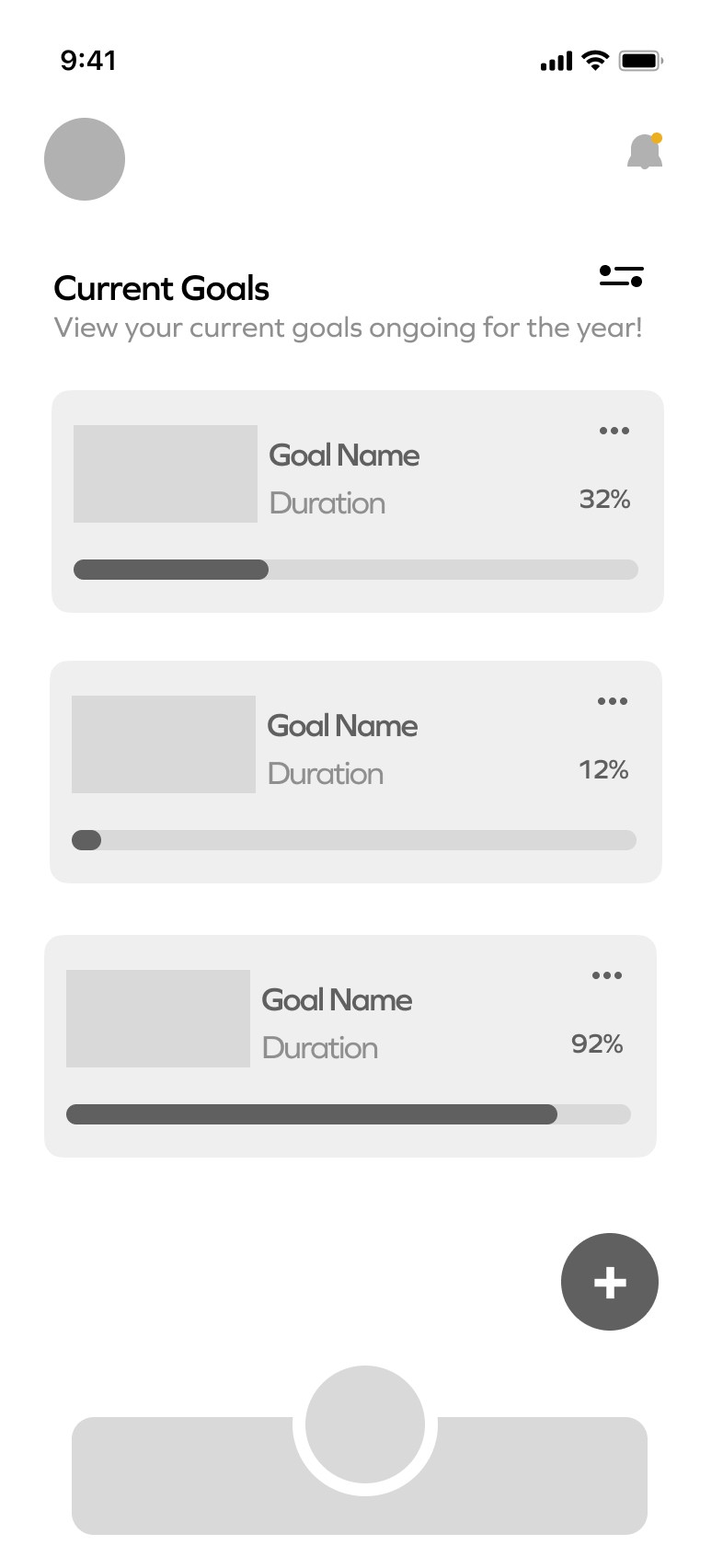

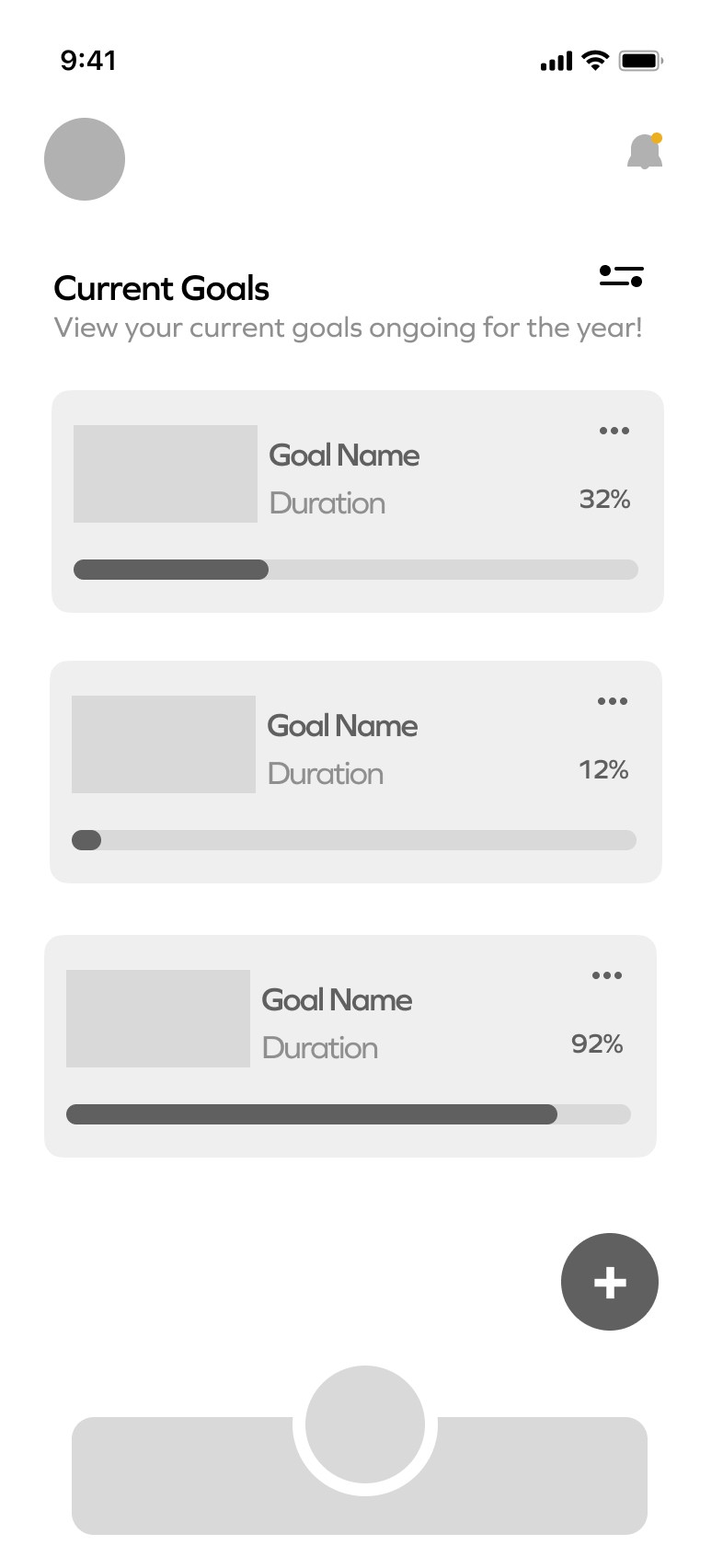

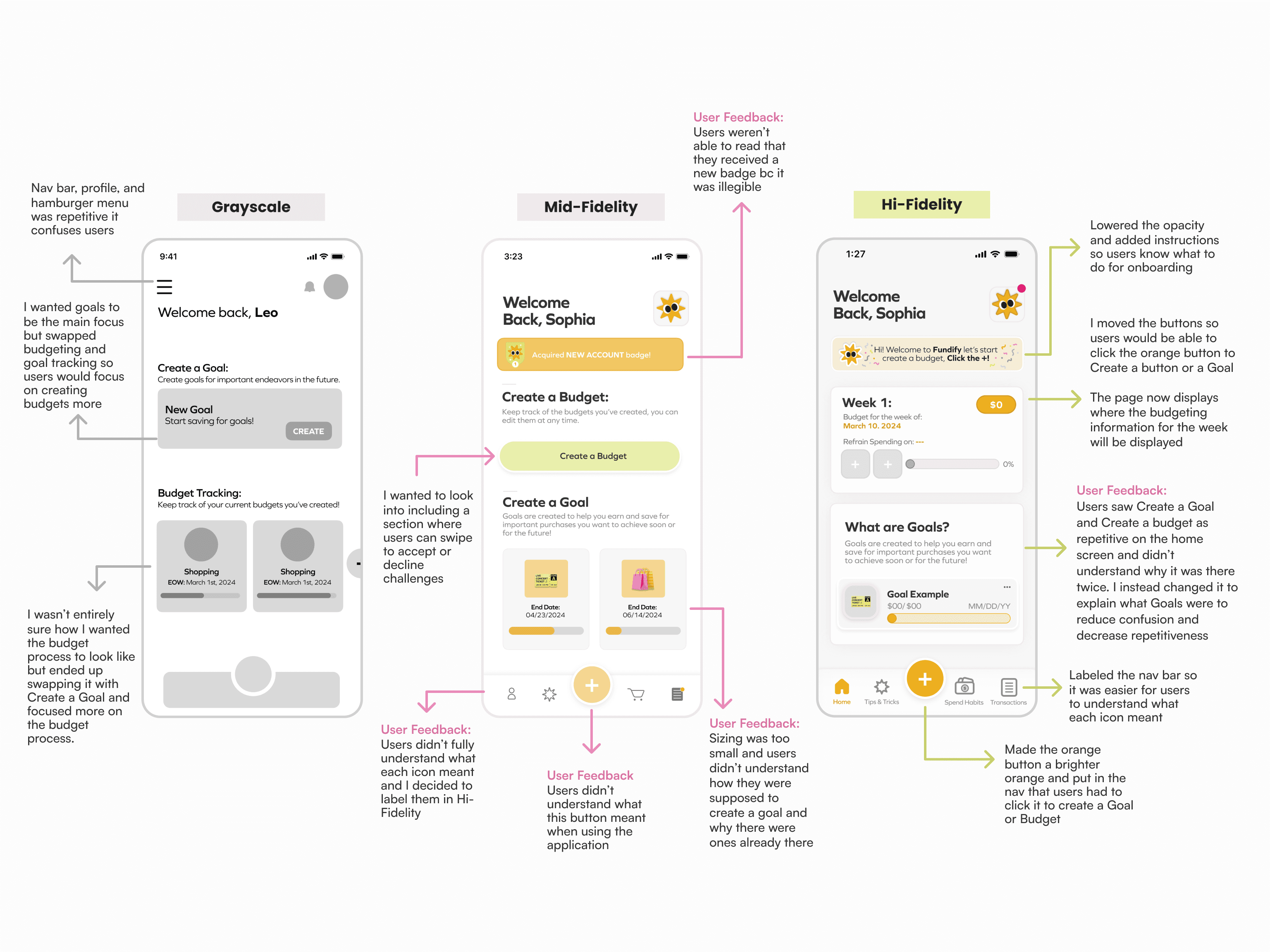

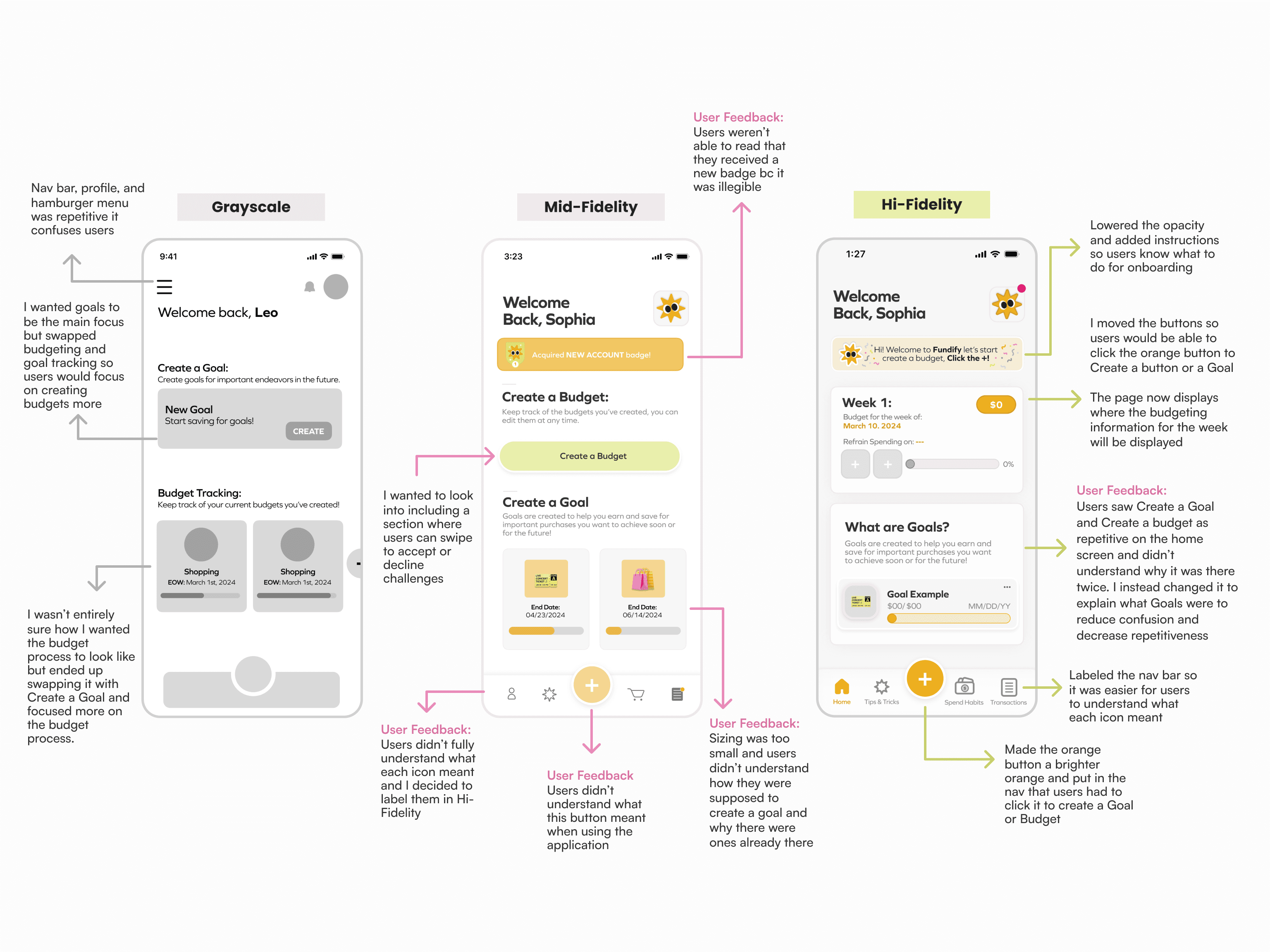

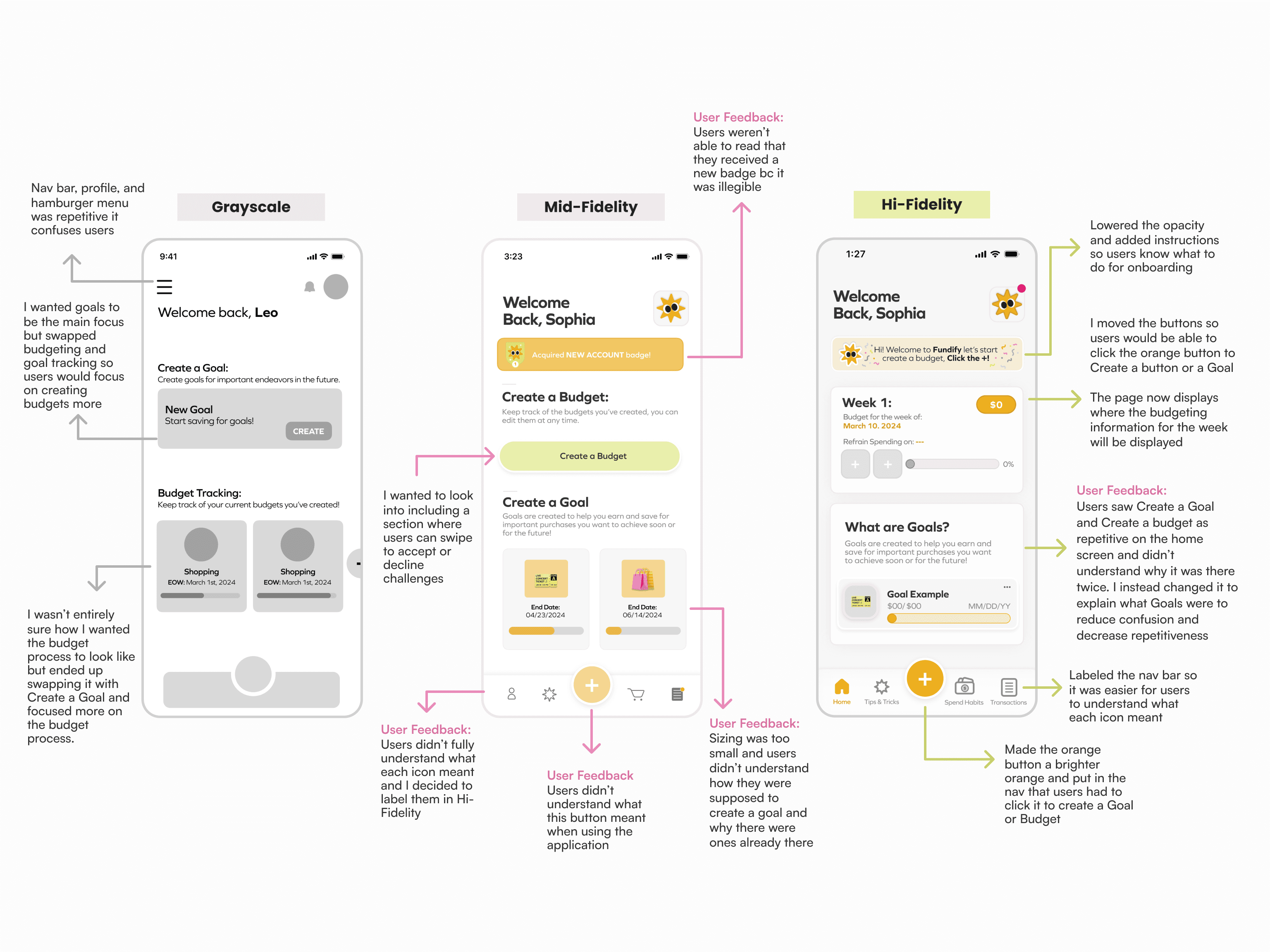

Grayscale Wireframes

Grayscale Wireframes

Grayscale Wireframes

When developing Fundify I transformed my sketches into grayscale wireframes. I looked at what worked and asked friends for their opinion regarding how the applications features work.

When developing Fundify I transformed my sketches into grayscale wireframes. I looked at what worked and asked friends for their opinion regarding how the applications features work.

When developing Fundify I transformed my sketches into grayscale wireframes. I looked at what worked and asked friends for their opinion regarding how the applications features work.

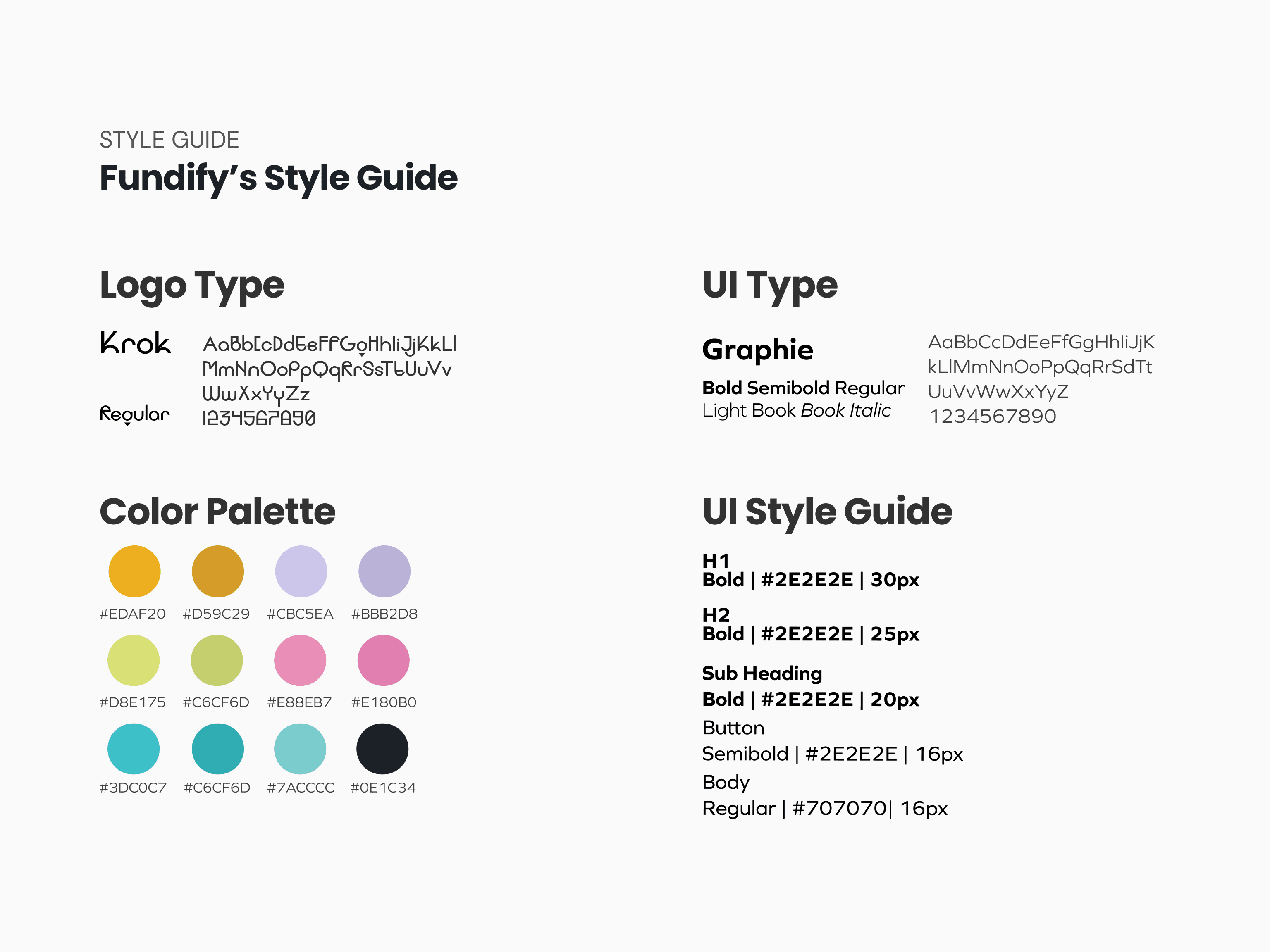

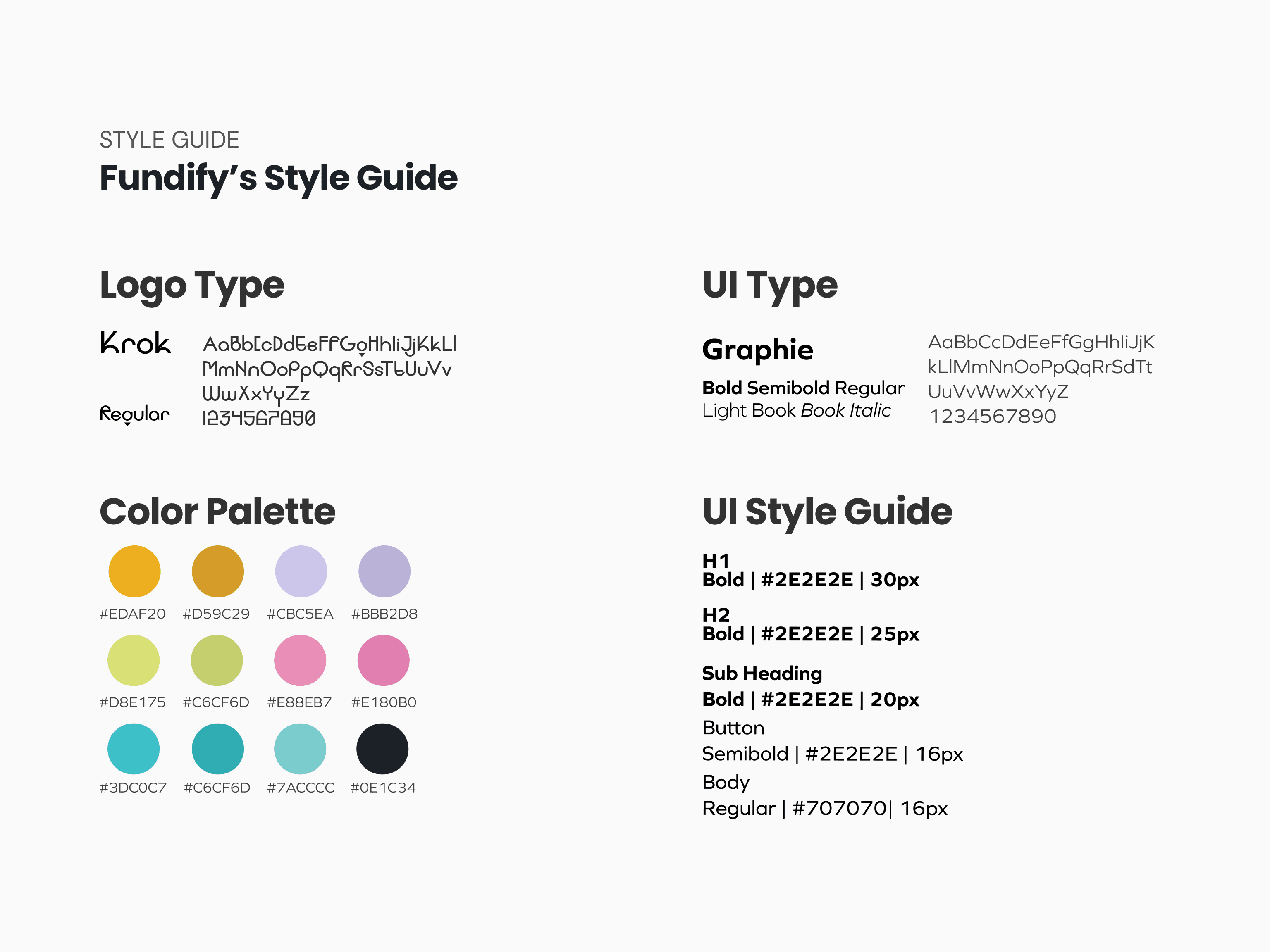

Solving Challenge #1

I spoke with one of my peers and we searched up current design trends and popular color palettes for Gen Z. We thought having a colorful palette aside from a muted green would be the best decision and will gather students' interest.

Solving Challenge #2

After testing on current students I made sure that the application was simple and straight-forward. I didn't want students to deal with difficult interfaces. I made sure the key features could be discovered easily and quickly!

Solving Challenge #3

I added a feature where students are able to win badges and unlock different colors for their Sprite character. I wanted the process of learning about budgeting and goal setting to be fun for students and researched gamification strategies from current applications such as, Duolingo.

Ongoing Challenge #4

Coming Soon

This is still an ongoing challenge! For the future I'd like to add different methods for students with different levels of budgeting experience.

the process

Solving The Challenges I Faced:

the process

How'd I Solve The Challenges?

Solving Challenge #1

I spoke with one of my peers and we searched up current design trends and popular color palettes for Gen Z. We thought having a colorful palette aside from a muted green would be the best decision and will gather students' interest.

I spoke with one of my peers and we searched up current design trends and popular color palettes for Gen Z. We thought having a colorful palette aside from a muted green would be the best decision and will gather students' interest.

Solving Challenge #2

After testing on current students I made sure that the application was simple and straight-forward. I didn't want students to deal with difficult interfaces. I made sure the key features could be discovered easily and quickly!

After testing on current students I made sure that the application was simple and straight-forward. I didn't want students to deal with difficult interfaces. I made sure the key features could be discovered easily and quickly!

Solving Challenge #3

I added a feature where students are able to win badges and unlock different colors for their Sprite character. I wanted the process of learning about budgeting and goal setting to be fun for students and researched gamification strategies from current applications such as, Duolingo.

I added a feature where students are able to win badges and unlock different colors for their Sprite character. I wanted the process of learning about budgeting and goal setting to be fun for students and researched gamification strategies from current applications such as, Duolingo.

Ongoing Challenge #4

Coming Soon

This is still an ongoing challenge! For the future I'd like to add different methods for students with different levels of budgeting experience.

This is still an ongoing challenge! For the future I'd like to add different methods for students with different levels of budgeting experience.

the process

the process

Solving The Challenges I Faced:

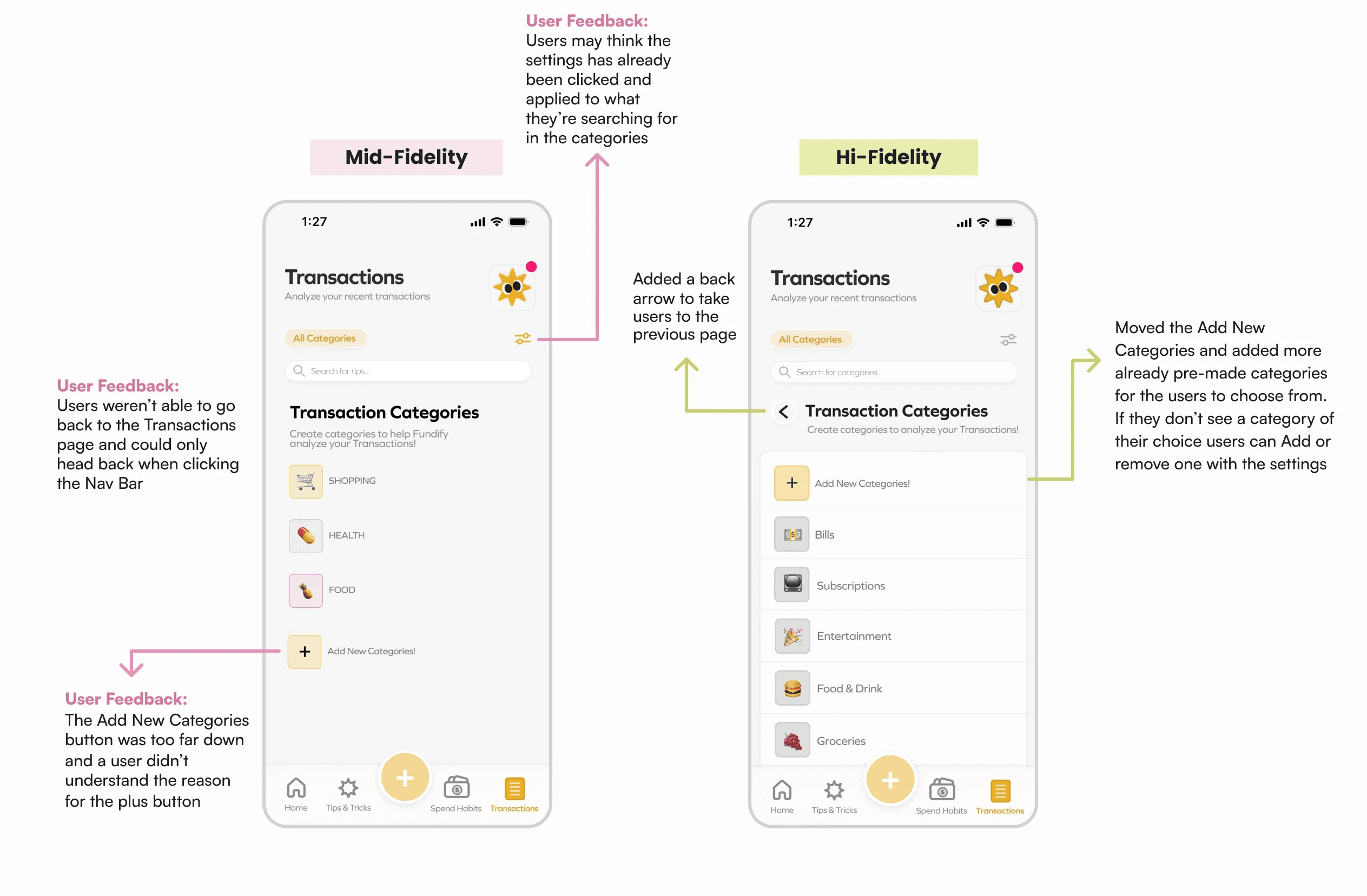

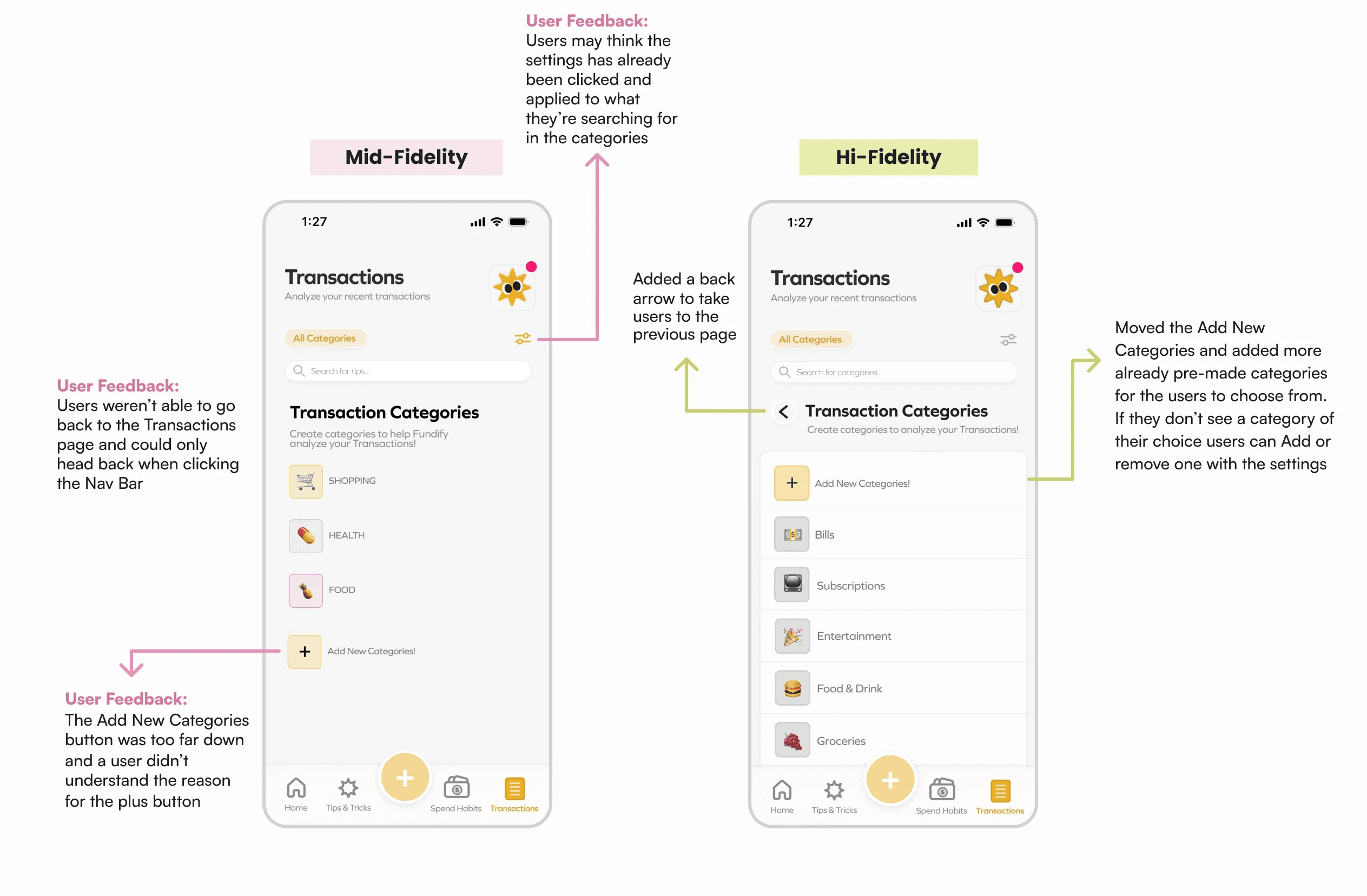

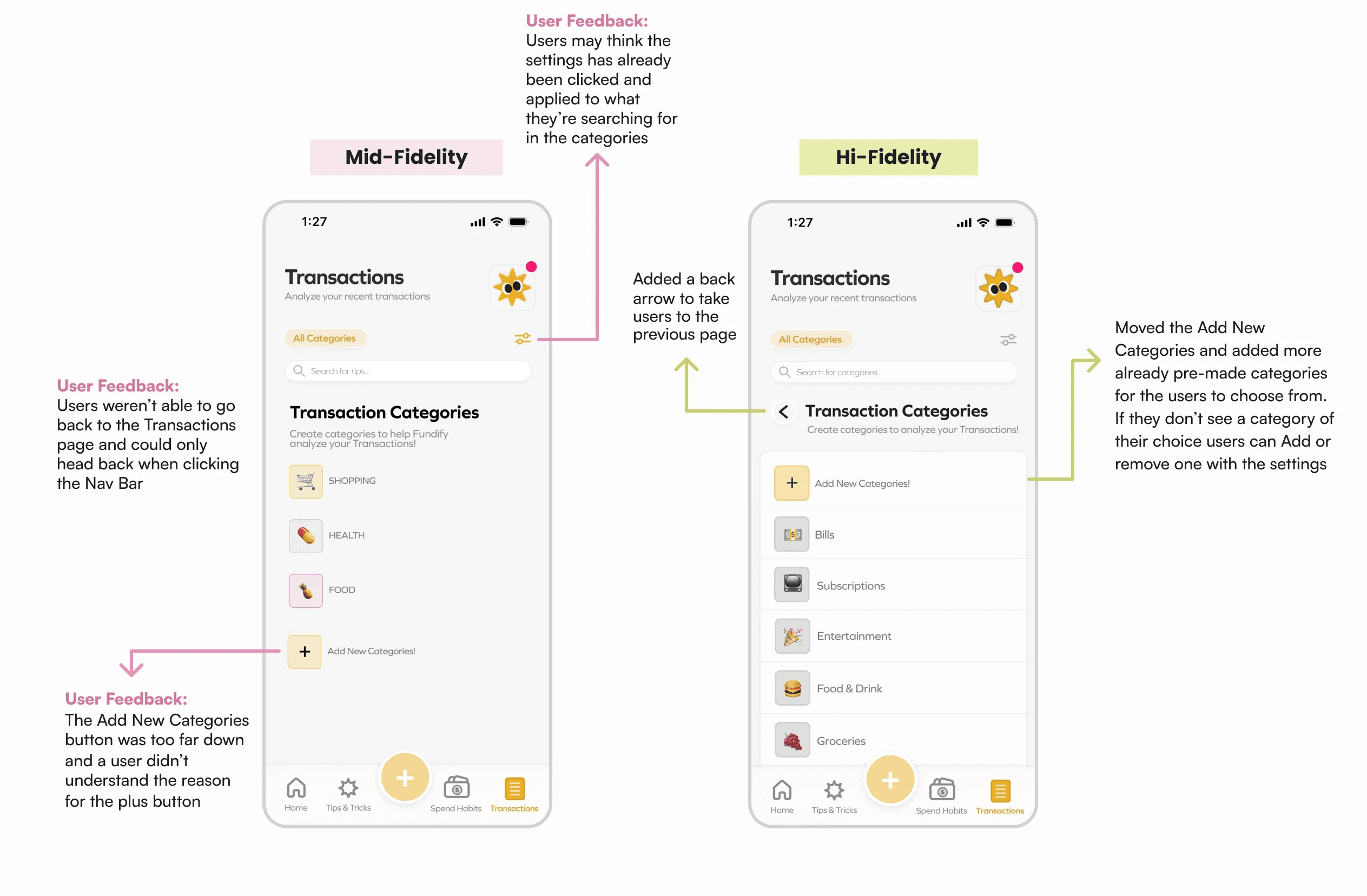

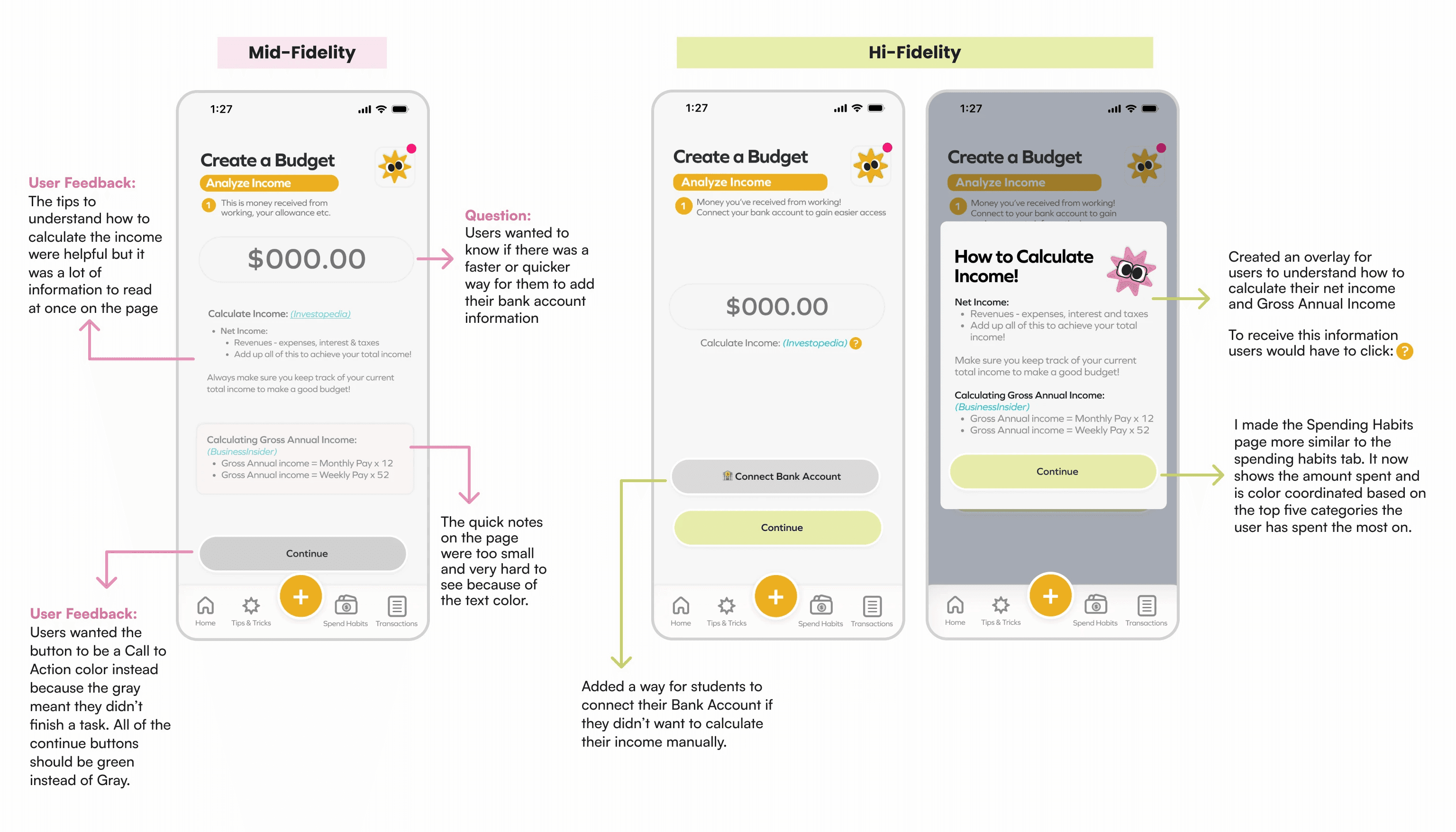

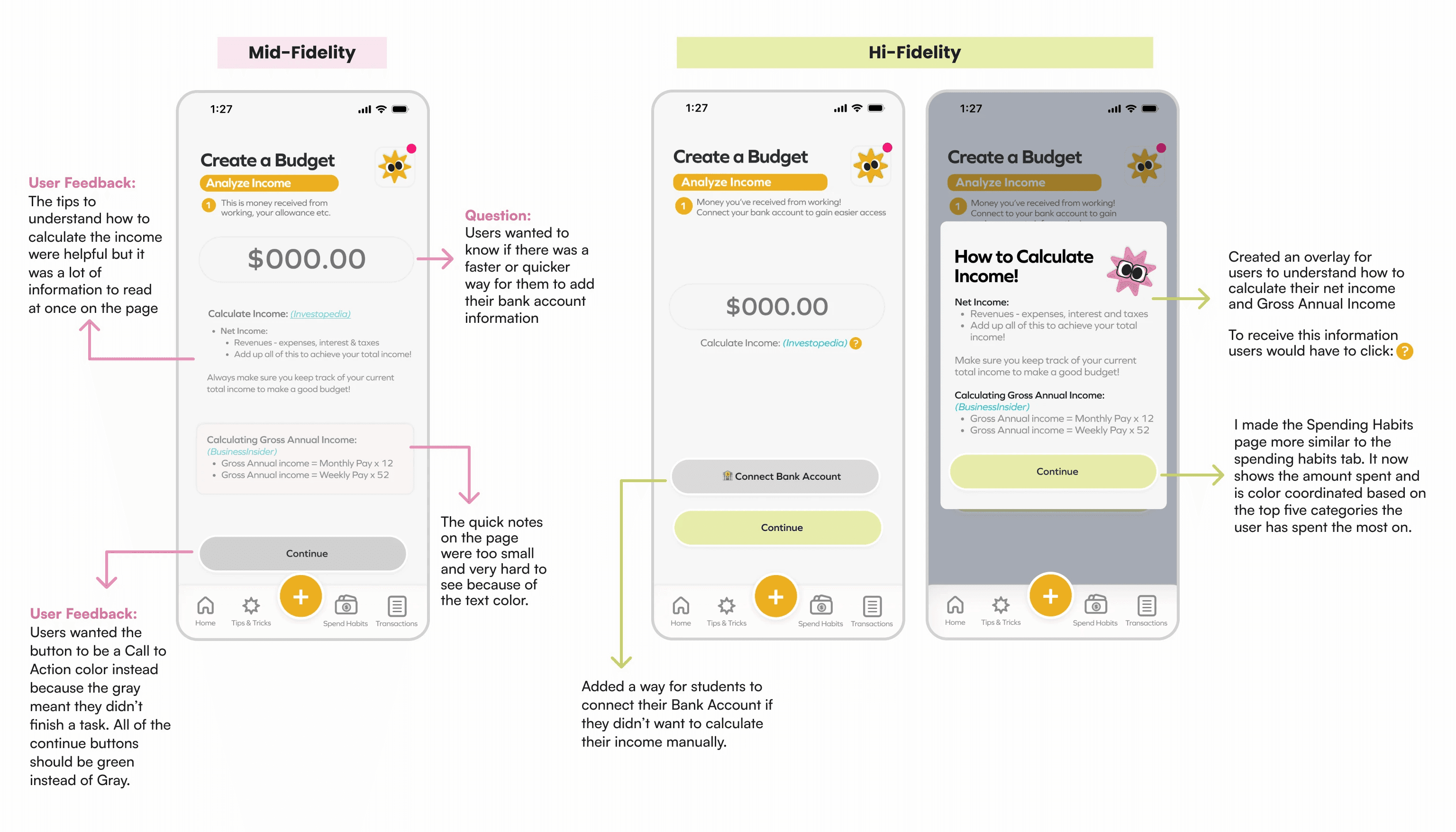

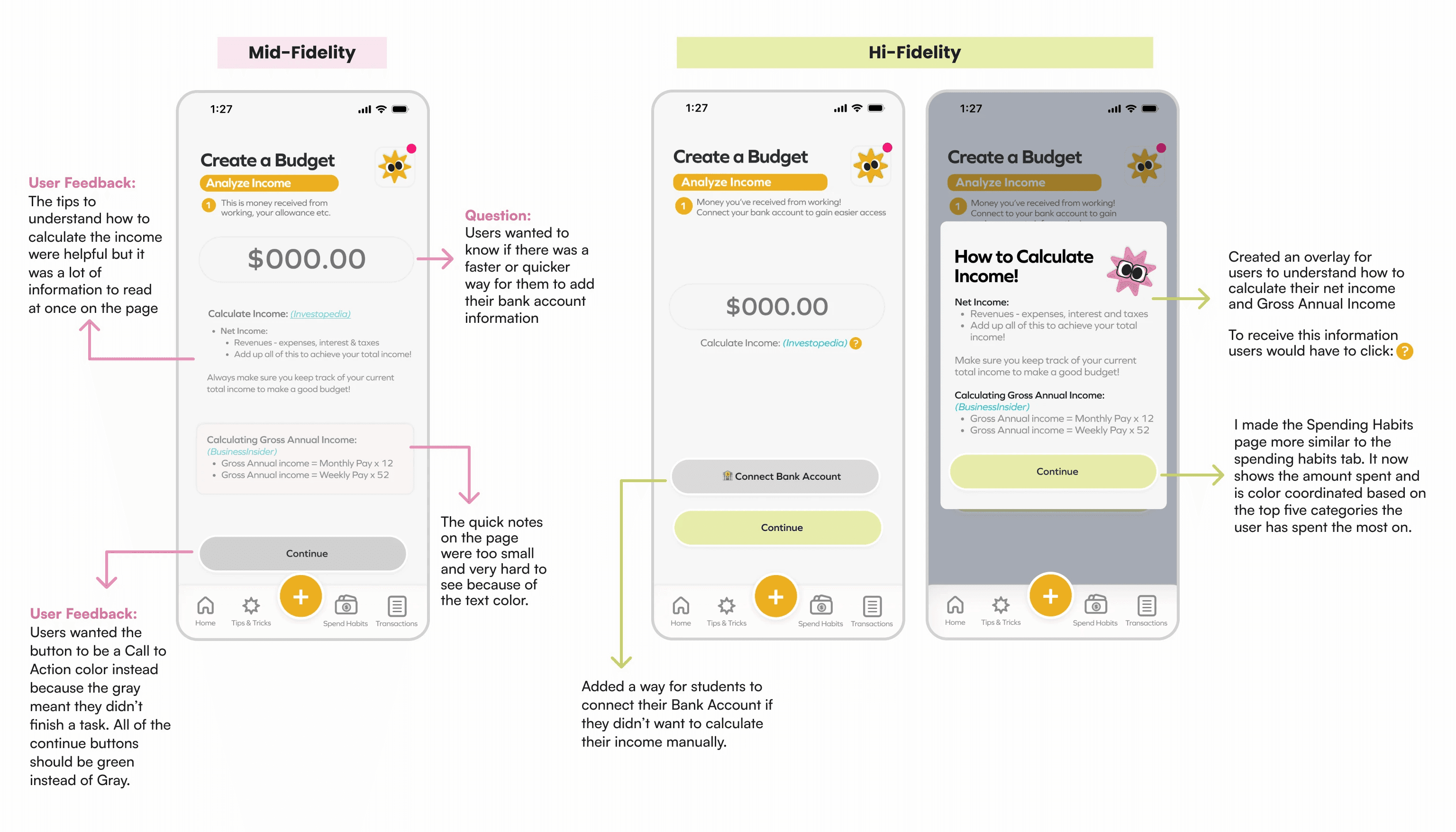

User Testing

User Testing

User Testing

I conducted two rounds of user testing for the Mid and Hi-Fidelity prototypes. I wanted to see if users were able to access Fundify and go through the onboarding without any problems. When first creating Fundify I looked at a lot of current banking apps for inspiration.

I conducted two rounds of user testing for the Mid and Hi-Fidelity prototypes. I wanted to see if users were able to access Fundify and go through the onboarding without any problems. When first creating Fundify I looked at a lot of current banking apps for inspiration.

I conducted two rounds of user testing for the Mid and Hi-Fidelity prototypes. I wanted to see if users were able to access Fundify and go through the onboarding without any problems. When first creating Fundify I looked at a lot of current banking apps for inspiration.

UI WORKFLOW

UI WORKFLOW

Walkthrough of Fundify — Hi-Fidelity

Walkthrough of Fundify

Walkthrough of Fundify

Hi-Fidelity Wireframes

Hi-Fidelity Wireframes

Accessing Fundify

Accessing Fundify

Users are able to sign up regularly for a Fundify account.

They can choose whether they are a Beginner, Intermediate or Advanced Budgeter.

Users can choose a color for their sprite character to help them along their journey

Users are able to sign up regularly for a Fundify account.

They can choose whether they are a Beginner, Intermediate or Advanced Budgeter

Users can choose a color for their sprite character to help them along their journey

Users are able to sign up regularly for a Fundify account.

They can choose whether they are a Beginner, Intermediate or Advanced Budgeter

Users can choose a color for their sprite character to help them along their journey

Fundify Prototype

Fundify Prototype

Fundify Prototype

Hi-Fidelity Wireframes

Hi-Fidelity Wireframes

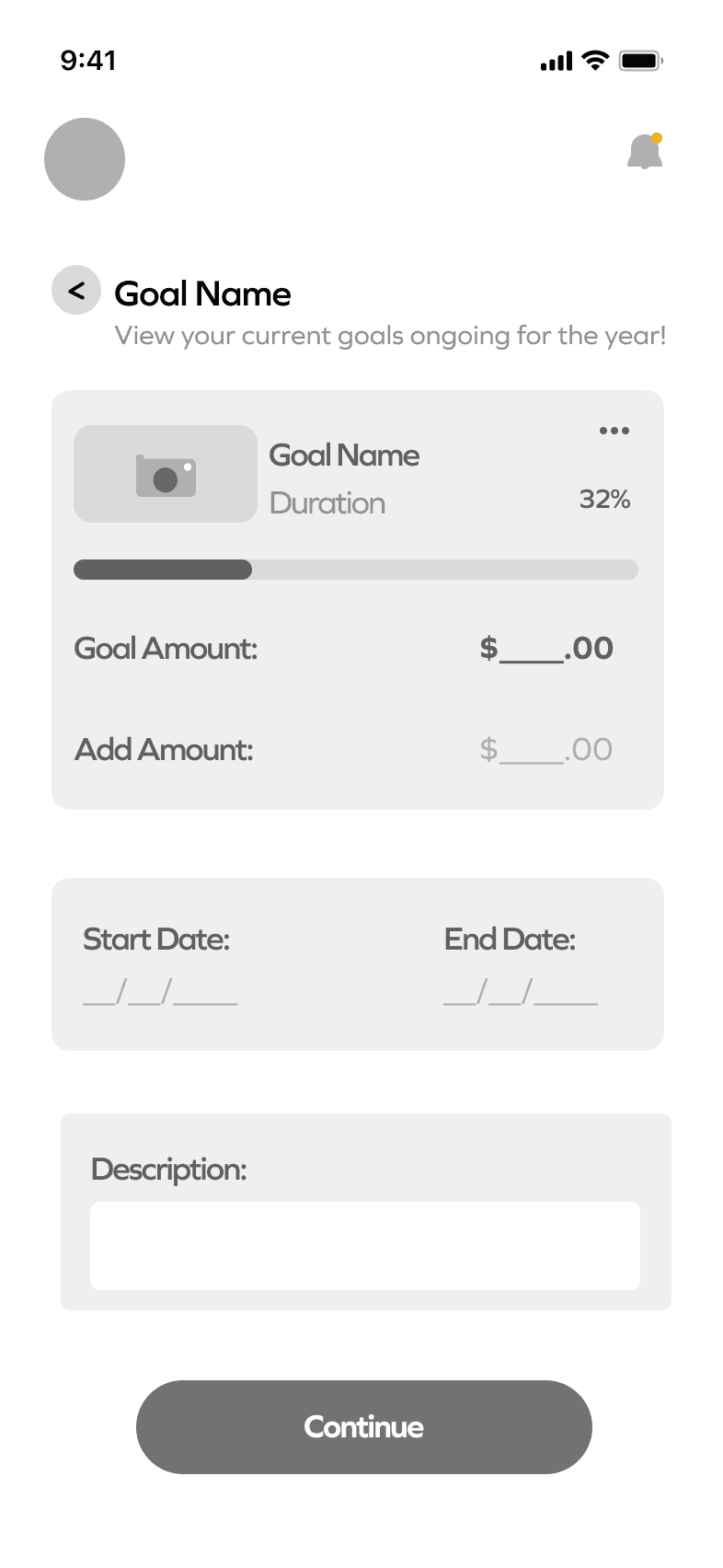

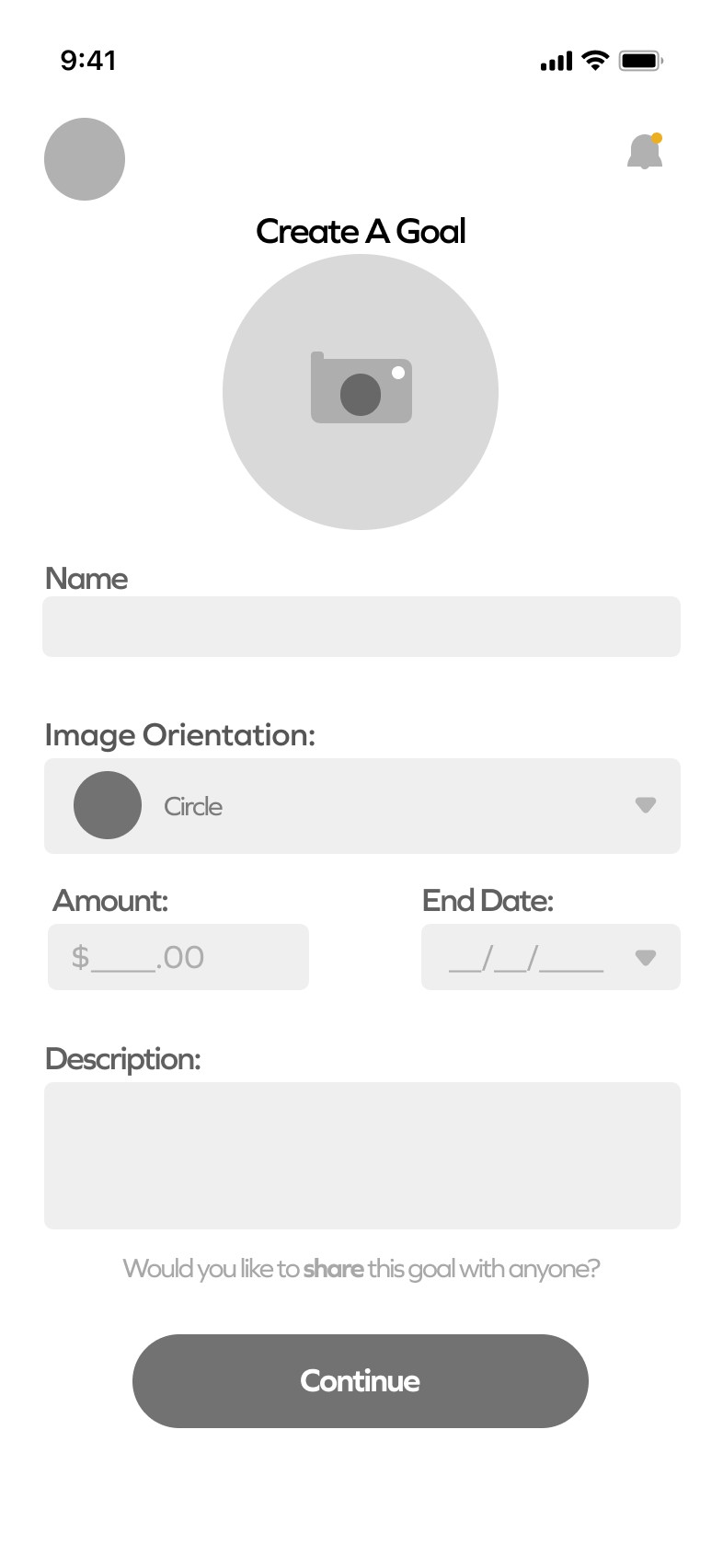

Create a Goal

Create a Goal

Goals are created and ensured to help users stay motivated to complete and earn badges.

Goals are created and ensured to help users stay motivated to complete and earn badges.

Goals are created and ensured to help users stay motivated to complete and earn badges.

Hi-Fidelity Wireframes

Hi-Fidelity Wireframes

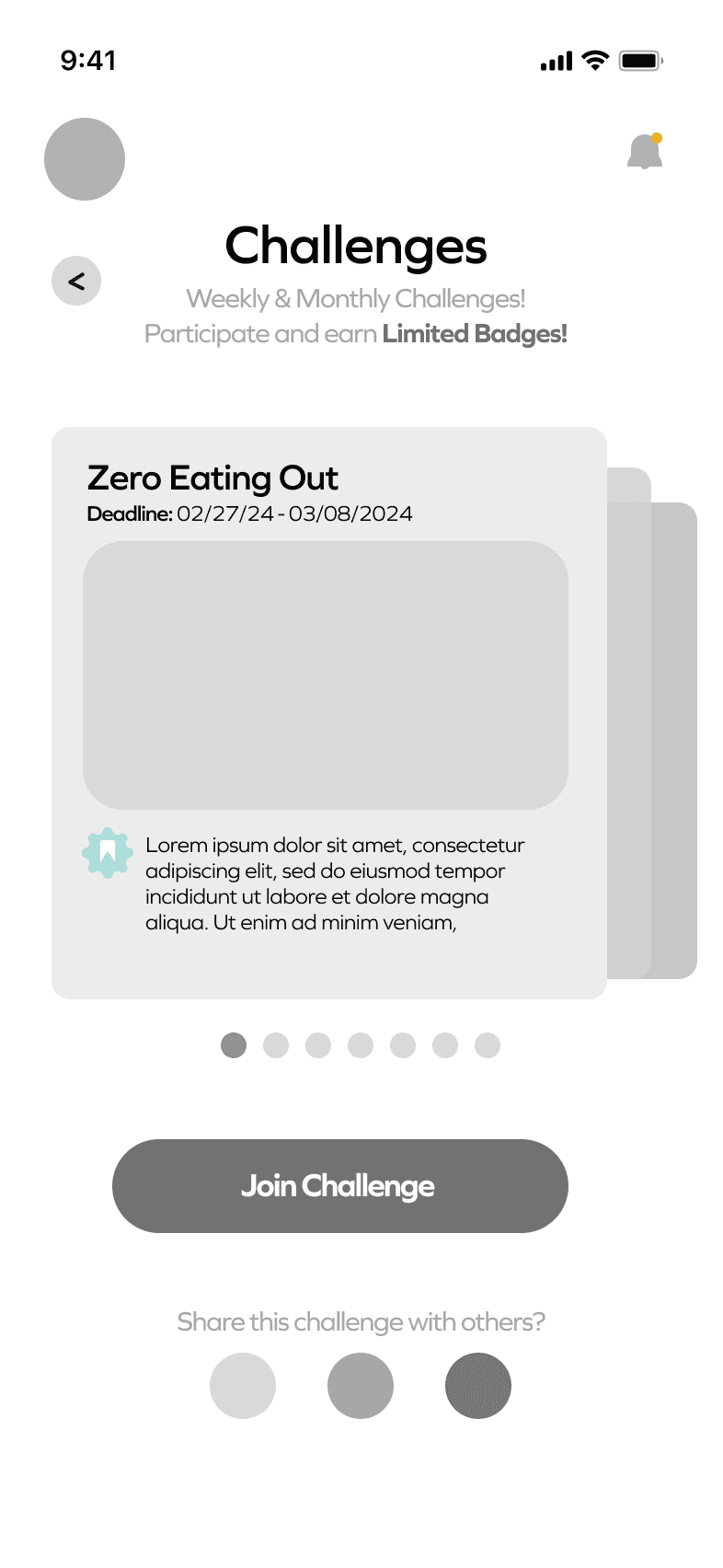

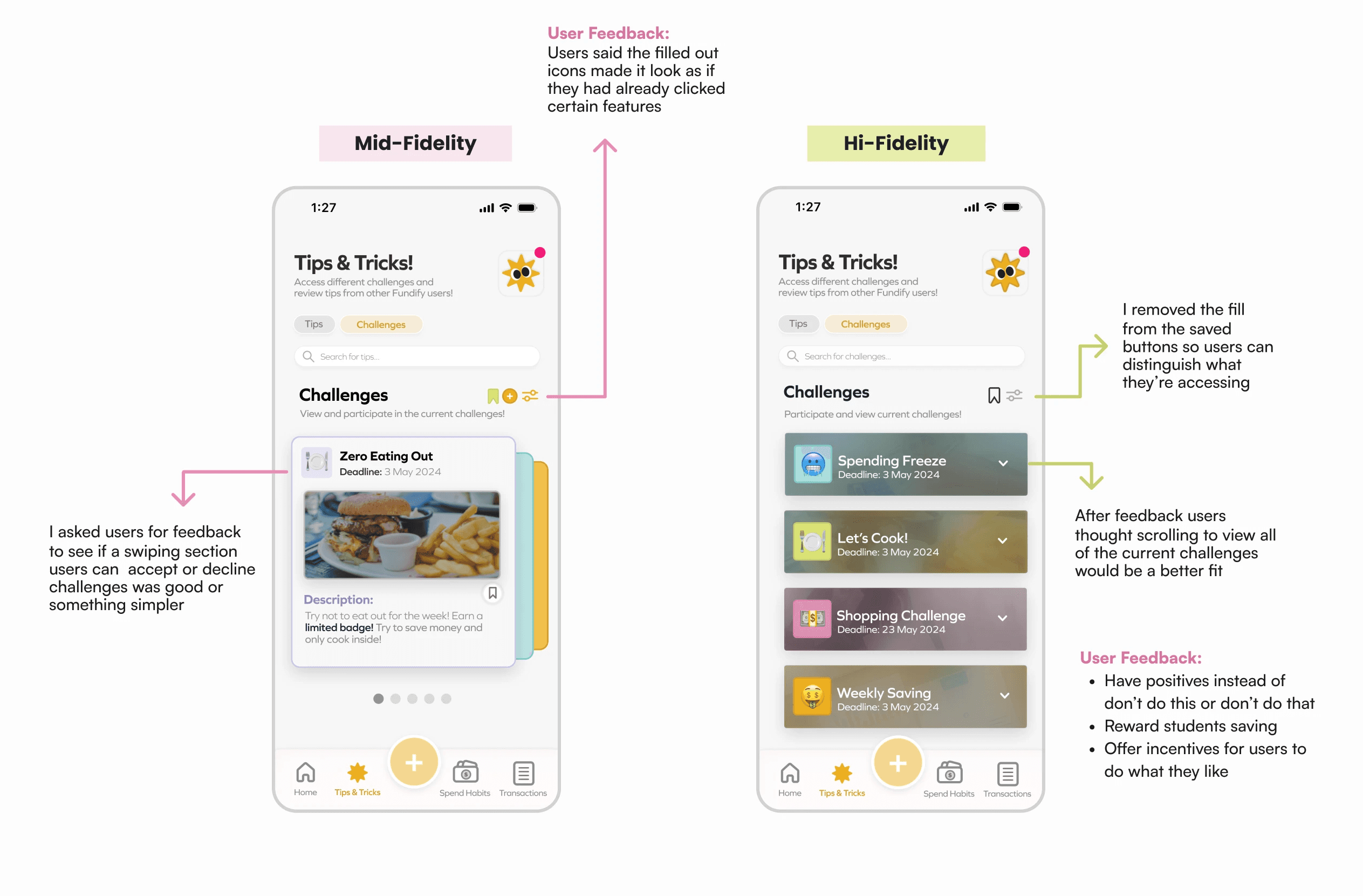

Tips & Tricks

Tips & Tricks

A way for students to share tips with one another regarding their strategies.

Challenges allow users to earn badges and improve their budgeting and goal setting.

A way for students to share tips with one another regarding their strategies.

Challenges allow users to earn badges and improve their budgeting and goal setting.

A way for students to share tips with one another regarding their strategies.

Challenges allow users to earn badges and improve their budgeting and goal setting.

Hi-Fidelity Wireframes

Hi-Fidelity Wireframes

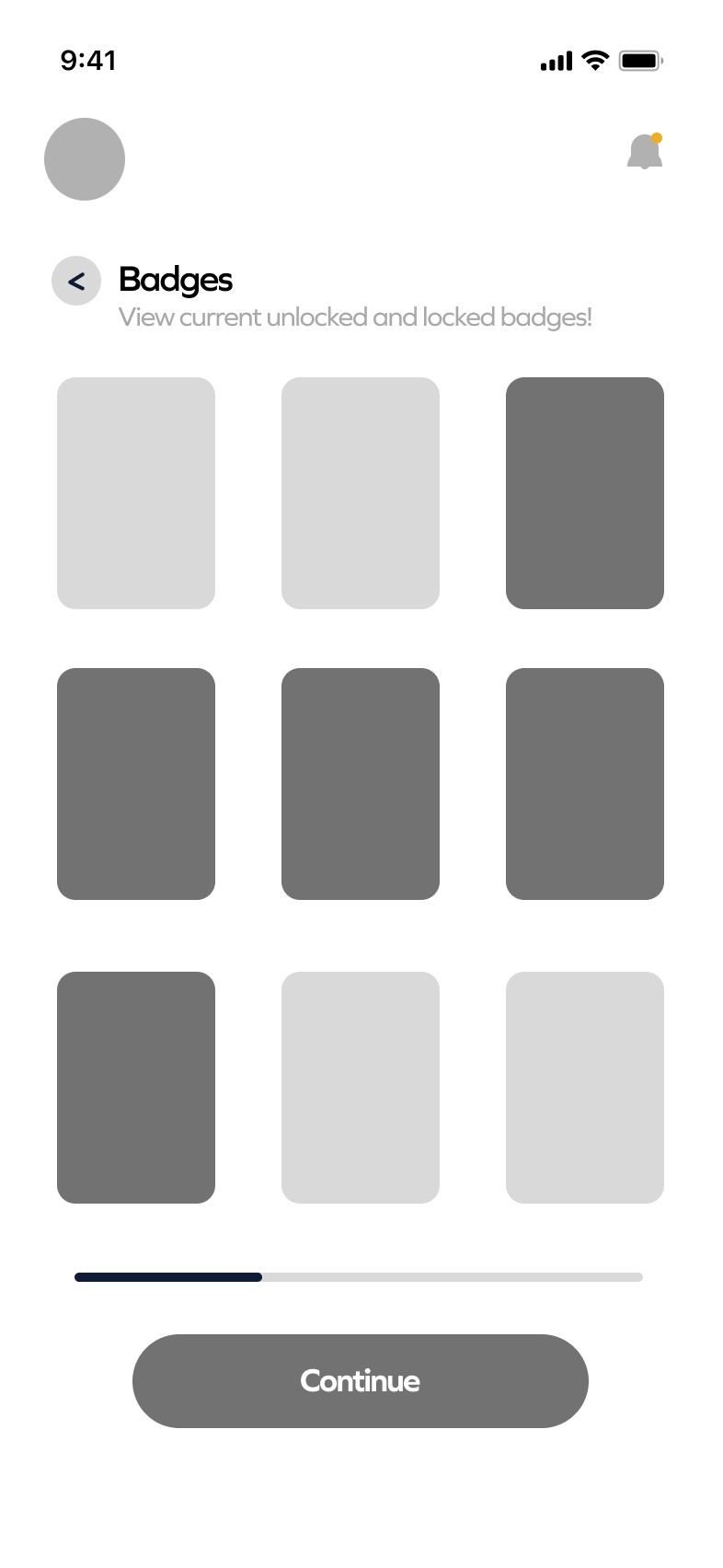

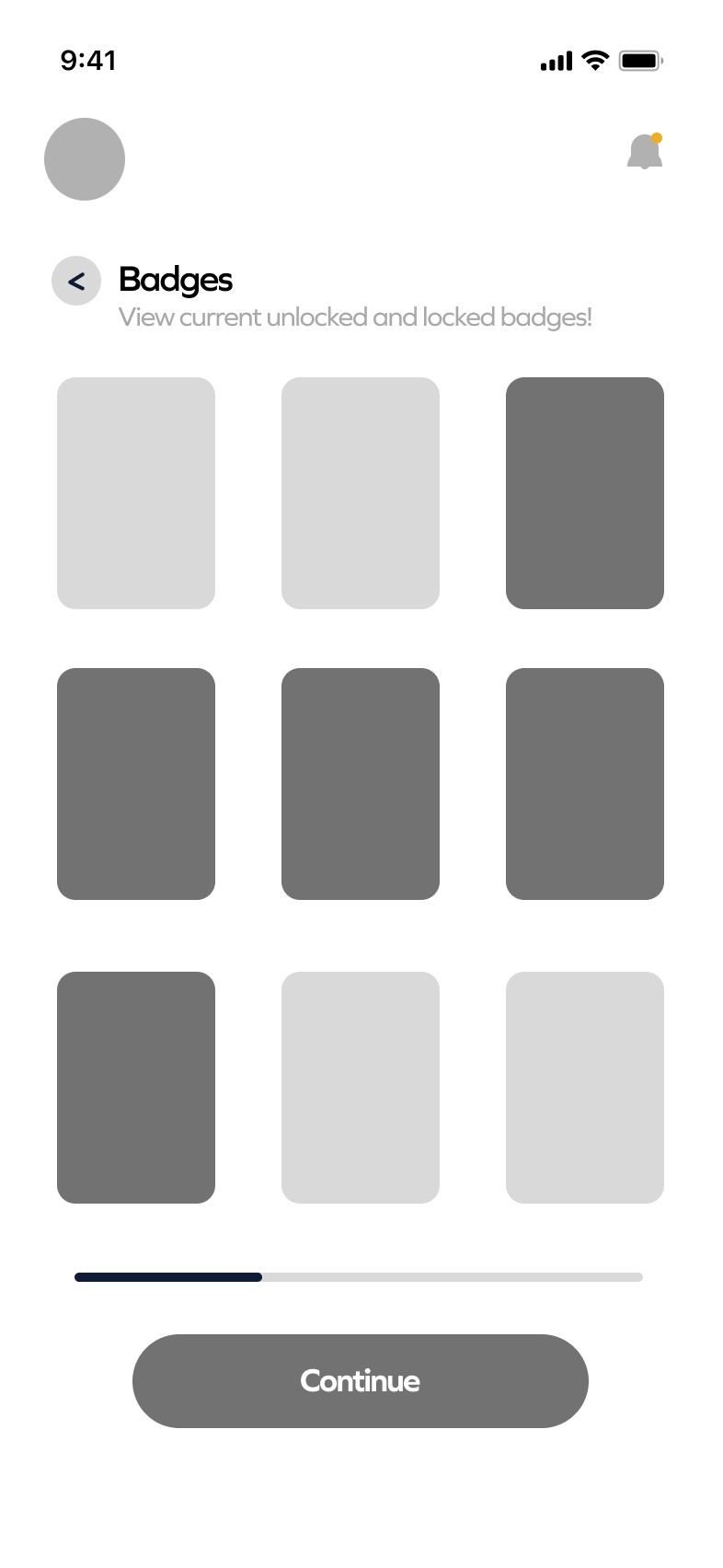

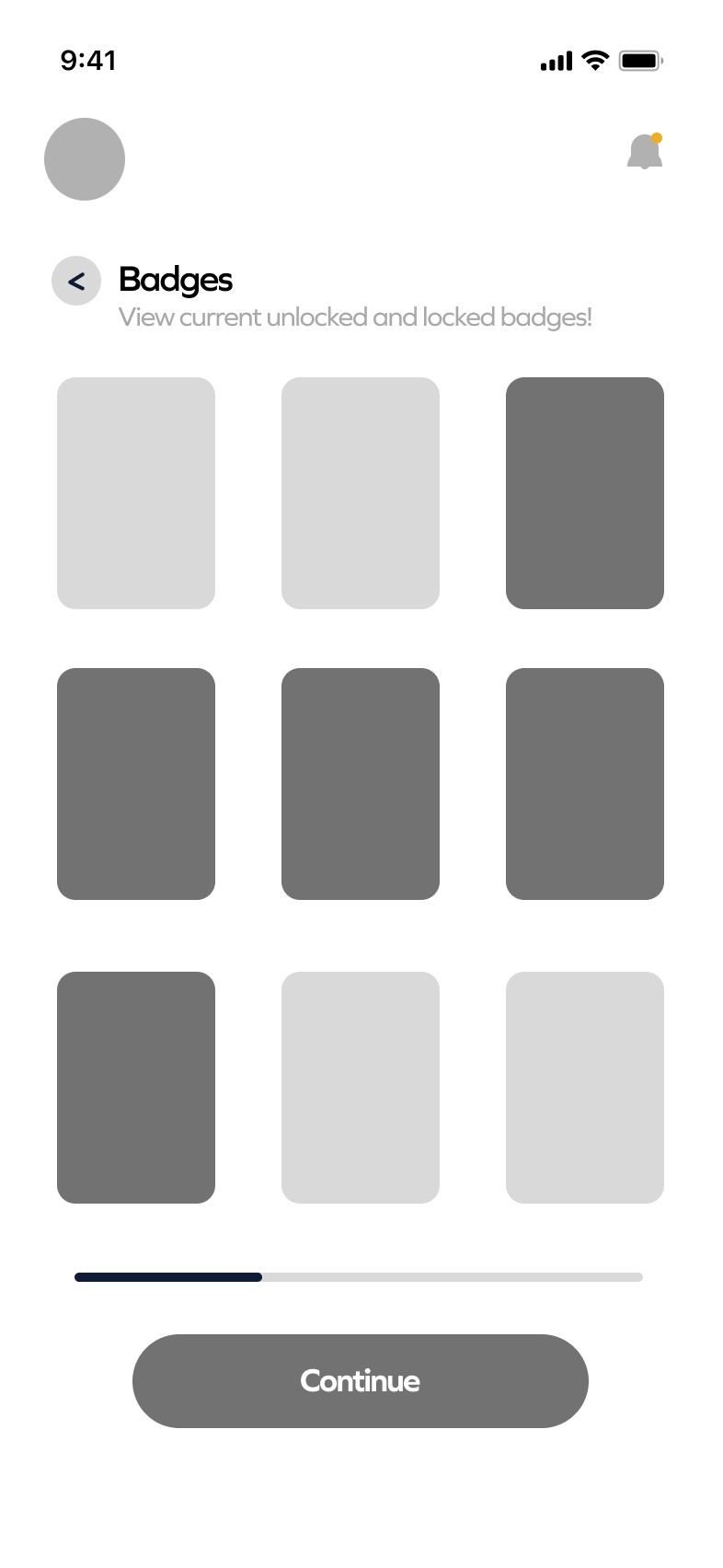

Badges

Badges

Users are able to see the badges they’ve earned and can continue to earn more by completing challenges in the Tips & Tricks section. Or through onboarding.

Users are able to see the badges they’ve earned and can continue to earn more by completing challenges in the Tips & Tricks section. Or through onboarding.

Users are able to see the badges they’ve earned and can continue to earn more by completing challenges in the Tips & Tricks section. Or through onboarding.

Hi-Fidelity Wireframes

Hi-Fidelity Wireframes

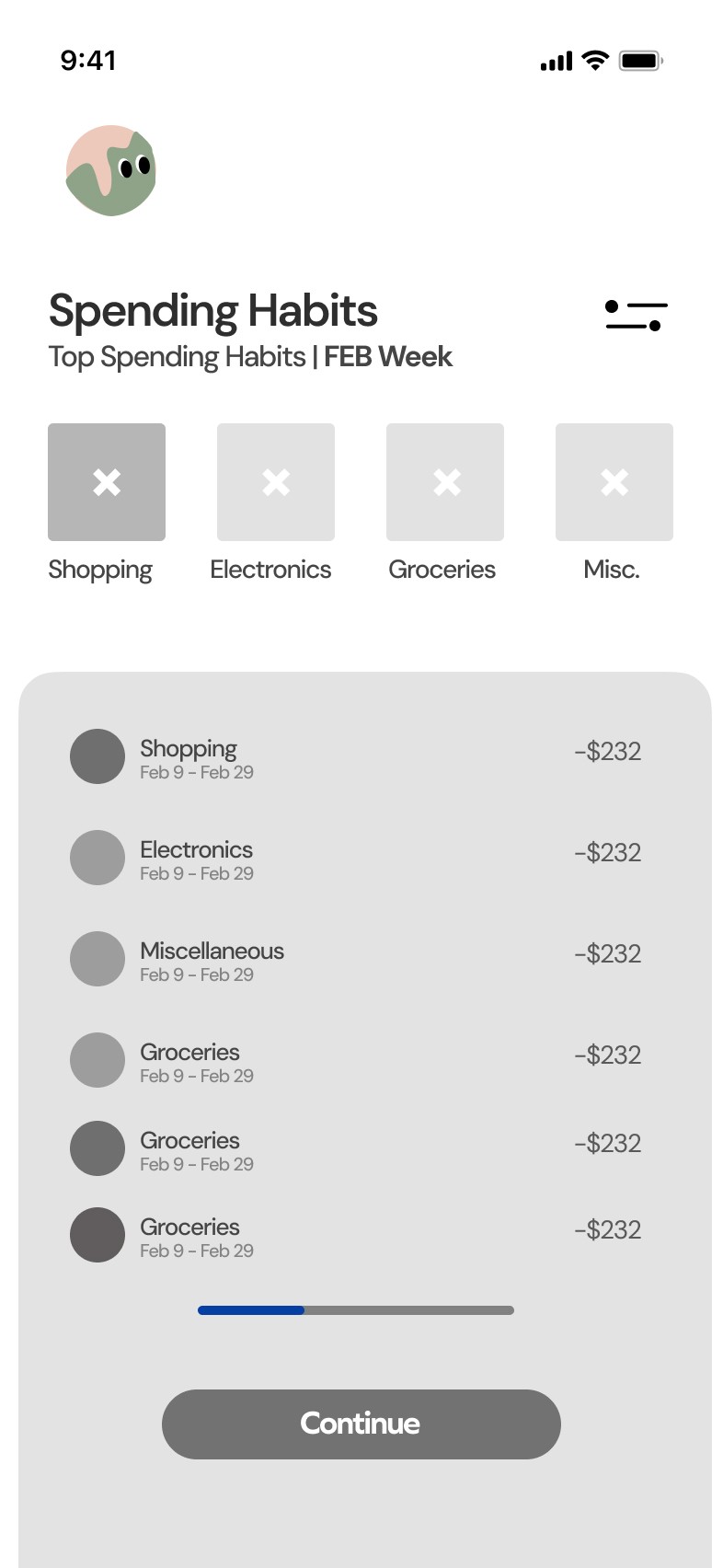

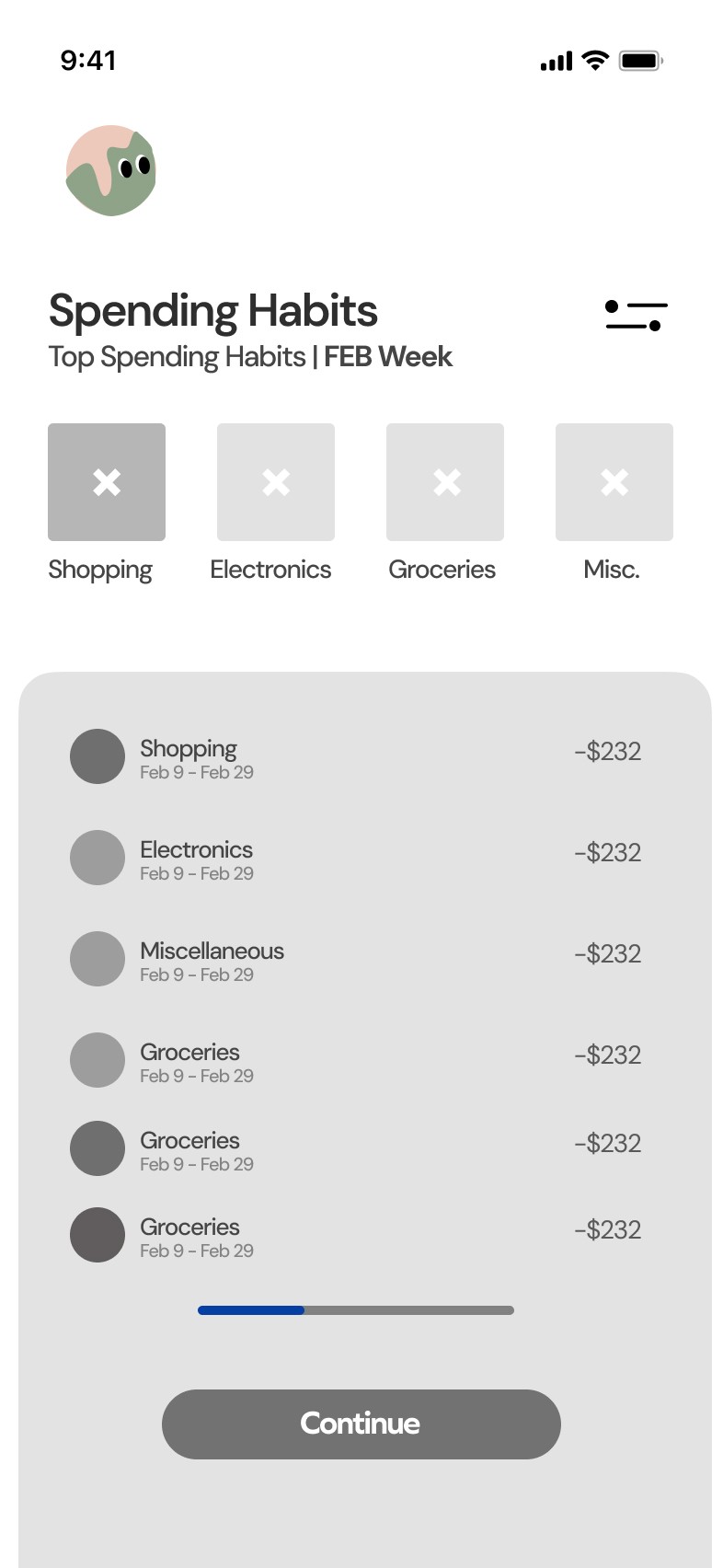

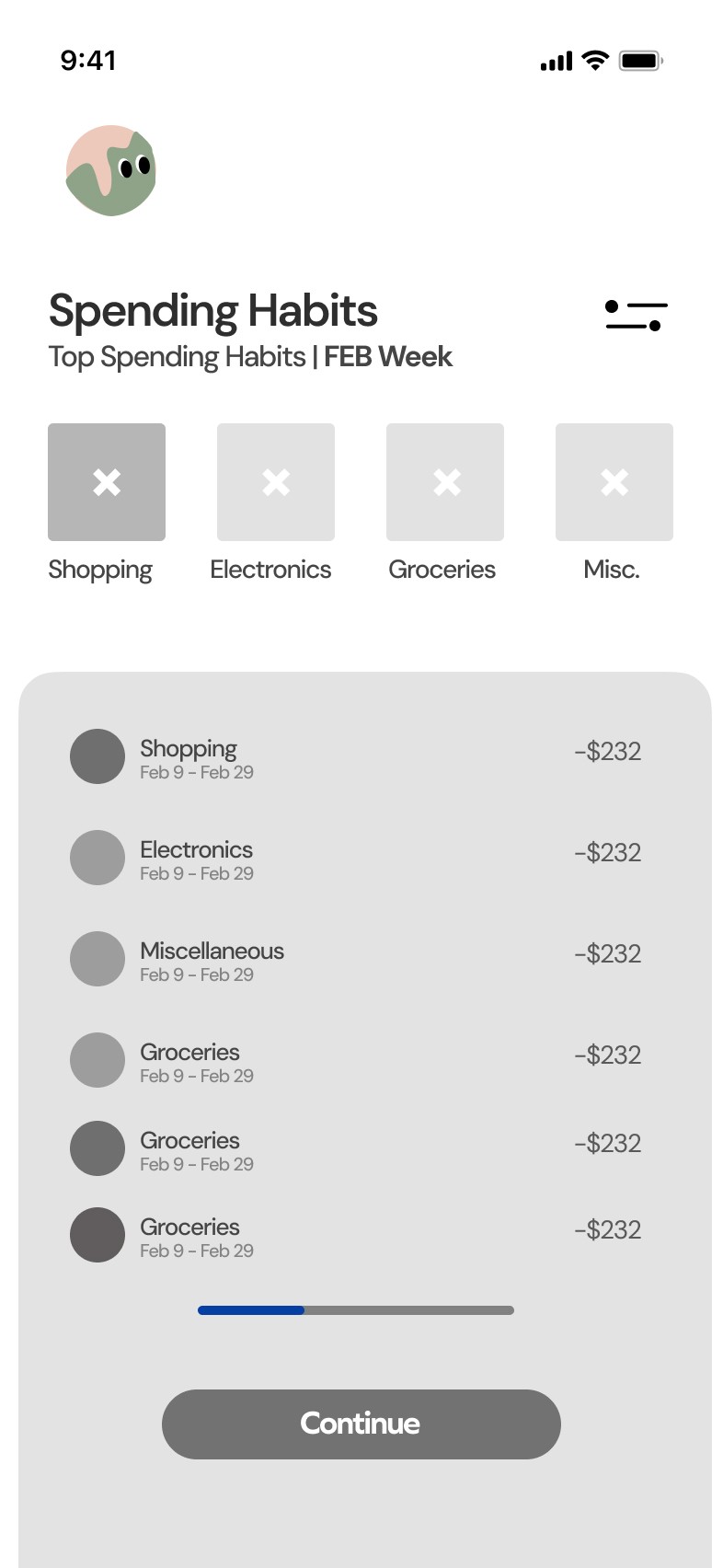

Spending Habits

Spending Habits

Users are able to identify their current spending habits for the week and see where they've spent the most money on. They can analyze their purchases when they click each bar.

Users are able to identify their current spending habits for the week and see where they've spent the most money on. They can analyze their purchases when they click each bar.

Users are able to identify their current spending habits for the week and see where they've spent the most money on. They can analyze their purchases when they click each bar.

Hi-Fidelity Wireframes

Hi-Fidelity Wireframes

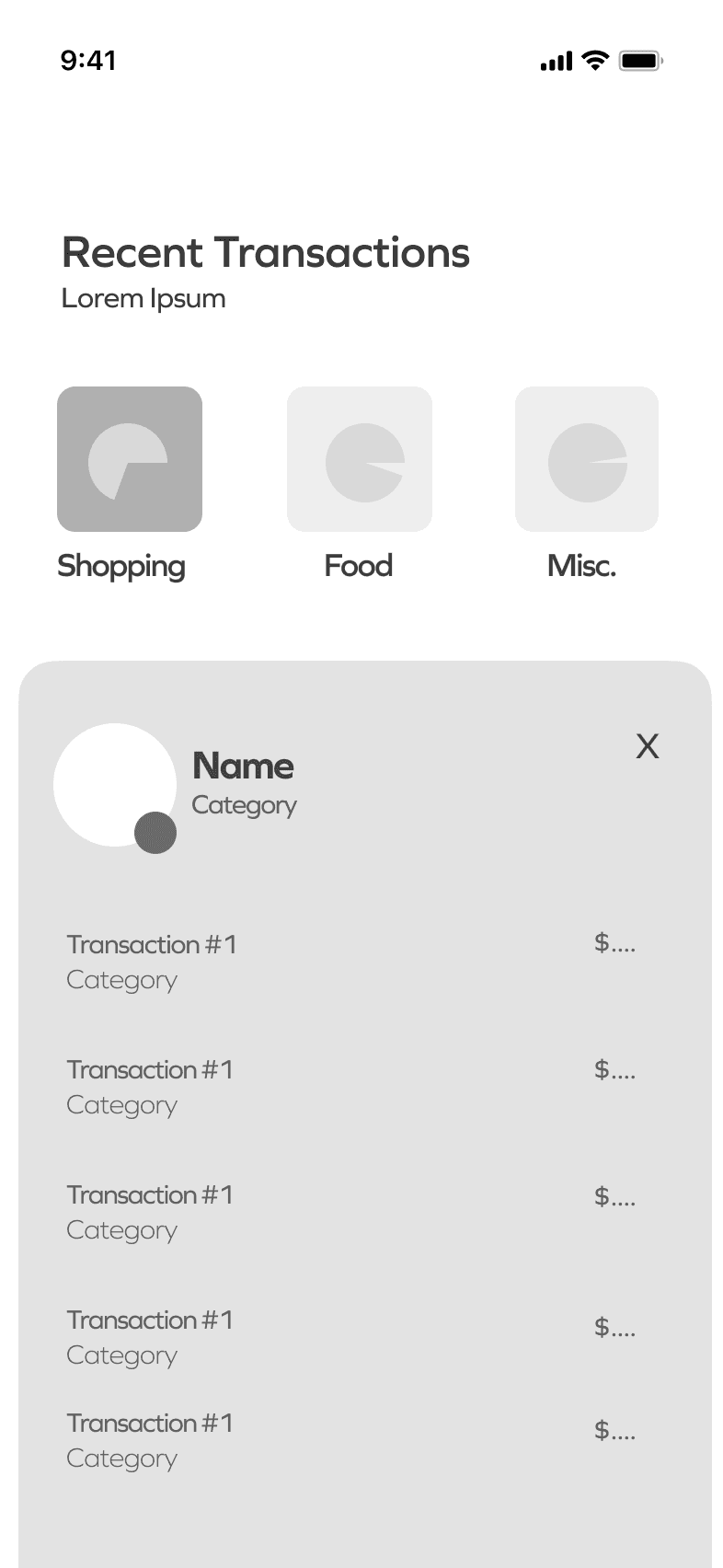

Transactions

Transactions

Students can create categories to analyze and view their weekly or monthly transactions.

Students can create categories to analyze and view their weekly or monthly transactions.

Students can create categories to analyze and view their weekly or monthly transactions.

What I’ve Learned

What I’ve Learned

Key Takeaways

Key Takeaways

Throughout the iteration of Fundify I learned a lot more tips about Fundify and the importance an application like this will have on those who want to learn how to save their money and create goals.

I would like to explore the possibility of creating additional screens and features for Fundify. The current application was solely designed for users who are new to budgeting and have never explored it before. I’d work on developing screens tailored for users who already have some level of financial knowledge. I want to focus on further analyzing the features of the current application. I want users to learn and understand how budgeting and goal setting can help them in the future.

Throughout the iteration of Fundify I learned a lot more tips about Fundify and the importance an application like this will have on those who want to learn how to save their money and create goals.

I would like to explore the possibility of creating additional screens and features for Fundify. The current application was solely designed for users who are new to budgeting and have never explored it before. I’d work on developing screens tailored for users who already have some level of financial knowledge. I want to focus on further analyzing the features of the current application. I want users to learn and understand how budgeting and goal setting can help them in the future.

View PDF

View PDF

Let’s Connect!

If you like any of these projects and want to learn more please don’t hesitate to reach out!

© 2024 Manuela Mensah

Let’s Connect!

If you like any of these projects and want to learn more please don’t hesitate to reach out!

© 2024 Manuela Mensah

If you like any of these projects and want to learn more please don’t hesitate to reach out!

Let’s Connect!

© 2024 Manuela Mensah

If you like any of these projects and want to learn more please don’t hesitate to reach out!

Let’s Connect!

© 2024 Manuela Mensah